Starting January 1, 2026, every Nigerian who trades, sells, or earns cryptocurrency must pay taxes on it. No more guessing. No more ignoring it. The Nigeria Tax Act 2025 (NTA 2025) made it official: crypto profits are taxable, and the government is ready to enforce it. If you’ve been holding Bitcoin, trading Ethereum, or getting paid in USDT, this affects you - whether you like it or not.

How Crypto Is Now Classified in Nigeria

Before 2026, crypto sat in a legal gray zone. You could buy it, but banks couldn’t help you. The government didn’t say it was illegal, but it didn’t say it was legal either. That changed with the Investments and Securities Act 2025 (ISA 2025). Now, cryptocurrencies, tokens, and even NFTs are officially classified as securities under the authority of the Securities and Exchange Commission (SEC). This isn’t just a label change - it means crypto transactions are now tracked, recorded, and regulated like stocks or bonds.This move ties crypto directly to Nigeria’s financial oversight system. The SEC now requires every crypto business - exchanges, wallet providers, staking platforms - to get a license as a Virtual Asset Service Provider (VASP). If a company doesn’t have this license, it can’t operate legally. And if you’re using an unlicensed platform? You’re not just at risk of losing your funds - you’re also exposing yourself to tax penalties.

What Counts as a Taxable Event?

You don’t pay tax just for holding crypto. But every time you move it, sell it, or use it to buy something, you trigger a taxable event. Here’s what the Nigeria Tax Act 2025 says:- Selling crypto for Naira or foreign currency - You owe capital gains tax on the profit.

- Trading one crypto for another - Even swapping BTC for ETH counts as a disposal. The gain is calculated from your original purchase price.

- Using crypto to pay for goods or services - If you bought coffee with Dogecoin, the difference between what you paid for it and its value at the time of purchase is taxable.

- Earning crypto as income - Whether you’re paid in USDT by a client, get staking rewards, or mine Bitcoin, it’s treated as ordinary income and taxed at your personal income tax rate.

- Receiving crypto as a gift - If someone gives you crypto, you don’t pay tax right away. But when you later sell it, you’ll owe tax on the gain from the original owner’s cost basis.

There’s no exemption for small trades. Even if you made ₦5,000 in profit from a weekend trade, it still needs to be reported. The government doesn’t care how small - if it’s traceable, it’s taxable.

How the Government Is Tracking Your Crypto

The big shift isn’t just the law - it’s how they’re enforcing it. In December 2023, the Central Bank of Nigeria reversed its ban and started allowing banks to open accounts for licensed VASPs. That means your crypto transactions now flow through regulated financial channels. If you use a local exchange like Busha - which is fully licensed - your deposits, withdrawals, and trades are recorded and reported to tax authorities.Meanwhile, offshore platforms like Binance and KuCoin are being blocked. If you’re still using them, your transactions are harder to track - but that doesn’t mean you’re safe. The Nigerian Tax Authority now has access to digital payment records, bank transfers, and even blockchain analytics tools. They can trace wallet addresses linked to Nigerian IDs or bank accounts. Ignoring taxes won’t make them disappear - it just makes the penalty worse.

What Businesses Must Do

If you run a business in Nigeria that accepts crypto - whether as payment, payroll, or investment - you have new obligations:- Register as a licensed VASP with the SEC if you’re facilitating crypto transactions.

- Update your accounting software to record crypto income, expenses, and gains in real time.

- Keep detailed records of every transaction: date, amount, value in Naira at the time, and purpose.

- Include crypto earnings in your annual tax return under “other income” or “capital gains.”

- Hire a tax advisor who understands digital assets. Most accountants still don’t know how to handle crypto.

Companies that fail to comply can face fines, asset freezes, or even criminal charges. The NTA 2025 gives tax authorities the power to freeze bank accounts linked to unreported crypto activity. It’s not a warning - it’s a mandate.

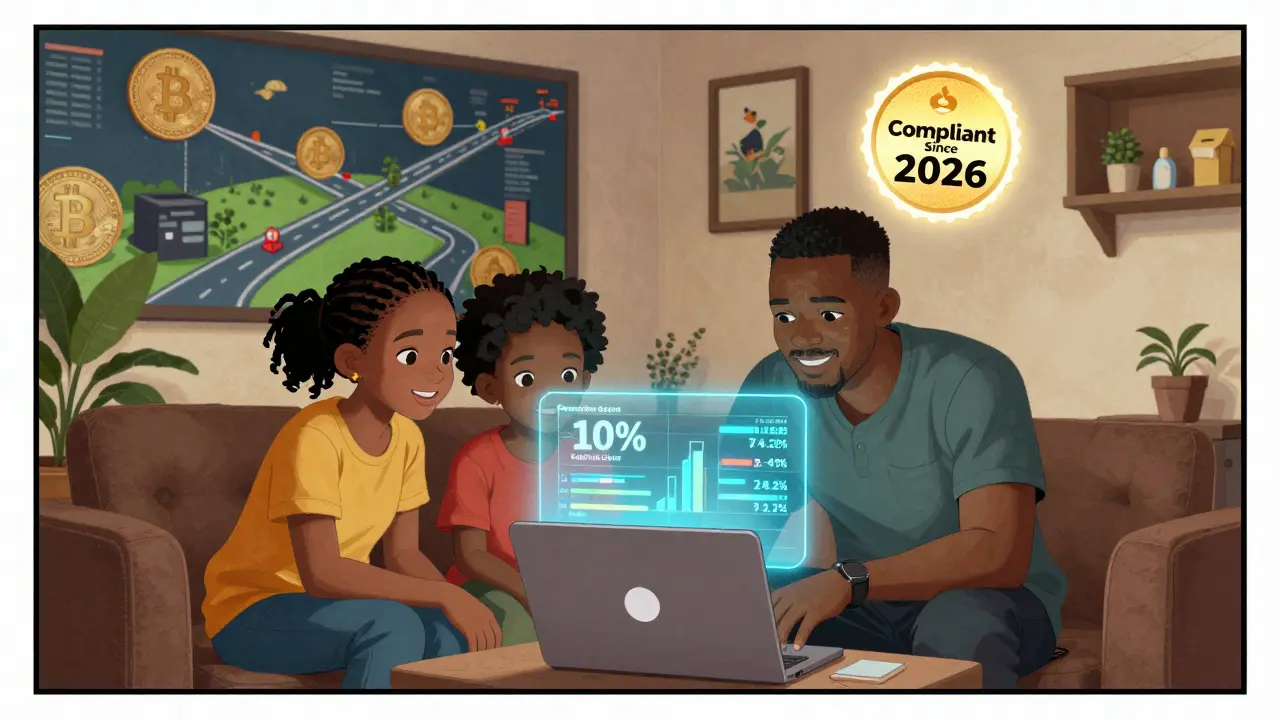

What Are the Tax Rates?

There’s no flat crypto tax rate in Nigeria. Instead, taxes depend on how you use crypto:- Capital gains tax: 10% on profits from selling or trading crypto. This applies to individuals and businesses.

- Income tax: If you earn crypto as salary, staking rewards, or mining, it’s taxed at your personal income tax rate - which ranges from 7% to 24% depending on your total income.

- Corporate tax: Companies that trade or hold crypto as part of their business pay 30% corporate tax on crypto-related profits.

Example: You bought 0.5 BTC for ₦2.5 million in 2024. In March 2026, you sell it for ₦4 million. Your profit is ₦1.5 million. You owe 10% capital gains tax - that’s ₦150,000. If you earned that same 0.5 BTC as a salary in 2025, it would’ve been taxed as income at your rate - possibly more than ₦150,000.

How to Stay Compliant

You don’t need to be an expert. But you do need to be organized. Here’s how to stay on the right side of the law:- Use only licensed Nigerian exchanges like Busha, Luno, or Quidax. They report to the tax authority automatically.

- Keep all transaction records - wallet addresses, timestamps, Naira values, and receipts.

- Use crypto tax software (like Koinly or CoinTracker) to calculate gains and losses. Many now support Nigerian Naira pricing.

- File your tax return by April 30, 2026, including crypto income under the “other income” section.

- Consult a tax professional who’s trained on Nigeria’s new crypto rules. Don’t rely on your regular accountant unless they’ve taken the SEC’s VASP compliance course.

What Happens If You Don’t Pay?

The Nigerian Tax Authority has made it clear: this isn’t a trial period. Starting in 2026, audits will begin. If you didn’t report crypto gains from 2025 or earlier, you’ll be hit with back taxes, interest, and penalties - up to 200% of the amount owed. Repeat offenders could face criminal prosecution.There’s no amnesty program. No grace period. The system is live, and it’s watching. If you’ve been avoiding taxes, now is the time to fix it - not because you fear the government, but because you want to protect your assets.

Why This Matters Beyond Taxes

This isn’t just about money. It’s about legitimacy. Nigeria’s new framework turns crypto from a risky underground activity into a regulated financial tool. It opens the door for institutional investors, fintech innovation, and even foreign investment. But only if you play by the rules.For the first time, Nigerian crypto users can operate with confidence - knowing their transactions are protected, their profits are legal, and their records are secure. The old days of hiding behind anonymity are over. The new era demands transparency. And if you’re ready for it, this could be the best time ever to build in crypto - legally, safely, and profitably.

Do I have to pay tax on crypto I bought before 2026?

Yes. The Nigeria Tax Act 2025 applies to all crypto disposals made on or after January 1, 2026 - regardless of when you bought it. If you sell Bitcoin you bought in 2020 in 2026, you owe tax on the profit. Your cost basis is the original purchase price in Naira, not the current value.

Can I use Binance or other offshore exchanges and avoid tax?

Technically, you might avoid detection - but you’re still legally required to report income from those platforms. The Nigerian government has tools to trace wallet addresses linked to Nigerian bank accounts or IDs. Using unlicensed exchanges increases your risk of penalties, frozen assets, or legal action. Licensed local exchanges like Busha are safer and automatically report to tax authorities.

What if I only earn crypto as staking rewards?

Staking rewards are treated as income. Each time you receive them, record the Naira value at the time of receipt. That amount is added to your annual income and taxed at your personal income tax rate (7%-24%). You don’t pay capital gains until you sell those rewards.

Do I need to file even if I didn’t make a profit?

Yes. You must report all crypto transactions, even if you broke even or lost money. The tax authority needs to see your full activity to verify your records. Losses can offset gains in future years, but only if they’re properly documented and declared.

Are there any crypto tax exemptions in Nigeria?

No. Unlike some countries that exempt small personal trades or long-term holds, Nigeria’s NTA 2025 has no exemptions. Every disposal, trade, or income receipt is taxable. There’s no minimum threshold - even ₦100 in profit must be reported.