Ecuador Crypto Cost Comparison Tool

How much does crypto cost in Ecuador?

This tool compares regulated exchange fees versus underground cash/gift card trading costs based on Ecuador's economic reality. Note: Underground trading carries significant risks.

Results will appear here after calculation

There’s no official record of an underground crypto market in Ecuador. No police raids. No seized servers. No leaked documents. No headlines about crypto cartels or black-market exchanges. And yet, thousands of Ecuadorians trade Bitcoin every day - not on Binance or Bit2Me, but in ways that leave no digital trail. So where is the line between legal trading and something darker?

Legal Crypto Is Everywhere - But Not Everyone Uses It

Ecuador made it legal to buy and sell cryptocurrencies in 2021. The government didn’t endorse them as money. They just stopped calling it a crime. That opened the door for CEX.IO, Bybit, Gemini, and Bit2Me to operate openly. You can buy Bitcoin with your debit card. You can trade USDT over bank transfer. You can even earn interest on your crypto holdings through regulated platforms. But legality doesn’t mean accessibility. In Q3 2025, the average Ecuadorian earned about $320 a month. A single Bitcoin transaction on a regulated exchange can cost $5-$15 in fees, depending on the payment method. For someone scraping together rent money, that’s not a fee - it’s a barrier. So they look elsewhere.How the Underground Moves: Cash, WhatsApp, and Trust

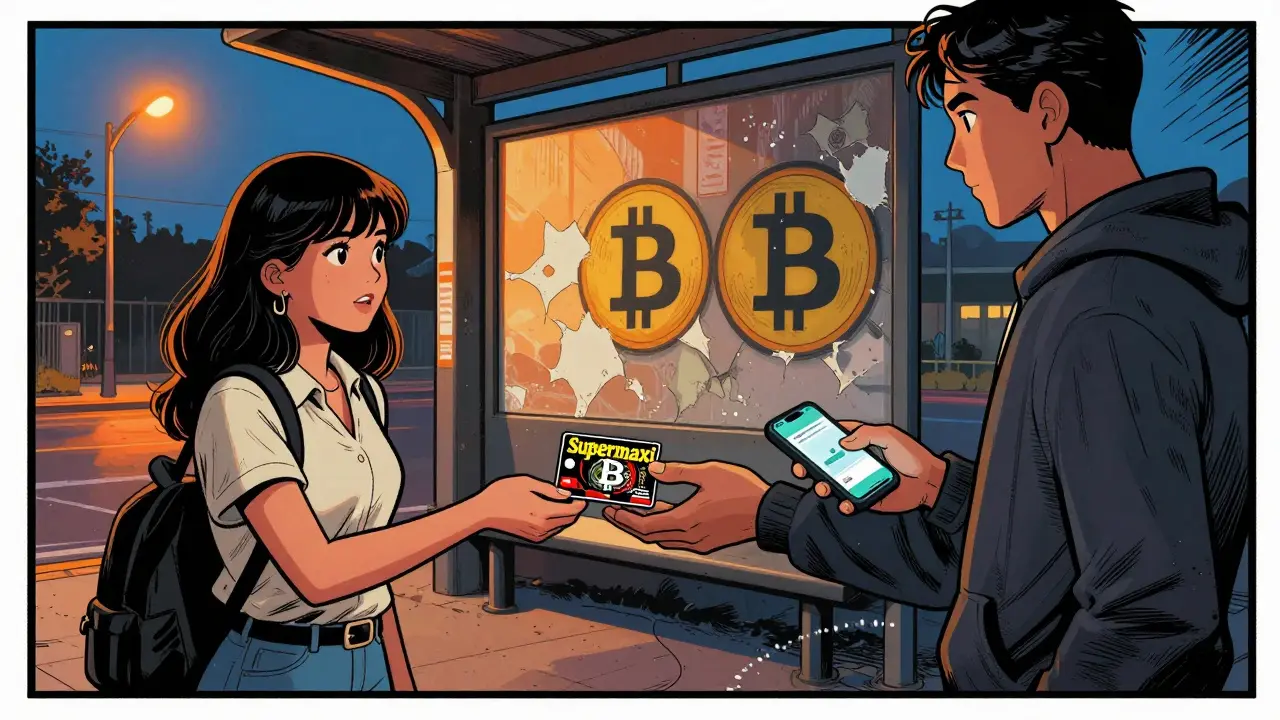

The real crypto economy in Ecuador doesn’t live on apps. It lives in the back seats of taxis, in corner stores, in WhatsApp groups with names like “Bitcoin Guayaquil - Cash Only” or “P2P Quito - No KYC”. Here’s how it works:- A buyer texts a seller: “Need 0.02 BTC. Cash in hand.”

- The seller sends a Bitcoin wallet address - no registration, no ID, no verification.

- The buyer walks into a grocery store, buys a $50 gift card, and hands it over at a bus stop.

- The seller confirms receipt of the card code, then sends the Bitcoin.

Why Do People Risk It?

The answer isn’t about secrecy. It’s about survival. Ecuador’s banking system is slow. Wire transfers take 3-5 days. Many people don’t have bank accounts at all. Those who do often face high fees and strict limits. When inflation hit 10.7% in 2024, people needed to move money fast. Bitcoin became a lifeline. And then there’s the fear of government oversight. Even though trading crypto is legal, many Ecuadorians remember the 2015-2018 period when the government tried to ban all digital currencies and pushed its own state coin - the “Ecuadorian Digital Coin” - which never launched. That left a deep distrust. Why give your ID to a platform that might disappear tomorrow? So they trade in the shadows. Not because they’re criminals. Because they’re cautious.

Who’s Running These Underground Networks?

There’s no single boss. No cartel. No dark web hub. Instead, it’s a loose network of local traders - students, mechanics, small shop owners, even teachers. Many started by buying Bitcoin legally, then realized they could sell it to friends for cash. Word spreads. A neighbor’s cousin knows someone who trades crypto. Soon, you’ve got a circle of five people trading weekly. Some become semi-professional. They post rates on Telegram channels. They accept payment via mobile wallets like “Dinero Móvil” or “PagaTodo”. They keep a small reserve of Bitcoin and USDT. They don’t need a license. They don’t file taxes. They just move money. And the government? They’re not ignoring it. They just don’t see it as a threat.The Regulatory Blind Spot

Ecuador’s financial regulator, the Superintendencia de Bancos, focuses on big players. They audit CEX.IO. They check if Bit2Me follows KYC rules. They care about money laundering through banks. They don’t track cash trades between strangers in a bus station. That’s the gap. The underground market isn’t large enough to be a crisis. It’s not generating billions. It’s not funding crime. It’s just helping ordinary people get around a broken system. In 2024, the Central Bank of Ecuador estimated that less than 1% of all crypto transactions in the country occurred outside regulated platforms. But that 1% represents tens of thousands of people. Each transaction is small - under $200. But add them up, and you’ve got a quiet, resilient economy running parallel to the official one.What Happens If You Get Caught?

Here’s the truth: you won’t get caught. There are no laws against peer-to-peer cash trades in Ecuador. As long as you’re not laundering drug money or financing terrorism, you’re not breaking anything. The government hasn’t prosecuted a single person for buying Bitcoin with cash. But there’s risk - not legal, but personal. Meeting strangers to exchange cash for crypto carries physical danger. There have been isolated reports of theft at meeting points in Guayaquil and Quito. Some traders now use public libraries or police station parking lots as neutral zones. Others only trade with people they know through mutual contacts. The bigger risk? Scams. Fake wallets. Fake gift cards. Sellers who vanish after you send cash. Because there’s no dispute system, no chargeback, no customer support. If you’re scammed, you’re out of luck.

Anselmo Buffet

December 12 2025This is how real finance works when the system fails you. No banks, no forms, no waiting. Just trust and cash. Simple as that.

Kathleen Sudborough

December 13 2025I lived in Ecuador for a year and saw this firsthand. People aren't criminals-they're just trying to feed their families. The government should be helping, not ignoring.

Vidhi Kotak

December 15 2025This reminds me of how people in rural India use UPI cash transfers when banks are closed. It's not about breaking rules-it's about making life work. The system needs to adapt, not punish.

Kim Throne

December 15 2025While the human element of this phenomenon is undeniably compelling, one must not overlook the macroeconomic implications of decentralized monetary substitution in a nation with persistent currency instability. The regulatory framework remains woefully inadequate.

Caroline Fletcher

December 16 2025So the government is just letting people trade Bitcoin in parking lots? Sounds like the perfect setup for a CIA op. Next thing you know, the Fed’s using gift cards to buy drones.

Heath OBrien

December 18 2025This is why America needs to ban crypto. People are meeting strangers in bus stations with cash. This is not freedom. This is chaos. 🤦♂️

Taylor Farano

December 19 2025Oh wow. So the solution to Ecuador’s banking crisis is... random people on WhatsApp? Groundbreaking. Next you’ll tell me people are bartering chickens for ETH.

Toni Marucco

December 20 2025The elegance of this system lies not in its legality, but in its resilience. It emerges not from rebellion, but from necessity-a silent, decentralized social contract forged by those excluded from the formal economy. It is not an underground market. It is a parallel civilization.

Hari Sarasan

December 21 2025The structural inefficiencies of Ecuador's financial architecture are exacerbated by the absence of centralized monetary governance. The proliferation of unregulated P2P mechanisms constitutes a systemic risk vector requiring immediate macroprudential intervention.

Stanley Machuki

December 23 2025People just want to move money. No drama. No fees. No waiting. This isn't underground. It's just smart.

Lloyd Cooke

December 25 2025There is a profound metaphysical truth here: when institutions fail to serve, individuals become the institution. The Bitcoin transaction is not a commodity exchange-it is an act of sovereignty. The state does not grant permission to exist. Existence grants permission to the state.

Kurt Chambers

December 27 2025Ecuadorians are just dumb if they think this is safe. The government’s gonna come down hard one day. And when they do, they’ll blame the people, not the system that failed them. America’s better than this.

Kelly Burn

December 28 2025This is why I love crypto 💎✨ People helping people without banks. No KYC, no drama, just vibes. Ecuadorians are the real OGs of financial freedom. 🌎❤️

Albert Chau

December 29 2025You call this survival? This is just reckless. People are risking their lives for a digital token. If you can’t trust your own government, maybe you should move.

Madison Surface

December 29 2025I can’t believe how many people are doing this without realizing they’re building something beautiful. It’s not illegal-it’s human. And it’s happening quietly, without fanfare, because they don’t need approval to survive.

Tiffany M

December 31 2025I’ve seen this in Nigeria, in Venezuela, in Argentina... People don’t want to break the law. They just want to live. Why is it so hard for people to understand that? This isn’t crime. It’s compassion with a wallet.

Eunice Chook

January 1 2026So the 1% is tens of thousands of people? That’s not a blip. That’s a movement. And the fact that the government ignores it proves they know they can’t control it.

Lois Glavin

January 3 2026This is the kind of innovation that doesn’t need a grant or a startup pitch. It just needs people who care enough to show up, cash in hand, and trust each other. That’s worth protecting.

Scot Sorenson

January 4 2026Oh wow, so the answer to Ecuador’s financial collapse is... gift cards? That’s the most pathetic thing I’ve read all week. You’re not building a future. You’re just bartering with plastic.