When the U.S. Treasury slapped sanctions on Garantex in April 2022, most thought it would be the end of the line for this Russian crypto exchange. But by August 2025, after another round of sanctions targeting its role in laundering over $100 million in cybercrime funds, the real story became clear: Garantex didn’t die. It evolved.

What Happened to Garantex?

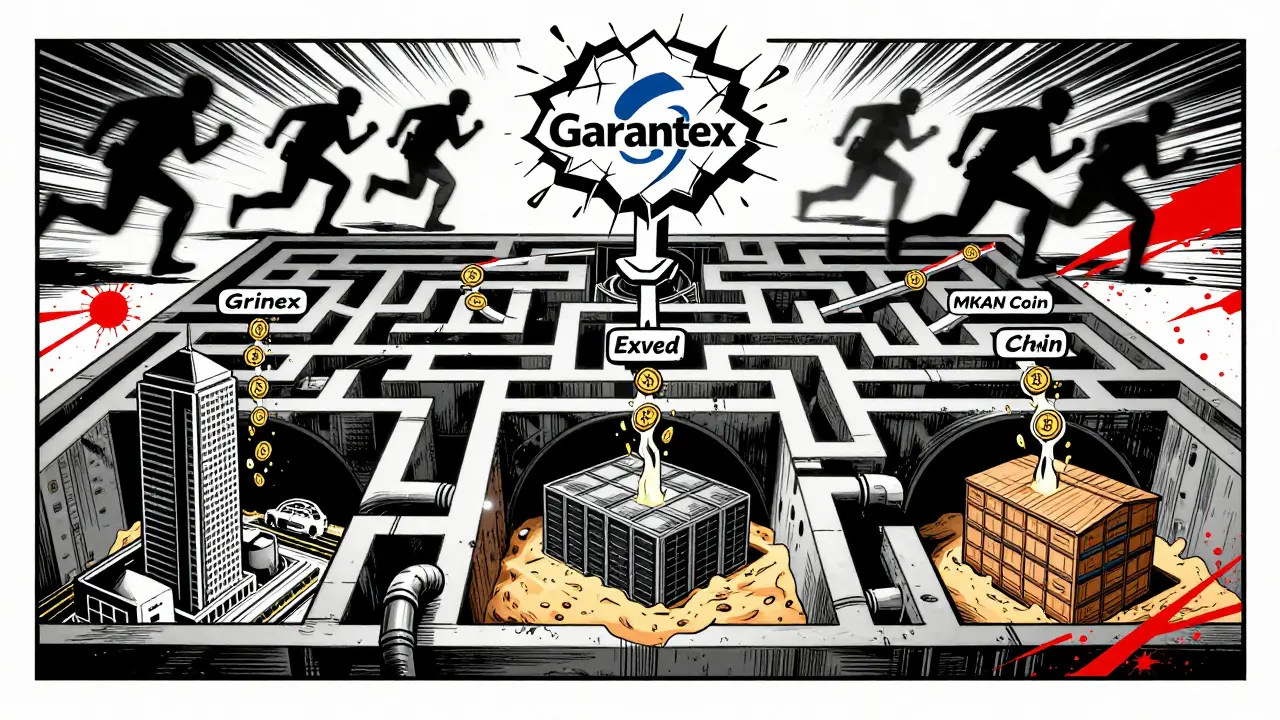

Garantex was never just another crypto exchange. Founded in 2019 by Sergey Mendelev and Aleksandr Mira Serda, it started as a Russian-focused platform with Estonian paperwork - a classic shell setup. But its real power came from how deeply it was woven into Russia’s underground financial network. It wasn’t just buying and selling Bitcoin. It was moving money for ransomware gangs, darknet markets, and sanctioned Russian elites. The U.S. Treasury didn’t just freeze accounts. They labeled Garantex a systemic threat to global financial integrity. By August 2025, Treasury Secretary Janet Yellen called it a "critical infrastructure for cybercriminals." The FBI confirmed Garantex processed over $100 million in transactions tied to known criminal actors - mostly in USDT, the stablecoin that moves like cash but leaves no paper trail. After the March 2025 international takedown - where U.S., German, and Finnish agents seized servers and froze $26 million - Garantex didn’t shut down. It split. The core team launched Grinex, Exved, and MKAN Coin. These aren’t competitors. They’re branches of the same network, each handling a different piece of the puzzle.How Russian Traders Still Use It

Despite the sanctions, over 18.7 million Russians still use crypto - up 22% in just one year, according to the Central Bank of Russia. And Garantex’s ecosystem is still their go-to bridge to the outside world. Here’s how it works in practice:- A Russian trader converts rubles into USDT using a local P2P agent.

- That USDT gets sent to Feilian Company Limited, a Hong Kong-based shell with an account at Alfa-Bank.

- Feilian then sends dollars, yuan, or more USDT to a foreign supplier - say, a electronics vendor in Thailand or a crypto liquidity provider in Dubai.

- The trader gets their goods, or cashes out abroad, without ever touching a Western bank.

The Hidden Costs

It’s not free anymore. Before the sanctions, Garantex charged 0.1% to 0.3% per trade. Now, users on forums like BitBrothers report fees jumping to 1.5% - a 15x increase. Why? Because the system is riskier. Every transaction now has to pass through more middlemen, more shell companies, more layers of obfuscation. New users face a steep learning curve. Two years ago, you could sign up, verify your ID, and start trading in a week. Now, it takes 3-4 weeks just to get connected to a trusted agent. The official support channels are gone. In their place: Telegram bots that answer with "wait" or "contact admin." Real help comes from other users in private groups - sharing tips like which Hong Kong agent still processes transfers or which UAE wallet address is still active. Documentation? It’s a mess. No more KYC forms. No more customer service emails. Just whispers in encrypted chats.

The Bigger Picture: Russia’s Crypto Evasion Network

Garantex isn’t alone. The Treasury sanctioned six other companies alongside it: A7, A71, A7 Agent, Old Vector, InDeFi Bank, and Exved. Exved, headquartered in Moscow-City, handles cross-border payments for dual-use goods - things like microchips and medical equipment Russia can’t legally import. Together, this network moves an estimated $300 million per month. That’s 15% of all Russian crypto-based international transfers, according to Transparency International Russia’s September 2025 report. Chainalysis data shows Russia accounts for about 12% of global crypto-related illicit activity. That’s not because Russians are uniquely criminal. It’s because they’re uniquely constrained. Sanctions cut them off from Visa, SWIFT, and Western banks. Crypto became the only open pipeline.Who’s Still Using It - And Why

You might think only criminals use this system. But that’s not true. Small business owners in St. Petersburg use it to pay for cloud servers hosted in Singapore. Students studying abroad send tuition money through it. Freelancers get paid in crypto because Western platforms like PayPal and Stripe blocked them. Even some former Garantex employees now run Telegram-based services that mimic the old platform - quietly, anonymously, profitably. The real driver isn’t crime. It’s survival. When your bank freezes your account because you sent $5,000 to a German supplier, and your government says you can’t legally buy foreign currency - crypto isn’t a choice. It’s the only way out.

What This Means for the Future

The U.S. and its allies thought sanctions would cripple Russia’s crypto ecosystem. Instead, they forced it to become more sophisticated. As Chainalysis CEO Michael Gronager put it in September 2025: "Sanctions are creating more sophisticated, harder-to-track money laundering systems rather than eliminating them." The old model - centralized exchange with a website and a support desk - is dead. The new model is a decentralized web of Telegram bots, shell companies, and offshore wallets spread across eight countries. It’s harder to shut down because there’s no single point of failure. The $6 million reward offered by the State Department for information leading to the arrest of Garantex’s founders shows how seriously they’re taking this. But arrests won’t fix it. The infrastructure is too distributed. The users are too desperate.Is There a Way Out?

For Russian traders, there’s no clean solution. Western regulators aren’t going to lift sanctions. Russian banks won’t offer foreign exchange. And crypto exchanges outside Russia won’t touch them. The only path forward is adaptation - learning how to navigate the underground system, finding trustworthy agents, accepting higher fees, and accepting that your financial life will always be one step away from being flagged. It’s not sustainable. But right now, it’s the only option.Are Garantex and its successor platforms still operational in 2026?

Yes. After being sanctioned and having servers seized in 2025, Garantex’s core team migrated operations to successor platforms like Grinex, Exved, and MKAN Coin. These platforms continue operating across jurisdictions including the UAE, Hong Kong, Thailand, and Kyrgyzstan, using Telegram bots and shell companies to avoid detection. Transactions still flow primarily in USDT, and the network processes an estimated $300 million monthly.

Can Russian users still convert rubles to crypto after sanctions?

Yes, but not directly. Russian users now rely on P2P agents and shell companies like Feilian Limited in Hong Kong. They send rubles to these intermediaries, who convert them into USDT or other stablecoins and send them abroad. This process avoids Russian bank monitoring and Western financial sanctions, but it takes longer and costs more - fees have jumped from 0.1% to as high as 1.5%.

Why is USDT the main currency used in this system?

USDT (Tether) is preferred because it’s stable, widely accepted, and moves quickly across blockchain networks without triggering traditional bank alerts. Unlike Bitcoin, which has public ledgers that can be traced, USDT transactions can be layered through multiple wallets and jurisdictions, making forensic tracking extremely difficult. Over 90% of Garantex’s known illicit transactions were in USDT, according to FBI forensic analysis from March 2025.

How do Russian traders find trusted agents now that official support is gone?

Traders rely on private Telegram groups, encrypted forums like BitBrothers, and word-of-mouth referrals. There’s no customer service - only community knowledge. New users often spend 3-4 weeks learning the ropes from experienced traders before attempting a transfer. Many report that trust is built over multiple small test transactions before moving larger sums.

Is it legal for non-Russian users to interact with Garantex or its successors?

No. U.S. and EU regulations prohibit any transaction with entities on OFAC’s sanctions list, including Grinex, Exved, and MKAN Coin. Even indirect involvement - like accepting USDT from a Russian user who used Garantex’s network - could trigger legal risk. Many international crypto exchanges now block wallets previously linked to Garantex’s infrastructure to avoid compliance penalties.

What’s the long-term outlook for crypto sanctions evasion in Russia?

Experts predict it will grow more complex. As regulators crack down on one channel, new ones emerge - often using newer privacy tools, decentralized protocols, or non-crypto methods like gold shipments or art sales. The goal isn’t to eliminate crypto use in Russia, but to make it harder, slower, and more expensive. That’s exactly what’s happening. The cat-and-mouse game is intensifying, and traditional sanctions tools are losing effectiveness.

Deepu Verma

January 22 2026This is actually kind of inspiring if you think about it. People finding ways to survive when the system tries to crush them. Crypto isn't perfect, but it's the only lifeline left for so many.

tim ang

January 23 2026bro i just tried to send usdt to my cousin in russia last week and my exchange flagged it as 'high risk' and froze my account for 72 hours. like... what even is this world anymore?

MOHAN KUMAR

January 25 2026Sanctions dont work. They just make people smarter.

Tselane Sebatane

January 26 2026Let me tell you something. This isn't just about Russia. This is the future of global finance. When the old systems break, people build new ones. Not with banks. Not with governments. With trust, Telegram, and USDT. The West thinks it's winning. It's not. It's just making the game harder for itself.

MICHELLE REICHARD

January 28 2026Oh please. Let’s not romanticize criminal infrastructure. This isn’t ‘adaptation’-it’s a sophisticated money laundering racket masquerading as economic resilience. The fact that people are proud of this is terrifying.

Bonnie Sands

January 29 2026Did you know the FBI planted a bot in those Telegram groups? They’re collecting wallet addresses and feeding them to Chainalysis. You think you’re safe? You’re not. They’re watching every transfer.

Anna Topping

January 30 2026It’s weird how the same people who scream about financial freedom when it’s crypto in the U.S. suddenly call it criminal when it’s Russians using it. Double standards don’t just exist-they’re institutional.

Darrell Cole

January 31 2026You people are delusional. This isn’t survival-it’s treason. You’re helping fund ransomware that holds hospitals hostage. That’s not ‘adaptation,’ that’s complicity. And you’re all just pretending you don’t know it.

Abdulahi Oluwasegun Fagbayi

February 2 2026The system is broken. The people are not. When the bridge collapses, you swim. Not because you want to, but because the water is rising. This is not a choice. It is physics.

Jeffrey Dufoe

February 2 2026My uncle in Moscow uses this system to pay for his daughter’s online college courses. He’s not a criminal. He’s just a dad trying to give her a future.

Arielle Hernandez

February 2 2026While the narrative of resilience is compelling, it is critically important to recognize that this system perpetuates transnational criminal activity under the guise of economic necessity. The normalization of illicit financial flows undermines global regulatory frameworks and sets a dangerous precedent for other sanctioned states. The moral hazard here is profound and should not be overlooked in favor of anecdotal narratives of survival.

katie gibson

February 3 2026so like… the whole thing is just a giant game of whack-a-mole and we’re all just pawns? i mean, if the founders get arrested, does the whole thing just… respawn? like a video game?

Ashok Sharma

February 3 2026Many people think sanctions are punishment. But they are also a signal. A signal that the world is watching. And those who adapt are not heroes-they are survivors. And survivors deserve respect, not judgment.