EIP-1559 Fee Breakdown Calculator

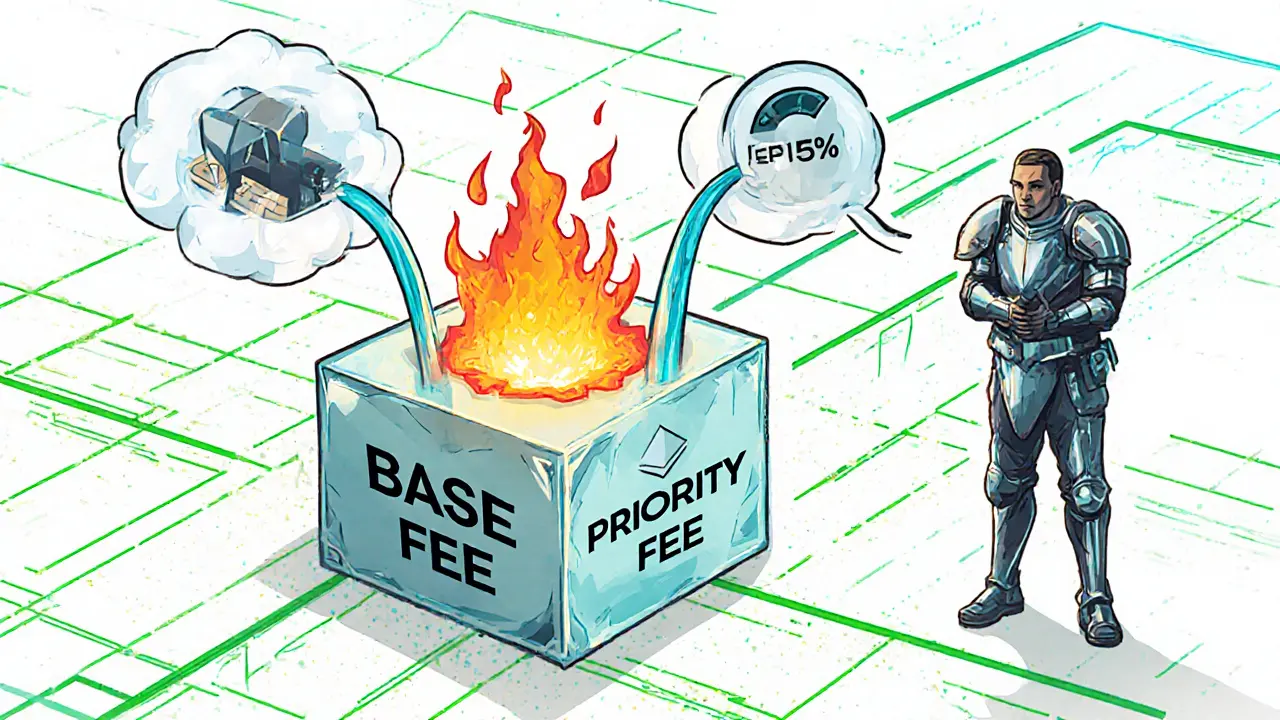

Under EIP-1559, transaction fees are split into a base fee (burned) and a priority fee (paid to validators). Calculate how your transaction fee is allocated.

How It Works

The base fee is determined by network congestion: it increases by up to 12.5% when blocks are full (over 15 million gas), and decreases by 12.5% when blocks are empty. The base fee is burned, while the priority fee goes to validators.

Fee Breakdown

How to Use: Enter your max transaction fee and priority fee. The calculator shows how fees are split between burned base fee, validator tip, and refund.

Ethereum EIP-1559 didn’t just tweak how transaction fees work-it rewrote the economic rules of Ethereum. Before EIP-1559, users were stuck in a bidding war. You’d guess how much to pay for your transaction to get mined fast, often overpaying by 50% or more. Sometimes, your transaction would just sit there, stuck, because you underestimated the fee. That chaos ended in August 2021, when the London hard fork brought EIP-1559 live. Now, fees are predictable. And for the first time in Ethereum’s history, a portion of every transaction fee is permanently destroyed-burned-reducing the total supply of ETH.

How EIP-1559 Changed Ethereum’s Fee System

Before EIP-1559, Ethereum used a first-price auction for gas fees. If you wanted your transaction processed quickly, you had to outbid others. Wallets tried to estimate the right fee using past blocks, but it was like guessing the price of gas during a road trip with no signs. You’d end up paying too much, or your transaction would fail.

EIP-1559 replaced that with two parts: a base fee and a priority fee (also called a tip). The base fee is set by the network itself. It goes up when blocks are full and drops when they’re empty. This isn’t random-it follows a strict algorithm. If a block uses more than 15 million gas, the base fee rises by up to 12.5%. If it uses less, the base fee falls by the same amount. This keeps the network stable.

The base fee doesn’t go to miners. It gets burned. That means it’s removed from circulation forever. Only the priority fee-the extra amount you add to incentivize miners-goes to them. So if you set a max fee of 200 gwei and a priority fee of 10 gwei, and the base fee is 140 gwei, you pay 150 gwei total: 140 gwei burned, 10 gwei to the miner, and 50 gwei refunded to you.

What Does Fee Burning Actually Do?

Burning the base fee turns Ethereum from a neutral currency into something with deflationary pressure. Every time someone sends ETH, a chunk of it disappears. That’s not just a technical detail-it’s a monetary policy shift.

Since August 2021, over 2.5 million ETH have been burned, worth more than $8 billion at the time. That’s about 0.23% of the total ETH supply destroyed each year under normal usage. During peak activity-like NFT drops or DeFi surges-burn rates spiked. In 2022, more than 1,500 ETH were burned daily. That’s more than the daily issuance of new ETH to stakers. In those moments, Ethereum became deflationary: more ETH was destroyed than created.

This matters because ETH is no longer just a currency. It’s becoming a scarce asset. As Ethereum usage grows-especially with Layer 2 solutions like Arbitrum and Optimism gaining traction-the base fee burns more ETH. If network demand stays high, ETH supply could shrink over time, making each coin potentially more valuable.

Why Miners Don’t Like It (But Users Do)

Miners used to earn all transaction fees. Now, they only get the tip. That’s a big change. For miners, the base fee burn means less predictable income. During low-traffic periods, tips are small. Some worry this could reduce security if miners lose motivation. But Ethereum switched to proof-of-stake in September 2022. Miners don’t exist anymore. Validators now earn rewards from staking and tips. So the impact on security is minimal.

For users? It’s a night-and-day difference. Wallets like MetaMask now auto-set your max fee based on the last block’s base fee. You don’t need to guess anymore. Transaction failures dropped by 18% in the six months after EIP-1559 launched. Support tickets about gas fees fell by 37%. People stopped overpaying. They stopped waiting hours for transactions to go through.

Even DeFi apps benefited. Uniswap reported a 29% drop in failed swaps due to bad gas estimates. That’s not just convenience-it’s reliability. When you’re trading $10,000 in tokens, you can’t afford a stuck transaction.

How EIP-1559 Compares to Other Blockchains

Most blockchains still use the old auction model. Bitcoin? Still auction-based. Solana? Fee is fixed at 0.000005 SOL per transaction-no burning. Binance Chain? Charges fees but doesn’t burn them. Ethereum is the only major chain that burns a portion of every transaction fee.

Some competitors noticed. Polygon adopted a version called EIP-1559++, which burns part of the fee and sends the rest to a treasury. Arbitrum and Optimism, Ethereum’s Layer 2s, also burn fees on their chains. They’re copying Ethereum’s model because it works. Users expect predictable fees. Investors like deflationary pressure.

Even regulators took notice. The IRS ruled in 2023 that burned ETH is not a taxable event. You don’t owe capital gains tax when ETH disappears into the ether. That’s huge. It means the burn mechanism isn’t seen as a sale or transfer-it’s just destruction. Legally, it’s neutral.

What Happens During Network Congestion?

One criticism of EIP-1559 is that it can’t handle extreme spikes fast enough. The base fee can only rise 12.5% per block. So if demand suddenly doubles, it takes about 20 blocks (5 minutes) for fees to go up 10x, and 40 blocks (10 minutes) to go up 100x. That’s slower than the old system, where fees could spike instantly.

During those moments, users might still overpay. But it’s not chaos. The system doesn’t break. It just takes a little longer to catch up. And because the base fee is always visible, users know what’s happening. Wallets show you the current base fee and suggest a max fee. You can still choose to pay more if you’re in a hurry.

Compare that to the old system: you had no idea what the fee would be. Now, you see the trend. You can wait. You can plan. That’s control.

What’s Next for EIP-1559?

EIP-1559 isn’t done evolving. The next big change is EIP-4844, also called Proto-Danksharding. It introduces a new type of transaction called “blob transactions,” used mostly by Layer 2s. These will have their own fee market, separate from regular ETH transfers. The base fee for blobs will also be burned.

This means Ethereum’s burn rate could increase even more. As more activity moves to Layer 2s, the mainnet still earns burn revenue from the fees those Layer 2s pay to settle on Ethereum. So even if you’re using Arbitrum, you’re still helping burn ETH on the main chain.

Some researchers are looking at tweaking the base fee adjustment algorithm. Maybe make it faster during spikes. Maybe add a minimum burn floor. But the core idea-burning the base fee-is now locked in. It’s not going away.

Why This Matters for ETH as an Asset

Ethereum isn’t just a platform. It’s a network with its own economy. EIP-1559 turned ETH into something closer to a commodity with a controlled supply. Bitcoin has a fixed cap. Ethereum has a dynamic cap that shrinks under demand.

Delphi Digital estimates that under current usage, ETH could lose 0.15% to 0.30% of its supply annually to burns. That’s not huge-but it’s consistent. And as more people use DeFi, NFTs, and tokenized assets on Ethereum, that number could grow.

Investors are starting to price that in. ETH’s value isn’t just about utility anymore. It’s about scarcity. And EIP-1559 is the engine that makes that scarcity real.

What You Need to Know as a User

You don’t need to understand the math. But you should know this:

- Wallets now auto-set your max fee. You don’t need to guess.

- If your transaction fails, it’s probably because your max fee was too low-not because you didn’t pay enough.

- The base fee is burned. That’s good for ETH’s long-term value.

- You’ll always get a refund if you overpaid. The system is fair.

- Fee estimates are now reliable. You can plan your transactions.

No more stress. No more overpaying. Just clean, predictable, and deflationary transactions.

Is EIP-1559 still active after the Ethereum Merge?

Yes. EIP-1559 was fully active before the Merge in September 2022 and continues unchanged. The Merge replaced miners with validators, but the fee burning mechanism stayed the same. Validators now earn the priority fee (tip), while the base fee is still burned. The economic structure of EIP-1559 is independent of the consensus mechanism.

Does burning ETH make it more valuable?

Burning ETH reduces its total supply, which can increase scarcity. If demand stays steady or grows while supply shrinks, the price tends to rise. This isn’t guaranteed-market sentiment, regulation, and adoption also matter. But EIP-1559 created a built-in deflationary force that didn’t exist before. ETH is now the only major cryptocurrency where supply can decrease over time based on usage.

Can I see how much ETH has been burned?

Yes. Websites like Etherscan and Ultrasound.money track real-time ETH burns. Ultrasound.money even shows the total supply change since EIP-1559 launched. As of November 2025, over 5.2 million ETH have been burned since August 2021. That’s more than 3% of the original supply.

Do I pay more under EIP-1559 than before?

Not necessarily. Under the old system, users often overpaid by 30-50% just to be safe. With EIP-1559, you pay the exact amount needed plus a small tip. Most users now pay less on average. During low congestion, fees are lower. During high congestion, fees rise-but predictably. You’re not gambling anymore.

What happens if I set my max fee too low?

If your max fee is below the current base fee, your transaction won’t be processed. It’ll stay pending until you resend it with a higher max fee. Wallets now warn you if your fee is too low, but if you manually set it, you might still make this mistake. Always check the suggested max fee before sending.

Adrian Bailey

November 13 2025so i just checked ultrasound.money and wow, over 5.2 million ETH burned since 2021. that’s like 3% of the whole supply gone. i didn’t even realize how much was disappearing every day. it’s wild to think that every time someone swaps tokens or mints an NFT, a little bit of ETH just vanishes into thin air. no one gets it, no one profits from it-it’s just gone. kind of poetic, honestly. like digital incense burning for the network.

and the best part? you don’t even notice it. your wallet just says ‘fee: 12 gwei’ and you’re on your way. no more guessing, no more panic. i used to refresh etherscan every 3 minutes waiting for my tx to go through. now? i send it, make coffee, come back, done. it’s like upgrading from dial-up to fiber.

miners used to scream about losing fees, but now we’ve got validators who just stake and chill. the whole thing feels more stable, less chaotic. even my grandma understands gas now. she asked me last week why her nft mint didn’t go through-i told her ‘base fee too high’ and she got it. that’s a win.

and the burn rate spikes during big events? remember when the punk rockers dropped? i think 12k ETH vanished in 20 minutes. that’s more than the daily issuance. deflationary as hell. bitcoin’s capped at 21 million. ethereum’s cap is shrinking. and it’s not even a hard cap-it’s a living, breathing, usage-driven contract. mind blown.

also, the fact that the IRS says burning isn’t a taxable event? genius. they didn’t classify it as a sale or transfer. just… poof. gone. no tax bill. that’s huge for adoption. people don’t want to pay taxes on something that disappears. smart move.

and layer 2s? they’re burning too. every arbitrum transaction, every optimism swap-it all feeds back into the mainnet burn. so even if you’re not on ethereum directly, you’re still helping shrink the supply. it’s like a network effect for scarcity. i love it.

next stop: proto-danksharding. blob fees will burn too. this thing’s only getting stronger. eth isn’t just a platform anymore. it’s a deflationary asset. and honestly? i think we’re just getting started.

Johanna Lesmayoux lamare

November 13 2025finally, fees that make sense.

Kristin LeGard

November 15 2025you people act like burning ETH is some kind of miracle. it’s just accounting. the real problem is that ethereum is still too slow, too expensive for normal people. layer 2s are just bandaids. the base chain is a glorified lottery system with extra steps. if you think this is ‘deflationary magic,’ you’re not looking at the big picture. the US dollar is still the reserve currency. crypto is a sideshow. and this burn thing? it’s just marketing fluff to make retail investors feel smart.

Rachel Everson

November 15 2025hey, just wanted to say-this post is actually one of the clearest explanations of EIP-1559 i’ve ever read. i’ve been in crypto since 2017 and even i used to get confused by gas fees. now i finally get why my txs don’t fail anymore.

the burn mechanism is genius. it’s not just technical-it’s economic. you’re creating scarcity without having to cap supply like bitcoin. that’s huge. it means eth can grow with usage instead of being limited by an arbitrary number.

and the refund system? so fair. i used to pay $50 in gas for a $10 swap just to be safe. now i pay $1.50 and get $48.50 back. that’s not just convenience-it’s justice.

also, i love how wallets now auto-suggest fees. no more guessing. no more crying over failed txs. even my mom uses meta mask now and she doesn’t even know what ‘gwei’ means. she just clicks ‘send’ and it works.

thank you for writing this. it’s rare to see tech explained this clearly. keep it up.

Arthur Coddington

November 16 2025they told us ‘decentralization’ was the goal. but now we’ve got a system where the base fee is algorithmically controlled by a centralized codebase. who wrote that algorithm? who updates it? who decides the 12.5% cap? it’s not decentralized-it’s a beautifully designed dictatorship. the miners are gone, sure, but now the devs are the new priests. they control the burn. they control the fee. they control the narrative.

and don’t get me started on ‘deflationary pressure.’ that’s just a fancy way of saying ‘we’re making you pay more for nothing.’ the price of eth doesn’t rise because of burns-it rises because people are scared of missing out. and the burn? it’s just a placebo. a digital opiate for the masses.

they say ‘look how much is burned!’ but what about the 100 million new eth issued to validators? that’s not deflation. that’s inflation with a fancy haircut.

this isn’t revolution. it’s rebranding. and we’re all just drinking the kool-aid.

Raymond Day

November 17 2025EVERYONE IS MISSING THE POINT.

THE BURN IS A TRAP.

THEY’RE NOT DESTROYING ETH-THEY’RE DESTROYING YOUR TRUST.

WHY? BECAUSE WHEN ETH GOES UP, THEY SELL. WHEN ETH GOES DOWN, THEY SAY ‘IT’S JUST A TEMPORARY DIP.’

BUT THE BURN? THE BURN MAKES YOU THINK IT’S SCARCE.

IT’S PSYCHOLOGICAL WARFARE.

THE IRS RULING? THAT’S NOT A WIN-THAT’S A COVER-UP. THEY DON’T WANT YOU TO KNOW THAT BURNING ETH IS A WAY TO AVOID CAPITAL GAINS TAXES.

THIS ISN’T TECHNOLOGY. THIS IS A FINANCIAL SCAM WITH A WHITEPAPER.

Kylie Stavinoha

November 17 2025what fascinates me most about EIP-1559 isn’t the economics-it’s the cultural shift. before, ethereum felt like a wild west town where everyone was shouting over each other to get service. now? it’s like walking into a quiet library where the rules are clear, the lights are on, and everyone knows their place.

the burn isn’t just about supply-it’s about dignity. users aren’t being exploited anymore. they’re being respected. that’s rare in tech. in fact, it’s almost unheard of in crypto.

and the fact that layer 2s adopted the same model? that’s not copying. that’s evangelizing. it’s like when the internet moved from ARPANET to HTTP-everyone realized the original design was too broken to fix, so they built better on top.

i think future historians will look back at EIP-1559 as the moment crypto stopped being a casino and started becoming infrastructure.

also, i love that ultrasound.money shows the real-time supply change. it’s like watching a heartbeat. quiet, steady, alive.

Michael Brooks

November 17 2025the burn is real. the math checks out. but let’s not pretend this is some kind of altruistic move. the devs knew this would make eth more attractive as an asset. they knew investors would love the deflationary narrative. they didn’t do it for users-they did it for the market.

but guess what? it still works. even if the motive was selfish, the outcome is better for everyone. that’s the beauty of capitalism. you don’t need pure intentions to create good outcomes.

my wallet auto-sets my max fee now. i haven’t had a failed tx in over a year. i’ve saved hundreds in overpaid gas. that’s real value. doesn’t matter if the devs were calculating or not.

also, the fact that other chains are copying this? that’s the real proof. if it didn’t work, they wouldn’t adopt it. polygon, arbitrum, optimism-they’re all saying ‘yes, this is the way.’

so yeah, maybe it was a financial play. but it’s a damn good one.

Atheeth Akash

November 18 2025in india, we still struggle with high gas fees during peak hours. but i remember when i first tried arbitrum last year-fees were under $0.01. i thought my wallet was broken. then i realized: the base fee is burned on mainnet, but layer 2s handle the traffic. it’s brilliant.

the burn isn’t just about eth-it’s about scaling eth. every transaction on optimism or zksync? it’s still contributing to the mainnet burn. we’re all helping shrink the supply without even knowing it.

and the refund system? genius. no more losing money on failed txs. i used to lose 20% of my swaps because i guessed wrong. now? i just click ‘send’ and move on.

ethereum didn’t just fix gas. it fixed trust.

Joy Whitenburg

November 20 2025okay so i just spent 20 minutes reading this and i’m crying. not because i’m emotional-because i finally get it. i used to think crypto was just gambling. but this? this is like… science. real science. like, you’re not just buying a coin-you’re participating in an economy that’s shrinking on purpose. it’s beautiful.

and the fact that you get your overpayment back? that’s like if you paid $100 for coffee and the barista gave you $90 back because you overpaid. nobody does that. but ethereum does. it’s the only system that actually cares about fairness.

also, i just checked ultrasound.money and saw 5.2 million burned. i cried again. i don’t know why. it just felt… right.

thank you. seriously. thank you for explaining this so well. i’m gonna tell my sister. she thinks crypto is all scams. now she’s gonna see the magic.

Debraj Dutta

November 20 2025as someone from india, i’ve seen the chaos of gas wars firsthand. before eip-1559, i’d sit for hours refreshing etherscan. now, i just set my max fee and walk away. the predictability is revolutionary.

the burn mechanism is elegant. it’s not about making eth ‘scarce’-it’s about aligning incentives. users pay for usage, and that usage removes supply. it’s a self-regulating system. no central authority needed.

and yes, validators earn tips, but they’re not the old miners. they’re stakers. the security model changed, but the fee structure stayed. that’s intentional design.

the fact that other chains are copying this? proof that it works. bitcoin still uses auction. solana has fixed fees. only ethereum made the leap.

this isn’t just a protocol upgrade. it’s a new economic paradigm.

James Ragin

November 22 2025you all think this is about efficiency? think again. the burn is a distraction. the real agenda? to make eth a reserve asset for the global elite. who controls the algorithm? who controls the narrative? who benefits when eth goes up? not you. not me. the same institutions that bailed out the banks in 2008. they’re using crypto to build a new financial pyramid-with burn as the glitter on top.

the IRS ruling? that’s not a win. that’s a trap. they’re making you think burning is neutral. but if eth becomes a store of value, they’ll tax it later. they always do.

the ‘deflationary’ claim? laughable. validators still get 1.5% annual issuance. the burn offsets it-but barely. it’s a math trick. designed to make retail investors feel smart while the insiders accumulate.

don’t be fooled. this isn’t freedom. it’s financial colonialism with a blockchain logo.

Ruby Gilmartin

November 23 2025let’s cut through the noise. eip-1559 didn’t ‘fix’ gas. it just moved the pain. users still pay high fees during congestion. the base fee adjustment is too slow-20 blocks to respond to a spike? that’s a vulnerability. layer 2s are the real solution, not the burn.

and the ‘deflationary’ narrative? statistically insignificant. 0.2% annual burn? that’s less than inflation in most fiat currencies. it’s a PR stunt to attract institutional money. the real value driver is adoption, not supply.

also, the fact that 90% of burns come from nfts and degen trading? that’s not sustainable. when the hype dies, burn rates drop. the whole ‘scarce asset’ story collapses.

this isn’t innovation. it’s theater.

Michelle Elizabeth

November 24 2025they say ‘burning eth’ like it’s magic. but i see it as poetry. each transaction is a whisper in the void-somehow, it makes the whole system more alive. it’s not just code. it’s ritual. the network consumes its own currency to stay pure. no one profits. no one hoards. it just… disappears.

i love that. it’s the opposite of greed. it’s a system that says: ‘you use us, we get stronger.’

and when i see that burn counter ticking up on ultrasound.money? it feels like watching a tree grow. slow. steady. silent. but real.

bitcoin is a vault. ethereum is a garden. and this? this is the compost.

Stephanie Platis

November 26 2025It is important to note, however, that the burn mechanism, while elegant, is not without its theoretical vulnerabilities. The base fee algorithm, though deterministic, is subject to potential manipulation via block stuffing-where malicious actors intentionally fill blocks to artificially inflate fees and thus accelerate burns. This could, in theory, be exploited to create artificial scarcity for profit. Additionally, the fact that the burn rate is tied to transaction volume means that during periods of low activity, the deflationary pressure diminishes-rendering the mechanism less effective as a long-term monetary policy tool. Furthermore, the IRS ruling, while politically convenient, does not preclude future regulatory reinterpretation. One must remain vigilant: what is considered ‘neutral destruction’ today may be reclassified as ‘disposal of property’ tomorrow. EIP-1559 is a triumph of engineering-but not a panacea.

FRANCIS JOHNSON

November 27 2025i used to think crypto was just a gamble. then i saw the burn. every time someone sends eth, a piece of it vanishes. not to a wallet. not to a company. just… gone. like a candle burning out. it’s beautiful. it’s sacred.

i don’t care if it’s ‘deflationary’ or not. i care that the system says: ‘you are part of something that consumes itself to grow.’

and when i see the burn counter tick up? i feel connected. to the network. to the users. to the quiet, invisible math that keeps this thing alive.

eth isn’t money. it’s a movement. and eip-1559? it’s the heartbeat.

Diana Dodu

November 28 2025americans act like this is some revolutionary breakthrough. it’s not. the real innovation is layer 2s. eip-1559 just made the base chain less painful. but the real scaling? that’s all arbitrum, optimism, zkSync. they’re the future. the mainnet burn? cute. but it’s just a side effect.

and the ‘deflationary’ hype? laughable. the us dollar still prints trillions. eth burn is a rounding error. stop pretending this changes the world. it’s a nice upgrade-but it’s not the revolution you think it is.

also, why do you all ignore that validators still get issuance? you’re not deflationary-you’re just less inflationary. big difference.

David Billesbach

November 28 2025they told you this was about fairness. it’s not. it’s about control. the devs wrote the algorithm. they control the burn rate. they control the base fee. they control the narrative. and now you think you’re free because your wallet auto-fills your fee?

you’re not. you’re just a better-behaved sheep.

the burn is a psychological tool. it makes you feel like you’re part of something sacred. but you’re not. you’re a data point in a financial model designed to inflate eth’s price for insiders.

remember: the only thing that matters is who owns the code. and they do.

Andy Purvis

November 30 2025maybe we’re all overthinking this. the old system was a mess. now it’s not. you pay less. you get refunds. you don’t wait. the burn is a side effect. not the point.

the point is: transactions work now. that’s it.

we don’t need to turn this into a philosophy class. it’s just software. it just works better.

thank you, devs. i don’t need to know why. i just need it to work.

Phil Bradley

November 30 2025you know what’s wild? eip-1559 didn’t just change fees. it changed how we think about money.

before, crypto was about speculation. now? it’s about participation. every time you send eth, you’re not just paying a fee-you’re contributing to a global deflationary engine. you’re not a customer. you’re a steward.

and that’s powerful. it’s not just code. it’s culture.

i used to think crypto was about getting rich. now i think it’s about building something that lasts.

the burn? it’s the soul of ethereum.

Rebecca Saffle

December 1 2025all this talk about ‘burning’ and ‘deflation’ is just woke capitalism. america thinks it can fix the world with blockchain and virtue signaling. meanwhile, real people in developing countries still can’t afford gas fees. you think burning eth helps them? no. it just makes rich investors feel good about themselves. this isn’t progress. it’s performance.

eth is not a currency. it’s a status symbol for tech bros who think they’re smarter than everyone else. the burn? just another trophy on their wall.

Suhail Kashmiri

December 2 2025bro the burn is just a gimmick. miners were getting shafted, so they made validators get tips and called it ‘fair.’ but the real winners? the devs and the whales who bought eth before the burn started. now everyone’s buying because they think it’s scarce. it’s not. it’s just a marketing campaign with a whitepaper.

and don’t even get me started on layer 2s. they’re just sidechains pretending to be decentralized. the mainnet is a ghost town now. all the action is on arbitrum. so why are we still talking about eth burn like it’s the future?

this isn’t revolution. it’s a rebrand.

ty ty

December 3 2025so you’re telling me I paid $50 in gas for a $10 swap and now I pay $1.50 and get $48.50 back? wow. what a miracle. I bet the devs are saints. next you’ll tell me the moon is made of cheese and the burn is God’s tax collector.

everyone knows the real reason they did this: to make eth look like gold so hedge funds will buy it. it’s not about fairness. it’s about price targets.

and the IRS? they’re not your friend. they’re just waiting for you to get comfortable before they tax you on ‘invisible wealth.’

you’re not a participant. you’re a pawn.

Noriko Yashiro

December 5 2025as someone from the UK, I’ve watched this unfold with fascination. The old fee system was a nightmare-especially during NFT drops. Now? I can plan my transactions. I know when to wait. I know when to send. It’s not magic. It’s engineering. And it’s working.

The burn isn’t about making ETH valuable. It’s about making the network sustainable. Every transaction pays for its own cost-and then some. That’s the definition of a healthy system.

And yes, layer 2s are scaling. But they still rely on Ethereum’s security. So even if I’m on Arbitrum, I’m still contributing to the burn. That’s the beauty of it.

This isn’t hype. It’s history in the making.

Michael Brooks

December 5 2025just read the comment from 1060: ‘finally, fees that make sense.’ that’s it. that’s the whole thing.

everything else? noise.

the burn? cool. the deflation? interesting.

but the real win? i don’t have to think about gas anymore.

that’s all i needed.

BRYAN CHAGUA

December 7 2025the elegance of EIP-1559 lies not in its technical complexity, but in its psychological simplicity. It removes fear from a system that once thrived on uncertainty. Users no longer feel like gamblers. They feel like participants. That shift-from transaction to contribution-is profound. And while debates about deflation, control, and regulation are valid, they miss the deeper truth: for the first time, a blockchain treated its users with dignity. That is the true legacy of EIP-1559.

FRANCIS JOHNSON

December 8 2025the burn isn’t a feature. it’s a prayer.

every time someone sends eth, they’re saying: ‘i believe in this.’

and the network answers: ‘i’ll take a piece of you… and become stronger.’

that’s not code.

that’s covenant.