Buying Bitcoin in Canada doesn’t trigger a tax bill. But selling it? That’s when the Canada Revenue Agency (CRA) takes notice. If you’ve traded, sold, or used crypto to buy coffee, you’ve likely created a taxable event - even if you didn’t cash out to Canadian dollars. Most Canadians don’t realize this. In fact, a 2025 survey found that 54% of crypto owners feel unprepared for tax season. The good news? You don’t need to be an accountant to get it right. This guide breaks down exactly how crypto is taxed in Canada, what you owe, what’s free, and how to avoid costly mistakes.

How the CRA Classifies Cryptocurrency

The CRA doesn’t treat Bitcoin or Ethereum like cash. They’re not currency. They’re property. That means every time you trade, sell, or spend crypto, it’s treated like selling a stock, a piece of art, or a car. You don’t pay tax when you buy crypto with CAD. You don’t pay tax when you hold it. But the moment you dispose of it - whether you trade it for another coin, buy a laptop with it, or cash out to your bank - you trigger a taxable event.

This isn’t new. The CRA laid this out in 2013 and updated it in 2020. In August 2025, they reinforced it with draft legislation that confirms crypto-assets are commodities, not money. So if you’re thinking, “I didn’t earn income, so I don’t owe tax,” you’re wrong. You’re selling an asset. And the government wants its cut.

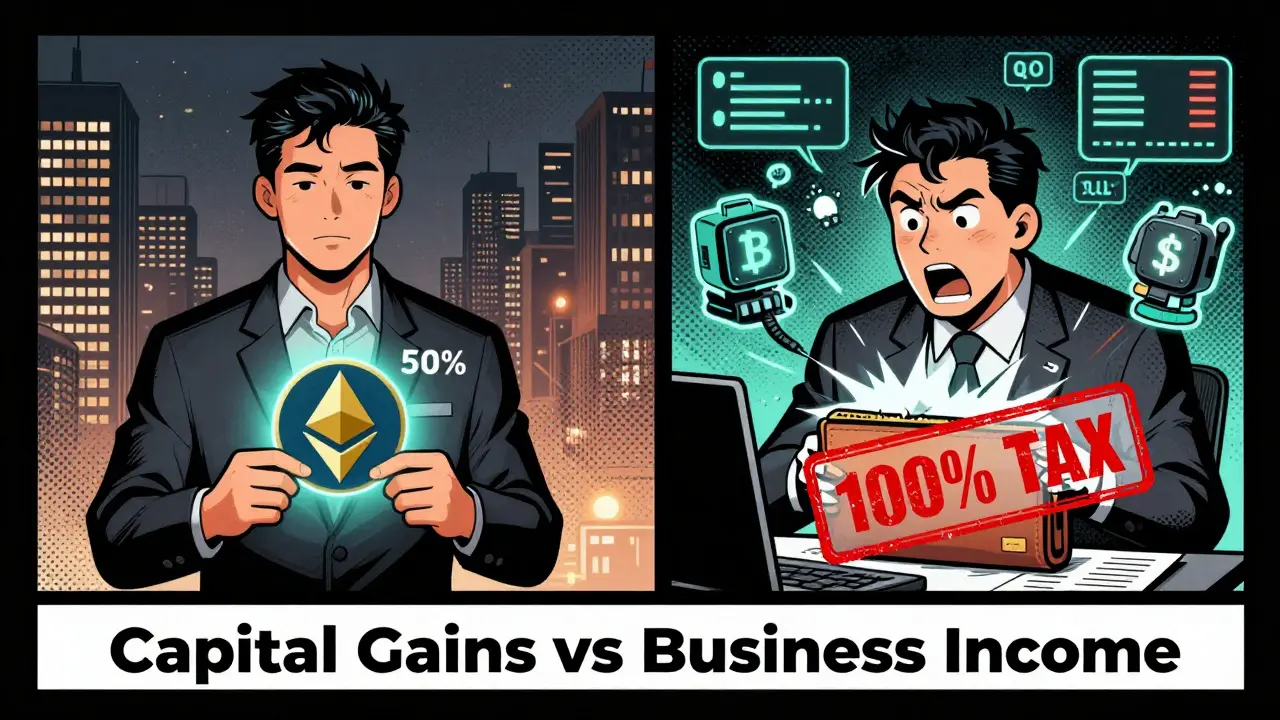

Two Ways Crypto Gets Taxed: Capital Gains vs. Business Income

There are two buckets for crypto taxes in Canada: capital gains and business income. Which one you fall into depends on how you use crypto.

Capital gains apply if you’re buying and holding crypto as an investment. This covers most individual investors. When you sell or trade, only 50% of your profit is taxable. For example, if you bought $5,000 worth of Ethereum and sold it for $12,000, your gain is $7,000. Only $3,500 is added to your income. That’s the big advantage.

Business income kicks in if you’re trading frequently, running a mining operation, or getting paid in crypto for services. The CRA looks at your behavior. Did you trade 20 times last month? Did you use automated bots? Did you treat crypto like a job? If yes, they’ll likely classify it as business income. And here’s the catch: 100% of the profit is taxable. No 50% discount. That means that same $7,000 gain becomes fully taxable - potentially doubling your tax bill.

One real case from 2024: a Toronto trader made $48,000 in crypto profits over 18 months. He thought he was investing. The CRA audited him and reclassified all gains as business income. He owed $15,000 more than he expected.

What Counts as Taxable Income

Not all crypto activity is the same. Here’s what triggers tax:

- Selling crypto for CAD - Taxable. You realize a gain or loss.

- Trading one crypto for another - Taxable. Even if you didn’t touch fiat, you disposed of one asset for another.

- Using crypto to buy goods or services - Taxable. That pizza you bought with Bitcoin? You just triggered a capital gain on the BTC you spent.

- Receiving crypto as payment - Taxable as business income. If you’re a freelancer and get paid in ETH, the fair market value in CAD on the day you received it is your income.

- Mining, staking, or airdrops - Taxable as business income. The value of the crypto when you receive it is income. You don’t wait until you sell it.

What’s not taxable?

- Buying crypto with CAD

- Holding crypto (no sale or trade)

- Transferring crypto between your own wallets

- Receiving crypto as a gift (unless you later sell it)

- Creating a DAO (Decentralized Autonomous Organization)

That last one - DAO creation - is often misunderstood. If you help launch a DAO and get tokens as part of the setup, those tokens are taxable when you receive them. But setting up the structure itself? No tax.

Tax Rates: How Much You Actually Pay

Canada uses a progressive tax system. Your crypto gains get added to your other income - salary, side gigs, rental income - and taxed at your marginal rate.

For 2025, federal tax rates are:

- 15% on income up to $55,867

- 20.5% on income between $55,868 and $111,733

- 26% on income between $111,734 and $173,205

- 29% on income between $173,206 and $246,752

- 33% on income over $246,752

Then you add provincial rates. Ontario adds up to 13.16%. Quebec adds up to 25.75%. British Columbia adds up to 12.06%.

Let’s say you’re in Ontario and made $100,000 in capital gains. You only pay tax on half of that: $50,000. Your federal tax on $50,000 is about $10,500. Add Ontario’s 9.15% on that portion (since it pushes you into the $98,463-$150,000 bracket), and you owe another $4,575. Total: $15,075.

Now, if that same $100,000 was business income? You pay tax on the full $100,000. Federal tax jumps to $22,000. Ontario adds $9,150. Total: $31,150. That’s more than double.

Tax Loss Harvesting: The Legal Way to Cut Your Bill

Lost money on crypto? You can use that to reduce your tax bill - but only if you follow the rules.

Capital losses can offset capital gains. But here’s the catch: only 50% of your loss is deductible. So if you lost $10,000, you can only use $5,000 to reduce your taxable gains.

And there’s a trap: the superficial loss rule. If you sell a crypto asset at a loss and buy it back - or even buy a very similar one - within 30 days before or after the sale, the CRA disallows the loss.

Example: You sell 1 BTC for $50,000 at a $10,000 loss. You buy 1 BTC again 15 days later. The CRA says: “No loss allowed.” You still owe tax on the gain you made earlier. The fix? Wait 31 days before buying back. Or buy a different asset - like ETH instead of BTC.

One Reddit user, u/TaxSmartTrader, saved $3,200 in 2024 by timing his losses and avoiding the 30-day window. Another, u/CryptoTaxNightmare, spent 47 hours trying to track his trades across five exchanges - and still got audited.

How to Report Crypto on Your Tax Return

You report crypto on two forms:

- Schedule 3 - For capital gains and losses. This goes with your T1 personal tax return.

- Form T2125 - For business income from mining, staking, or crypto trading as a business.

You need to track:

- When you bought each coin

- How much you paid (in CAD)

- When you sold or traded it

- What you received (and its value in CAD at the time)

Most people use crypto tax software. TurboTax Canada gets 3.8 stars on Trustpilot - users say its crypto features are “incomplete.” Koinly gets 4.6 stars. Why? It has built-in CRA templates, supports Canadian exchanges, and auto-calculates capital gains using the correct method (FIFO or ACB).

The CRA doesn’t require you to use software. But if you’re trading more than 5 times a year, you’re asking for trouble doing it by hand.

What Happens If You Don’t Report

The CRA is watching. Crypto-related audits rose 37% from 2023 to 2024. They’re getting data from exchanges. Wealthsimple, Coinsquare, and Bitbuy now provide CRA-compliant tax statements to users - up from 62% in 2022 to 87% in 2025.

Penalties are harsh:

- 5% of the tax you owe, plus 1% per month you’re late (max 12 months)

- 10% of the tax owed if the CRA says you were grossly negligent

“Gross negligence” is how the CRA labels repeated mistakes, ignoring warnings, or hiding transactions. In 2025, their compliance review found that 73% of audited crypto returns had material errors. The top three? Wrong cost basis (42%), misclassifying income as capital gain instead of business income (31%), and not reporting international exchange activity (27%).

One man in Vancouver didn’t report $80,000 in crypto gains from Binance. The CRA found it through bank deposits. He paid $45,000 in taxes, penalties, and interest. He didn’t go to jail - but he lost his home equity.

What’s Changing in 2026

The draft legislation released in August 2025 proposes new rules:

- Crypto transactions over $10,000 must be reported to the CRA - similar to how banks report cash deposits.

- Exchanges will be required to collect and report user KYC data to the CRA.

- Penalties for non-compliance will increase.

The Department of Finance estimates this will bring in $285 million extra in tax revenue by 2027. That’s not a warning - it’s a signal. The era of “I didn’t know” is over.

What You Should Do Right Now

Don’t wait until April. Here’s your action plan:

- Collect all transaction history from every exchange, wallet, and platform you used in 2025.

- Use crypto tax software like Koinly or CoinLedger to calculate your gains and losses.

- Classify each transaction: capital gain or business income?

- If you have losses, check if they’re eligible for tax loss harvesting - and avoid the 30-day window.

- File Schedule 3 and/or T2125 with your T1 return by April 30, 2026.

If you’re unsure, hire a CPA who’s done crypto taxes before. The Canadian CPA Association found that 68% of tax pros think the system is too complex for average people. You’re not dumb for needing help. You’re smart for getting it.

Canada’s crypto tax rules aren’t designed to punish you. They’re designed to make sure everyone pays their fair share. Get it right, and you’ll sleep better. Get it wrong, and you’ll pay the price - with interest.

Surendra Chopde

January 9 2026Just bought my first ETH last week and had no idea this was a taxable event. Thanks for laying it out so clearly - I was about to make a huge mistake.

Michael Richardson

January 9 2026Canada’s got it backwards. If you’re not holding USD, why should you pay tax on crypto? This is just socialism with a spreadsheet.

Tre Smith

January 10 2026Let’s be real - 54% of crypto owners are unprepared because they’re lazy. You don’t get to treat speculative assets like Monopoly money and then cry when the IRS comes knocking. The CRA’s rules are clear, consistent, and legally sound. If you can’t track your trades across five exchanges, you shouldn’t be trading. And yes, that includes you, u/TaxSmartTrader - your 3,200 savings came from exploiting loopholes, not good planning.

LeeAnn Herker

January 11 2026Wait - so the government says Bitcoin is property but also demands we report every single transaction like we’re running a bank? Sounds like a trap. Who’s really benefiting here? The big exchanges? The tax software companies? The same people who told us mortgage-backed securities were safe? I’m not buying it. This isn’t taxation - it’s surveillance with a receipt.

sathish kumar

January 12 2026As someone from India who has been tracking crypto gains for five years, I can confirm the CRA’s approach is one of the most transparent globally. Many emerging markets still lack clarity. Canada’s framework, though strict, provides a solid foundation for compliance. The key is documentation - and using ACB method correctly.

Veronica Mead

January 12 2026It is imperative to recognize that the classification of cryptocurrency as property, rather than currency, is not merely a bureaucratic formality - it is a necessary legal distinction rooted in centuries of property law doctrine. The Canadian Revenue Agency has acted with commendable diligence in upholding fiscal integrity. To treat digital assets as anything less than capital property would be to undermine the very principles of equitable taxation. One cannot selectively apply accounting standards based on convenience or ignorance. This guide is not only accurate - it is morally imperative.

Frank Heili

January 13 2026For anyone doing more than 10 trades a year, use Koinly. I’ve seen too many people try to do it manually and end up with audit nightmares. The FIFO vs. ACB thing trips everyone up. Also - if you’re mining or staking, don’t forget to record the CAD value at the moment you received the coins. That’s your cost basis. And yes, even if you didn’t sell it yet - it’s still income. I’ve helped 47 clients fix this exact mistake last year.

Gideon Kavali

January 14 2026Let me be absolutely clear: This isn’t about ‘fair share.’ It’s about control. The government doesn’t want you to succeed - they want you to report. They want your data. They want your history. They want to know when you bought, when you sold, and how much you made - so they can tax it, regulate it, and eventually ban it. This isn’t taxation - it’s the first step toward financial fascism. And if you’re okay with that, you’re already lost.

Jordan Leon

January 14 2026There’s a philosophical tension here - between personal autonomy and collective responsibility. If I choose to hold value in a decentralized asset, why should the state dictate how I account for it? Yet, if I derive economic benefit from it, isn’t there a social contract at play? I don’t have the answer. But I do know this: if we keep treating crypto like a tax loophole, we’ll lose the very innovation that makes it valuable. Maybe the real question isn’t ‘how much do we owe?’ - but ‘what kind of society do we want to build?’

Caitlin Colwell

January 15 2026Thanks for this. I finally understand why my friend got audited. I was going to use crypto to buy a laptop next month - now I know to wait until after tax season.

Tiffani Frey

January 15 2026Important note: If you transferred crypto from Binance to a Canadian wallet in 2025, you still need to report the fair market value at the time of receipt - even if you didn’t sell it. Many people miss this. Also, if you used a non-KYC exchange (like KuCoin or Bybit), you’re still required to report. The CRA doesn’t care if you think it’s ‘private’ - they get bank records, and they cross-reference. Don’t assume you’re invisible.

Allen Dometita

January 16 2026Bro, I made $20k in crypto last year and didn’t report a thing. Just bought a new truck. Who’s gonna find out? 😎

jim carry

January 18 2026YOU THINK THIS IS BAD? WAIT TILL THEY START TRACKING YOUR WALLET ADDRESSES ACROSS BLOCKCHAINS. THEY’RE ALREADY DOING IT. THEY’RE BUILDING AI THAT CAN TRACE YOUR TRANSACTIONS BACK TO YOUR IP. YOU THINK YOU’RE ANONYMOUS? YOU’RE A LIVING DATABASE. THE CRA ISN’T JUST TAXING YOU - THEY’RE REWRITING YOUR DIGITAL IDENTITY. AND YOU’RE HELPING THEM BY USING EXCHANGES. YOU’RE THE VICTIM. AND YOU DON’T EVEN KNOW IT.

Ritu Singh

January 18 2026They say crypto is property but then treat it like money - that’s the contradiction. They want to control the medium but deny it’s currency. It’s like calling a cat a dog and then charging you for barking. The system is broken. We’re living in a simulation where the rules change every time you blink. The real tax? Your sanity. I’m going to live off-grid and barter with gold now. At least gold doesn’t have a blockchain ledger.

Meenakshi Singh

January 20 2026My friend got hit with a $12k bill because he swapped BTC for ETH and didn’t realize it was taxable. He thought it was just ‘moving money.’ Now he’s working two jobs to pay it off. Don’t be him. Use Koinly. Seriously. It’s $50/year. Worth every penny.

kris serafin

January 21 2026Just used Koinly for the first time - took 12 minutes to import 800 trades from 3 wallets. Auto-calculated ACB, flagged superficial losses, even generated Schedule 3. I’m crying tears of joy. 🙏

Dave Lite

January 22 2026For those doing business income: if you’re using bots, trading 5+ times a week, or getting paid in crypto for services - you’re a business. That means you can deduct expenses: software, internet, electricity for mining, even your home office if you’re doing it full-time. Don’t just report gains - reduce your liability. Talk to a crypto-savvy CPA. They exist. I’ve worked with 3 in Toronto alone.

Andy Schichter

January 24 2026Wow. So I’m supposed to spend 47 hours tracking trades so some bureaucrat can take 30% of my gains? And I thought the point of crypto was to escape this nonsense. I guess I’ll just keep my coins in a locked drawer and hope they appreciate. Or maybe I’ll just move to El Salvador. At least there, they don’t care.

Mollie Williams

January 25 2026I used to think crypto was just about money - until I realized it was about freedom. But freedom without responsibility becomes chaos. The CRA isn’t the enemy. The enemy is the myth that you can opt out of consequences. Taxation isn’t punishment - it’s participation. We’re not just traders. We’re citizens. And this guide? It’s the map to being one without losing your soul.

Sabbra Ziro

January 25 2026To everyone panicking about the 30-day rule: don’t panic. Just wait 31 days. Or swap to a different asset - like BTC to LTC, not BTC to BCH. It’s not that hard. And if you’re unsure, ask a professional. No shame in that. I’ve seen too many people lose their savings because they thought they knew better. You don’t need to be an expert - just careful.

Rahul Sharma

January 25 2026From India, I can say: Canada’s crypto tax system is far more structured than ours. Here, we have no clear rules - so everyone ignores it. But that leads to bigger problems later. This guide is excellent. Clear, practical, and grounded in reality. Thank you for writing this.

Denise Paiva

January 26 2026They say ‘you don’t pay tax when you buy’ - but if you buy with a credit card and get cashback in crypto, is that income? What if you earn it through a referral bonus? What if you’re paid in USDT and convert it to CAD three weeks later? The rules are a maze. And the CRA doesn’t care if you’re confused. They’ll still come for you. This guide is helpful - but it’s also terrifying

Veronica Mead

January 26 2026While the preceding comment raises a valid concern regarding the ambiguity of ancillary income streams - such as referral bonuses or credit card rewards - it is worth noting that the CRA has consistently interpreted such receipts as taxable events under subsection 56(1)(a) of the Income Tax Act. The nature of the receipt - whether direct or indirect - does not negate its characterization as income. To suggest otherwise is to misunderstand the foundational principle of all-inclusive income taxation. One must account for every form of economic benefit, however incidental.