Crypto Regulations

When navigating Crypto Regulations, the worldwide set of rules that govern digital assets, exchanges, and related services. Also known as digital asset regulation, it decides who can launch a token, how an exchange must monitor trades, and what tax treatment applies. Crypto Regulations don’t exist in a vacuum – they intersect with Privacy Coins, tokens that hide transaction details to protect user anonymity, the compliance demands placed on Crypto Exchanges, platforms that match buyers and sellers of digital assets, and the jurisdictional strategies of places like Malta, an EU member that markets itself as a blockchain island with favorable tax and licensing rules. In short, Crypto Regulations encompass privacy‑coin delistings, require exchange compliance, and are influenced by Malta’s regulatory framework.

Key Areas to Watch

First, privacy‑coin delistings are a direct outcome of stricter anti‑money‑laundering (AML) standards, especially the FATF’s guidance on anonymous tokens. When an exchange removes a coin like Monero, it’s not just a business decision—it signals how regulators are tightening the definition of “acceptable risk.” Second, enforcement actions against exchanges illustrate how agencies such as the DOJ, SEC, and FINRA are using fines and lawsuits to enforce AML, KYC, and investor‑protection rules. These cases set precedents that shape future compliance roadmaps for every platform handling crypto. Third, Malta’s Blockchain Island approach shows how a clear, supportive regulatory regime can attract crypto businesses, offering tax perks, residency options, and a fast‑track licensing process that other jurisdictions are trying to emulate.

Below you’ll find a curated set of articles that dig into each of these topics. Whether you want to understand why privacy coins are disappearing from major platforms, learn the latest details of exchange fines, or explore how Malta’s strategy could be a model for the next crypto hub, the posts provide practical insights and actionable steps.

Ready to see the specifics? Scroll down to explore the full collection of analyses, case studies, and guides that break down the ever‑evolving world of Crypto Regulations.

DeFi transaction tax reporting in 2026 requires tracking every swap, stake, and yield farm. The IRS doesn't care if it's decentralized-you still owe taxes. Here's what you need to file, how to track it, and what happens if you don't.

Nigeria's new crypto tax law took effect in January 2026, making all crypto profits taxable. Learn what counts as a taxable event, how the government tracks transactions, and how to stay compliant with the Nigeria Tax Act 2025.

P2P crypto platforms let people in restricted countries trade Bitcoin and other cryptos directly, bypassing bans and bank freezes. Used by millions for remittances, inflation protection, and financial access, they're the hidden backbone of digital finance in the world's most restricted economies.

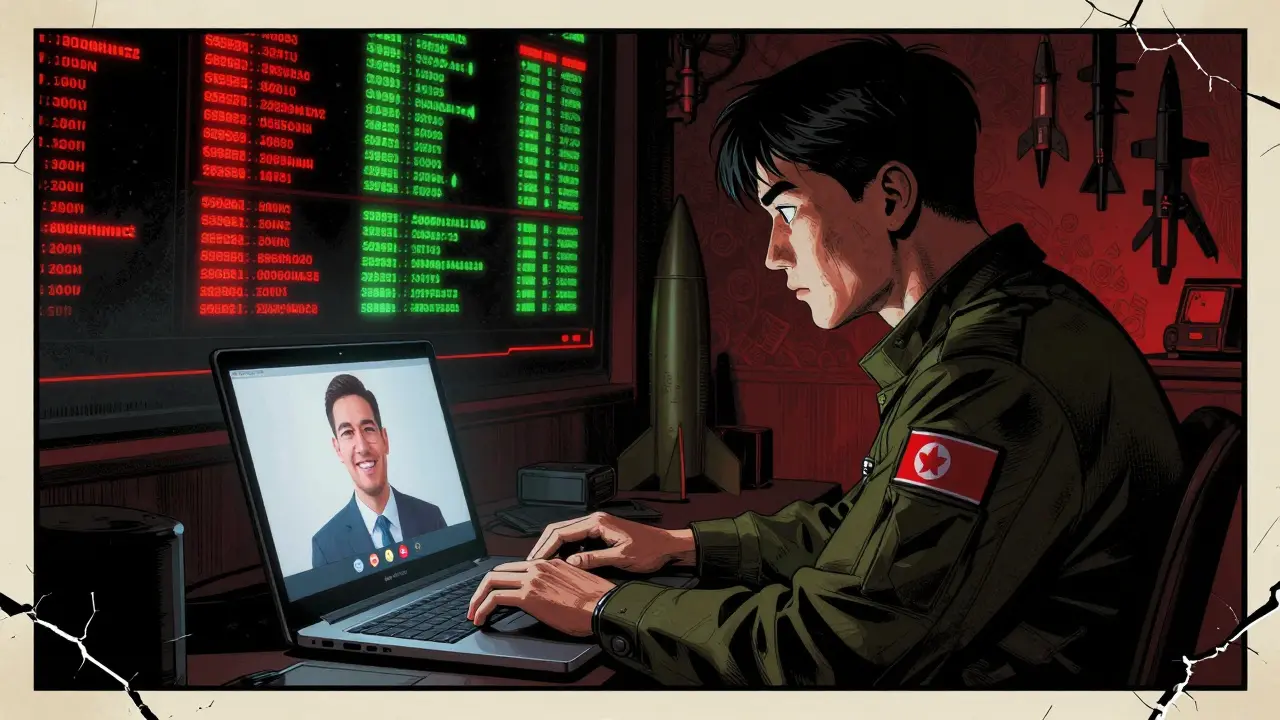

North Korean IT workers are laundering billions in crypto through fake remote jobs, funding weapons programs. Learn how they operate, how to spot them, and what governments are doing to stop them.

Switzerland offers one of the world’s clearest crypto frameworks for businesses in 2026, with structured licensing, strict AML rules, no crypto taxes, and global trust. Learn how to legally operate here.

Despite U.S. sanctions, Garantex and its successor platforms continue serving Russian crypto traders through a decentralized network of shell companies and Telegram bots, processing hundreds of millions monthly in illicit and sanctioned transactions.

Crypto money laundering can lead to 20 years in prison under U.S. federal law. Learn how charges work, who’s getting caught, and what steps can keep you out of jail in 2026.

Understand how Canada taxes cryptocurrency in 2026. Learn the difference between capital gains and business income, what transactions trigger tax, how to report, and how to avoid penalties from the CRA.

The Taliban banned Bitcoin in Afghanistan under Sharia law, calling it haram. But with banks collapsed and families starving, Afghans are using crypto more than ever - risking arrest to send remittances, pay for food, and survive.

Iran's Central Bank now requires all licensed crypto miners to sell a portion of their output directly to the state, turning mining into a state-controlled revenue tool amid sanctions and currency collapse.

Crypto enforcement stats for 2024-2025 show falling fraud but rising complexity. TRON's illicit volume dropped 50% after a joint crackdown, while global regulation lags behind policy. Here's what the numbers really mean.

Ecuador doesn't have an official underground crypto market, but thousands trade Bitcoin via cash and WhatsApp because banks are slow and fees are high. This is not crime - it's a workaround for financial exclusion.