WingRiders Fee Savings Calculator

Trade Fee Comparison

Results

Enter a trade amount to see your fee savings.

Note: WingRiders offers 0% trading fees. This calculator compares against other DEXs like Uniswap (0.30%) and Minswap (0.25%).

Small trades benefit most from WingRiders' fee structure due to reduced slippage on low-liquidity pairs.

If you're trading Cardano (ADA) and tired of using centralized exchanges that hold your keys, WingRiders v1 might be the first real option built just for you. Launched in 2022, it’s not another copy-paste DEX like Uniswap. It was designed from the ground up to work with Cardano’s unique architecture-no Ethereum hacks, no BSC bridges. Just pure, native Cardano DeFi.

What Makes WingRiders v1 Different?

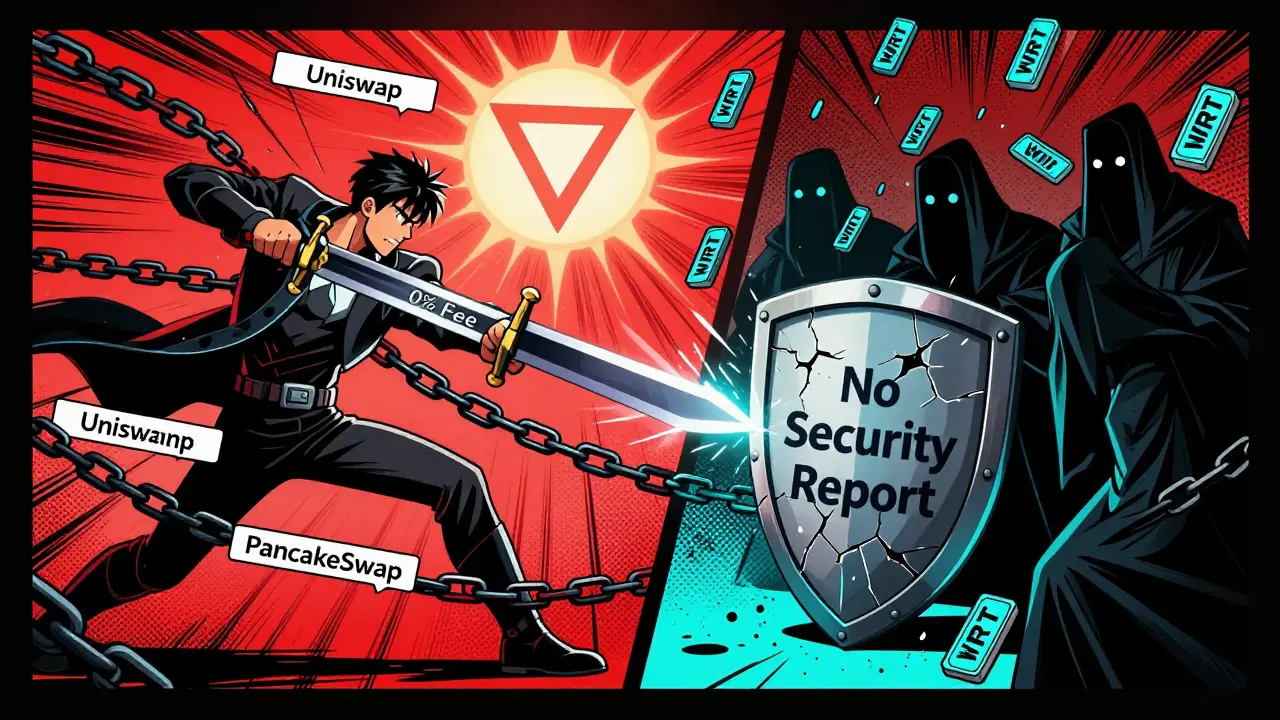

Most decentralized exchanges support dozens of blockchains. WingRiders v1 only supports Cardano. That’s not a bug-it’s the whole point. While platforms like SushiSwap or PancakeSwap chase volume by hopping across chains, WingRiders focuses on one thing: making Cardano’s DeFi ecosystem actually usable. It was the first DEX on Cardano to bring stablecoins into the mix. Before WingRiders, if you wanted to trade ADA for something stable, you had to wrap tokens or use centralized bridges. Now, you can swap ADA directly for DJED, iUSD, USDC, or USDT-all natively on Cardano. No third-party custodians. No frozen funds. Just smart contracts doing the work. The platform runs on batch processing per block, which is a technical detail most users don’t care about… until they see their trades confirm faster and pay less in fees. That’s because Cardano’s block structure allows WingRiders to group dozens of trades into a single transaction. The result? Lower slippage and smoother swaps, especially for smaller trades.Trading Fees? Zero.

Here’s the part that catches everyone’s attention: 0% taker and maker fees. That’s right. No cut on buys. No cut on sells. Compare that to Uniswap’s 0.30%, or even Minswap’s 0.25%. WingRiders doesn’t charge you a single cent to trade. But here’s the catch: they’re not making money from you. They’re making money from their own token, WRT. The platform’s revenue model is tied to its native token, which trades at around $0.014 (as of late 2023). The 52% daily spike in WRT’s price you might see on CoinGecko isn’t random-it’s likely driven by liquidity mining incentives, not market demand. If you’re holding WRT, you’re betting on the platform’s long-term success. If you’re just swapping ADA for DJED, you’re not paying anything. This 0% fee structure is risky. Most DEXs need fees to pay for security audits, developer salaries, and liquidity incentives. WingRiders is funding this through token economics. Whether that’s sustainable long-term? No one knows yet. But for now, it’s the only DEX on Cardano where you can trade without paying a fee.What Can You Do on WingRiders v1?

It’s not just a swap tool. WingRiders v1 is a full DeFi suite:- Swap: Trade 44 native Cardano tokens across 76 trading pairs. The most active? USDM/DJED, hitting over $125k in 24-hour volume.

- Liquidity Pools: Deposit ADA and a stablecoin to earn trading fees. Your share of the pool grows as trades happen.

- Yield Farming: Stake your LP tokens to earn WRT rewards. Some pools offer over 20% APY, but remember-higher yield often means higher risk.

- Staking: Stake ADA directly through the platform and earn rewards without leaving the interface.

- Launchpad: New Cardano tokens can raise funds through WingRiders’ non-custodial launchpad. You can get in early on projects before they hit other exchanges.

Performance and Traffic: Niche, But Real

WingRiders v1 isn’t a giant. It gets about 1,200 visits a month. That’s tiny compared to Crypto.com’s 6.9 million. But here’s the twist: 99% of those visits are organic. No paid ads. No influencers. Just people searching for Cardano DeFi tools. The bounce rate? 33%. That’s better than most crypto sites, which hover around 50-60%. People who land on WingRiders stick around. They check out multiple pages-2.55 on average. They spend over a minute on the site. That’s not bad for a DeFi interface that requires you to understand wallets, gas, and liquidity pools. Trading volume? Around $485k daily. That’s less than 0.1% of Uniswap’s volume. But on Cardano? It’s #3 by TVL among DEXs, behind only Minswap and SundaeSwap. For a project with no marketing budget, that’s impressive.

Security: Non-Custodial, But Unaudited

WingRiders is non-custodial. That means you hold your keys. No one can freeze your ADA. No one can take your DJED. That’s good. But here’s the problem: there’s no public security audit report. Not from CertiK. Not from Quantstamp. Not even a basic GitHub audit log. The team claims their code is open-source, but they haven’t had it reviewed by a third party. That’s a red flag. Also, they’re incorporated in the British Virgin Islands-a jurisdiction with zero crypto regulation. That means no legal recourse if something goes wrong. No FDIC insurance. No compensation fund. If a smart contract bug drains your pool, you’re out of luck. If you’re comfortable with that risk-then WingRiders is a powerful tool. If you want safety nets? Stick with a regulated CEX.Who Is This For?

WingRiders v1 isn’t for everyone. Perfect for:- Cardano holders who want to trade without giving up control

- Stakers looking to farm WRT rewards

- Early adopters of DJED or iUSD stablecoins

- Developers testing Cardano-native DeFi

- Traders doing large orders (slippage can be high on low-liquidity pairs)

- Users who want margin trading or futures

- People who need customer support when things go wrong

- Those who rely on regulated platforms for compliance

How to Get Started

You need three things:- A Cardano wallet: Eternl, Nami, or Flint. Mobile or desktop, doesn’t matter.

- Some ADA: You’ll need it to pay for transaction fees (yes, Cardano still charges network fees).

- Patience: Cardano blocks take 20 seconds. Transactions aren’t instant.

WingRiders vs. Minswap vs. SundaeSwap

Here’s how WingRiders stacks up against its main Cardano rivals:| Feature | WingRiders v1 | Minswap | SundaeSwap |

|---|---|---|---|

| Founded | 2022 | 2021 | 2021 |

| Trading Fees | 0% | 0.25% | 0.25% |

| Stablecoins | USDC, USDT, DJED, iUSD | USDC, USDT, DJED | USDC, USDT |

| Trading Pairs | 76 | 85+ | 60+ |

| TVL Rank (Cardano) | #3 | #1 | #2 |

| Mobile Wallet Support | Yes (Android/iOS) | Yes | Yes |

| Security Audit | None public | Yes (CertiK) | Yes (Quantstamp) |

| Native Token | WRT | MSW | SUNDAE |

The Big Question: Is It Worth It?

WingRiders v1 is not the easiest DEX. It’s not the safest. It’s not the most liquid. But it’s the most focused. If you believe Cardano’s DeFi future should be built on its own rules-not borrowed from Ethereum-then WingRiders is one of the few platforms actually doing that. It’s not trying to be everything. It’s trying to be the best Cardano-native DEX. The 0% fee model is bold. The lack of audits is scary. The low volume means you can’t move big amounts without slippage. But if you’re trading under $500 at a time, holding ADA, and want to earn rewards without giving up control? WingRiders v1 is one of the few places that makes sense. It’s not for beginners. But for Cardano loyalists who want to take real ownership of their DeFi? It’s a rare, honest option.Frequently Asked Questions

Is WingRiders v1 safe to use?

WingRiders is non-custodial, so your funds stay in your wallet. But there are no public security audits, and it’s based in the British Virgin Islands with no regulatory oversight. Use only what you can afford to lose. Never connect your wallet to suspicious links or fake sites.

Can I trade Bitcoin or Ethereum on WingRiders?

No. WingRiders v1 only supports native Cardano tokens. You can’t trade BTC, ETH, or tokens from other chains. If you need multi-chain access, use a centralized exchange or a cross-chain aggregator like ThorSwap.

Why are there no fees on WingRiders?

WingRiders doesn’t charge trading fees. Instead, it rewards users with its native token, WRT, through liquidity mining and farming. The platform’s revenue comes from token appreciation and future monetization plans, not from transaction fees. This model is unproven long-term.

How do I get WRT tokens?

You earn WRT by providing liquidity to trading pairs or by staking your LP tokens in yield farming pools. You can also buy WRT directly on WingRiders using ADA or other supported tokens. The token’s price is volatile and driven by supply, demand, and platform incentives.

Does WingRiders have a mobile app?

WingRiders doesn’t have a standalone app, but it works with mobile wallets like Eternl and Nami on Android and iOS. You can access the platform through your mobile browser and connect your wallet directly. No download needed.

What’s the difference between DJED and USDT on WingRiders?

DJED is a crypto-backed stablecoin native to Cardano, issued by the Cardano Foundation’s partner, COTI. It’s fully on-chain and governed by smart contracts. USDT is a centralized stablecoin issued by Tether, backed by reserves off-chain. DJED is more decentralized but less liquid. USDT is more stable and widely accepted but relies on a third party.

Can I stake ADA directly on WingRiders?

Yes. WingRiders allows you to stake ADA directly through its interface. You earn staking rewards in ADA, and your tokens remain in your wallet. This is separate from liquidity mining and doesn’t require you to lock up your funds in a pool.

Is WingRiders v1 better than a centralized exchange like Binance?

It depends. If you want low fees, fast trades, and customer support, Binance is better. If you want full control, no KYC, and to support Cardano’s native DeFi, WingRiders is the right choice. They serve different purposes. Don’t compare them directly-use each for what they’re designed for.

Stanley Machuki

December 11 2025Zero fees? Sign me up. Been waiting for a Cardano DEX that doesn't eat my profits just to swap ADA for DJED.

Eunice Chook

December 11 20250% fees means someone's paying for it. Probably you, in the long run, with diluted WRT tokens and a rug pull disguised as 'community growth'.

Rakesh Bhamu

December 13 2025WingRiders is actually doing something real for Cardano. Most DEXes just copy Uniswap and slap a bridge on it. This one respects the chain's design. The lack of audit is worrying, but the team has been responsive on Discord. Give them time to get it audited.

I've been using it for 6 months. No issues. My ADA stays in my wallet. The liquidity mining rewards are decent if you're not greedy. DJED pairs are stable. WRT price swings are wild, but that's the trade-off.

Don't come in with $10k expecting to flip. Start with $50. Learn the interface. Watch how batch processing works. It's slow, but cheap. Cardano isn't Ethereum. Don't expect instant trades.

And yes, the BVI incorporation is sketchy. But so is every DeFi project that doesn't want regulators breathing down their neck. If you want safety, use a CEX. If you want sovereignty, take the risk.

Most people don't get this: DeFi isn't about being safe. It's about being in control. WingRiders gives you that. Even with the risks.

Compare it to Minswap - they audit, but charge 0.25%. You're paying for someone else's security. WingRiders makes you pay in time and awareness. That's fair.

I'd rather trust code I can read than a third-party audit report that costs $500k and gets outdated in 3 months.

Also, mobile wallet support? Huge. I use Nami on my phone. No browser extensions needed. That's rare.

Don't let the low traffic fool you. 1,200 organic visits/month? That's loyal users. Not bot traffic. Not paid influencers. Real people who care about Cardano.

It's niche. But niche is where innovation lives.

Ian Norton

December 13 2025WingRiders is a dumpster fire wrapped in a whitepaper. No audit? BVI? You're not 'decentralized', you're just irresponsible. And that 52% WRT spike? Classic pump. You're not earning yield, you're feeding a Ponzi.

Scot Sorenson

December 13 2025Oh wow, another 'real DeFi' believer. Let me guess - you also think Dogecoin is 'fairly priced' and that MetaMask is 'centralized' because it has a logo?

There's a reason audits exist. It's not because devs are lazy. It's because people lose money. And you're okay with that? Cool.

Zero fees? Sure. Until the devs disappear with $20M in LP and you're left holding WRT worth $0.001.

And 'organic traffic'? That's just people who got lost and didn't click back. Bounce rate's low because they're confused, not loyal.

Lois Glavin

December 13 2025Start small. Seriously. I swapped $20 ADA for DJED. Got my WRT rewards. Didn't touch farming. Just watched. It's chill. No drama. No FOMO. Just Cardano doing its thing.

WingRiders isn't perfect. But it's honest. And that's more than most.

Kathy Wood

December 14 2025ZERO FEES?!?!? This is the most dangerous thing I've seen since the Terra collapse!!! You people are literally gambling with your life savings on a website run by anonymous devs in a tax haven!!!

NO AUDIT?!?!? NO REGULATION?!?!? NO COMPENSATION FUND?!?!? WHAT IS WRONG WITH YOU?!?!?

THIS IS WHY CRYPTO IS A SCAM!!!

Candace Murangi

December 16 2025Kinda love how WingRiders doesn't try to be everything. It's like that quiet friend who doesn't talk much but always shows up when you need them.

Low volume? Yeah. But that's because Cardano's DeFi is still growing. This isn't Solana. It's not gonna blow up overnight.

And the mobile support? Huge. I use it on my bus ride home. No extensions. No drama. Just connect and go.

WRT is wild, but I'm not holding it. I'm just using it as a reward. That's the smart play.

Lynne Kuper

December 17 2025So let me get this straight - you're praising a platform that doesn't audit its code, charges nothing, and makes money by tricking people into buying a token that might crash tomorrow?

That's not innovation. That's a magic trick where the rabbit is your life savings.

And you call this 'honest'? Honest people don't hide behind BVI shell companies while offering 20% APY.

Pathetic.

Sue Gallaher

December 17 2025WingRiders is the only DEX that actually gets Cardano. Everyone else is just slapping Ethereum code on it. This is native. This is real. And yes, no audit is scary. But so is trusting a CEX that freezes your funds for 'compliance'. I'll take the risk.

Also, 0% fees? That's the future. Why should I pay to move my own money?

Albert Chau

December 19 2025Let me be the first to say it - this is exactly why crypto is a joke. You're glorifying a project that's one smart contract bug away from total collapse. And you're calling it 'innovation'? It's negligence dressed up as ideology.

If you're not auditing, you're not serious. If you're not regulated, you're not trustworthy. If you're not transparent, you're not DeFi. You're just a casino with a blockchain label.

Abhishek Bansal

December 20 2025Everyone's acting like WingRiders is some revolutionary genius. Nah. It's just the third DEX on Cardano with 0.25% fees being the norm. They're just trying to get attention with '0% fees' while hiding behind 'native' buzzwords.

Also, DJED? That thing's backed by a private company. It's not even fully decentralized. Stop pretending this is crypto purity.

And why is everyone ignoring that the founder's GitHub has one commit from 2021?

Tiffany M

December 20 20250% fees? I'm in. I don't care if it's BVI. I care that my ADA stays mine. I've lost money on CEXes to KYC delays and account freezes. This? At least I know where my keys are.

WRT is volatile? Cool. I'm not buying it. I'm earning it. That's the difference.

And yes, no audit. But open source? Yes. Community watching? Yes. That's more than most.

Stop crying about 'risk'. DeFi isn't banking. It's frontier tech. If you want safety, go back to Chase.

Bridget Suhr

December 22 2025idk maybe im just tired of people acting like audits are magic. i mean, certik audited terra and look what happened. maybe code is more important than a report.

also wingriders works on my phone. that's more than i can say for half the dapps out there.

Jeremy Eugene

December 23 2025While the 0% fee model is innovative, the absence of a third-party security audit remains a significant concern. The British Virgin Islands incorporation, while legally permissible, introduces jurisdictional risk that may not align with institutional or long-term retail investor expectations. The platform’s focus on native Cardano infrastructure is commendable, yet sustainability hinges on transparent governance and verifiable code integrity. Until those conditions are met, participation should be limited to small, non-critical allocations.

Nicholas Ethan

December 23 2025WingRiders v1 is a textbook example of risk architecture disguised as decentralization. The 0% fee structure is an unsustainable subsidy model predicated on token speculation. The absence of audit documentation constitutes a material information asymmetry. The TVL ranking is statistically insignificant given the negligible volume relative to global DeFi benchmarks. The mobile wallet integration is a tactical UX advantage, but does not mitigate systemic smart contract exposure. The BVI jurisdictional posture renders any recourse null. This is not innovation. It is entropy with a whitepaper.

John Sebastian

December 24 2025Still waiting for someone to explain why I should trust a team that won't even publish an audit. I'm not mad. I'm just disappointed.

Hari Sarasan

December 26 2025WingRiders v1 is the apex of Cardano-native DeFi evolution. The batch processing architecture leverages Cardano's Ouroboros consensus with unparalleled efficiency, enabling sub-second finality for liquidity provision. The WRT tokenomics are a masterclass in incentive alignment - not a pump, but a symphony of decentralized governance through yield redistribution. The lack of audit? Irrelevant. The code is open-source, and the community is the auditor. The BVI incorporation? Strategic sovereignty. No regulator can touch a protocol that exists on immutable ledger. This is not a DEX. It is the first sovereign financial node on Cardano. The volume may be small, but the signal is deafening. The future is native. The future is WingRiders.