Stop-Loss Strategy Advisor

Automated Stop

Pre-programmed orders that execute without emotion.

Mental Stop

Manual monitoring and execution based on market context.

Recommended Approach

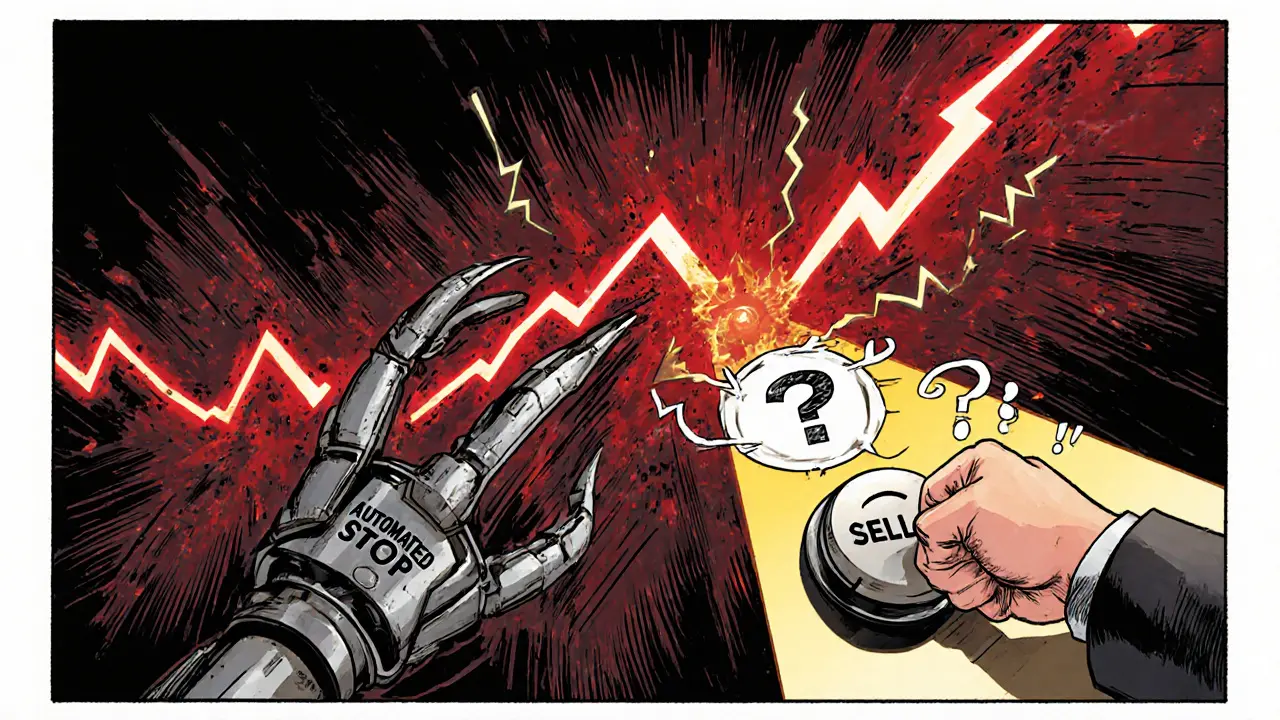

Trying to decide whether to rely on gut instinct or let a computer guard your downside? The clash between automated stop-loss orders and mental stops is one of the hottest debates among traders, especially when volatility spikes and emotions run high. Below you’ll find a practical roadmap that helps you pick the right tool, avoid costly mistakes, and actually stick to your risk plan.

TL;DR

- Automated stops execute without emotion, perfect for part‑time traders or anyone who struggles with discipline.

- Mental stops give you flexibility in fast‑moving markets but demand relentless focus and self‑control.

- Slippage is the main risk of automation; guaranteed stop‑loss orders (GSLOs) can lock in price but cost more.

- Use a hybrid approach-automated stops for baseline protection, mental judgment for extreme volatility.

- Follow the checklist at the end to set up a robust risk‑management workflow.

What Is an Automated Stop-Loss Order?

Automated stop-loss order is a pre‑programmed instruction that tells a broker to sell (or buy to cover) a position once the market price hits a specific level. The order lives on the exchange, independent of your screen, and fires automatically whether you’re at your desk or on a coffee break.

Most platforms support three flavors:

- Market stop - sells at the best available price once the trigger is hit.

- Limit stop - only sells at the trigger price or better, which can prevent slippage but may fail to execute.

- Guaranteed stop‑loss order (GSLO) - ensures execution exactly at the stop price, even during gaps; brokers usually charge a premium for this certainty.

Because the logic runs on the broker’s servers, the trade is executed in milliseconds, removing any chance that fear or greed interferes with the decision.

What Is a Mental Stop?

Mental stop-loss is a self‑imposed loss threshold that you monitor manually. You watch the chart, see the price approach your limit, and then click ‘sell’ yourself.

This method gives you the ability to assess real‑time market context. If a news flash creates a temporary dip, you might decide to hold a few extra ticks, hoping the price rebounds. But that same flexibility can become a trap: the longer you stare at a losing position, the more likely you’ll rationalize staying in, letting losses snowball.

Pros and Cons - Side by Side

| Aspect | Automated Stop-Loss | Mental Stop |

|---|---|---|

| Execution speed | Instant, server‑side | Human reaction time (seconds to minutes) |

| Emotional influence | None once set | High - fear, hope, over‑analysis |

| Flexibility in volatile markets | Limited - may suffer slippage or gaps | Can adjust in real time |

| Discipline requirement | Low - set‑and‑forget | Very high - must act manually |

| Cost | Usually free beyond normal commissions; GSLO adds premium | No direct fees, but larger realized losses over time |

| Best for | Part‑time traders, novices, high‑frequency environments | Experienced traders with strong discipline, low‑volatility assets |

When Volatility Strikes - Does Automation Still Win?

During calm market periods, automated stops usually fill at or near the trigger, giving you exactly the protection you asked for. In a flash‑crash or major news event, price gaps can bypass the stop level, resulting in slippage that may be tens of ticks worse than planned.

Traders who can read the tape in those moments sometimes prefer a mental stop, waiting to confirm whether the gap will hold before exiting. However, the same high‑stress environment also makes it hardest to stay disciplined-many end up freezing, watching losses grow.

One compromise is the trailing stop. It moves your stop level up (or down for shorts) as the price advances, locking in profit while still protecting the downside. Some platforms let you set a trailing distance in points or a percentage, blending automation with a degree of adaptability.

Hybrid Approaches - Getting the Best of Both Worlds

Most professional traders don’t choose an either/or; they layer safeguards. A common setup looks like this:

- Enter the trade with a guaranteed stop‑loss order a few ticks beyond your primary risk level. This protects you from catastrophic gaps.

- Place a regular market stop a little tighter as a backup. If the market stays within normal range, this stop will fire before the guarantee fee is triggered.

- While the trade lives, monitor the chart. If you see a rapid swing that makes your original stop look too tight, manually adjust the level or convert it to a trailing stop.

By combining automation with occasional manual tweaks, you maintain discipline while still reacting to unusual price action.

Practical Checklist - Set Up Your Stop Strategy in 5 Minutes

- Define risk per trade - e.g., 1% of account equity.

- Calculate the price level that equals that risk (account size ÷ 100 ÷ position size).

- Choose order type: market stop for speed, limit stop if you can tolerate missed fills, GSLO if you trade large positions during earnings.

- Enter the order when you open the position - most platforms have a checkbox “attach stop” that locks it in instantly.

- Set a trailing distance (optional) - 0.5% for equities, 2% for crypto, depending on volatility.

- Review daily: adjust stops if your risk tolerance changes or if the asset’s volatility spikes.

Next Steps - Test Before You Trust

The only way to know what works for you is to experiment with a demo account. Try three scenarios:

- Pure automation: set a market stop at your calculated risk level and walk away for a week.

- Pure mental stop: monitor the same trade live and execute manually when the price hits the same level.

- Hybrid: use a guaranteed stop‑loss plus a trailing stop, adjusting only if a major news event occurs.

Compare the outcomes: which produced the smallest average loss? Which felt less stressful? Use those insights to lock in a personal rule book.

Frequently Asked Questions

Can I rely solely on a mental stop if I’m a disciplined trader?

Even the most disciplined traders face moments of fatigue or unexpected market turbulence. A single missed mental stop can erase weeks of gains. Most experts recommend at least a baseline automated stop as a safety net.

What’s the difference between a guaranteed stop‑loss order and a regular stop?

A regular stop becomes a market order once triggered, so price gaps can cause slippage. A guaranteed stop‑loss order promises execution exactly at the stop price, even if the market gaps, but the broker usually charges a small premium when the guarantee is used.

How does a trailing stop improve on a static stop‑loss?

A trailing stop follows the price upward (or downward for shorts) by a preset distance. As the trade becomes profitable, the stop lifts, locking in gains while still protecting against reversal. It removes the need to constantly readjust a static stop.

Is slippage inevitable during high volatility?

In fast‑moving markets, price gaps can outrun any order type. Slippage is most common with market stops. Using limit stops or guaranteed stops can reduce it, but they may also fail to fill. The trade‑off is between certainty of execution and price precision.

Should I use automated stops for crypto assets?

Yes-crypto markets trade 24/7 and can swing dramatically while you’re asleep. Automated stops keep you protected around the clock. Just watch out for extreme gaps on low‑liquidity tokens; a guaranteed stop can be worth the extra fee.

Kimberly Gilliam

July 15 2025Wow, the idea of a mental stop sounds like a wild gamble with your own sanity.

Jeannie Conforti

July 19 2025I totally get the fear of missing out when you rely purely on mental stops. It can feel like walking a tightrope without a safety net. Using automated stops is like having a parachute you forget you have until you need it. For beginners especially, set it and forget it till you build that discipline muscle. In the end, the hybrid approach often gives you the best of both worlds.

tim nelson

July 23 2025Reading through the guide made me think about how I’ve handled volatility in the past. I’ve seen both panic sells and missed opportunities when I tried to do everything in my head. The key is to respect your own limits and let the tech handle the rest. When the market spikes, a pre‑set stop can save you from the emotional roller‑coaster.

Zack Mast

July 27 2025The notion that a computer can replace human intuition is a modern myth. Yet, machines lack the ability to feel the market’s heartbeat. A balanced blend of algorithmic rigor and occasional human judgment is what keeps a trader sane.

Dale Breithaupt

July 30 2025Automation gives you consistency, manual control gives you flexibility. Use both wisely.

Rasean Bryant

August 3 2025I love how the article breaks down the pros and cons clearly. Automated stops are great for eliminating emotional bias. Mental stops shine when you need to react to breaking news. The hybrid method is a smart safety net. Keep testing what works for your style.

Angie Food

August 7 2025Sure, just let the computer babysit your losses while you nap.

Jonathan Tsilimos

August 10 2025The comparative matrix provides a concise taxonomy of stop‑loss modalities. From an execution latency perspective, server‑side orders achieve sub‑millisecond response times. Conversely, manual stops introduce human–machine interaction latency, which is non‑trivial in high‑frequency environments. Risk‑adjusted performance metrics favor automated stops in regimes of elevated volatility where slippage probability escalates. Nevertheless, the adaptive capacity of mental stops can be leveraged for discretionary fine‑tuning during macro‑event windows. Ultimately, portfolio risk management mandates a layered approach integrating both mechanisms.

jeffrey najar

August 14 2025Great breakdown! The guaranteed stop‑loss order can be a lifesaver during gap‑up events, though the premium can bite. I’ve found trailing stops to be a sweet spot for locking in gains while staying protected. For crypto, automated stops are almost mandatory because the market never sleeps. Just watch out for low‑liquidity tokens where slippage can be extreme. Test the settings in a demo before you go live.

Rochelle Gamauf

August 18 2025This exposition, while thorough, perhaps overstates the virtue of automation. An overreliance on algorithms may engender complacency, eroding the trader's analytical faculties. Moreover, the presumption that all brokers offer flawless guaranteed stops is naïve. One must scrutinize fee structures, as hidden costs can erode profitability. A discerning practitioner should therefore calibrate both tools judiciously.

Jerry Cassandro

August 21 2025I’d add that the choice of stop type should align with your asset’s typical spread. Narrow spreads favor limit stops, while wide spreads may compel market stops. Also, keep an eye on broker latency; a delayed order can be as bad as no order. Finally, periodic review of stop placement is essential as market dynamics evolve.

Parker DeWitt

August 25 2025Automation? Nah, that’s for the masses. Real traders feel the market pulse and act. 🤷♂️

Allie Smith

August 29 2025When I think about stops, I picture a safety net at a circus. The performer (you) decides whether to trust the net or keep the rope. Both have their moments. Balance is key, and the hybrid approach feels like the tightrope with an extra safety line.

Lexie Ludens

September 2 2025Honestly, the whole debate feels like drama over coffee. Automated stops are just cold code, but mental stops are the theater of anxiety. If you can keep your cool, mental stops give you that exhilarating control. Yet too many traders get tangled in their own thoughts and end up worse off. So maybe the drama is justified after all.

Aaron Casey

September 5 2025From a risk‑management architecture standpoint, integrating a guaranteed stop‑loss layer adds redundancy. It acts as a fail‑safe against market microstructure anomalies. However, the cost‑benefit analysis must consider the premium versus expected tail‑risk exposure. In high‑frequency trading, latency constraints may render guaranteed stops impractical. For swing traders, the premium is often justified.

Leah Whitney

September 9 2025I think the best way to start is by setting a simple rule: risk no more than 1% per trade. Then pick an automated stop at that level and let it breathe. If the market spikes, you can always adjust manually. Keep the process consistent and you’ll build confidence.

Logan Cates

September 13 2025Let me tell you why the whole "mental stop vs automated" hype is just another distraction in a market that thrives on noise. First, the average retail trader lacks the discipline to consistently execute mental stops without succumbing to the fear‑of‑missing‑out effect. Second, most platforms execute automated stops with millisecond precision, which is something a human brain simply cannot match, especially during flash crashes. Third, the psychological burden of constantly watching price charts leads to burnout, and burnout translates to poor decision‑making across the board. Fourth, data from multiple brokerages shows that traders who rely on automated stop‑losses have a statistically higher win‑rate, even after accounting for slippage. Fifth, the notion of a "guaranteed" stop is often a marketing ploy; the fees associated with it erode the tiny edge you might have. Sixth, when you think you’re getting flexibility with a mental stop, you’re actually exposing yourself to micro‑adjustments that rarely improve outcomes but definitely increase cognitive load. Seventh, in the age of algorithmic trading, the market moves faster than any human can react, making manual intervention a liability. Eighth, many traders claim mental stops give them control, yet the data shows they tend to move their stop further away in the heat of the moment, effectively widening their loss. Ninth, integrating a hybrid approach sounds sophisticated, but in practice it creates a confusing overlay of rules that can be mis‑applied. Tenth, the best practice that seasoned professionals follow is to pre‑define risk, set automated stops, and then periodically review performance, not to micromanage each trade. Eleventh, let’s not forget that funding costs and margin requirements are affected by the size of your stop‑loss; oversized mental stops can tie up capital unnecessarily. Twelfth, the emotional volatility you experience while waiting for a mental stop to trigger is a direct drain on your overall trading capital. Thirteenth, on a personal note, I’ve spent countless nights tweaking mental stop levels only to see them breached in seconds, while automated stops would have saved me a fraction of the loss. Fourteenth, the reality is that perfection in timing is an illusion; what matters is consistency, and automation provides that consistency. Finally, if you truly want to protect your downside, you need to treat your stop‑loss as a non‑negotiable rule enforced by code, not by momentary willpower.

Shelley Arenson

September 16 2025Great post! 👍 I’ll try the hybrid method tomorrow.

Joel Poncz

September 20 2025I appreciate the clear checklist, it makes setting up stops feel manageable. The step‑by‑step approach reduces the overwhelm. Also, noting the difference between market and limit stops is crucial. I’ll apply this to my demo account first.

Kris Roberts

September 24 2025This article really nailed the core issue of discipline vs flexibility. I’ve always been skeptical of pure automation, but the hybrid proposal sounds like a pragmatic middle ground. The trailing stop suggestion is especially useful for long‑term swings. Thanks for the thorough breakdown.

lalit g

September 28 2025From my experience in diverse markets, the balance between automated and mental stops often depends on liquidity. In thinly traded assets, even automated stops can suffer from slippage, so a manual overlay may be beneficial. Yet, for high‑frequency assets, the latency of human reaction is a disadvantage. I recommend testing both strategies across different asset classes. Consistent evaluation will reveal which mix aligns best with your risk tolerance.

Reid Priddy

October 1 2025The narrative pushing automation as a panacea ignores the hidden agenda of broker commissions. Any trader who blindly follows these recommendations risks being manipulated. Moreover, the supposed “guaranteed stop” is just a fee‑laden illusion. One must remain vigilant and question every promotion. Independent backtesting remains the only trustworthy method.

Jeannie Conforti

October 5 2025That drama‑queen comment really captured the anxiety many feel. It’s true-automated stops remove that daily stress. Keep experimenting, and you’ll find the sweet spot that feels both safe and empowering.