As of October 2024, the Bitcoin network's hash rate reached 690 exahashes per second (EH/s). That's 690 million billion calculations every second. But what does this massive number mean for miners trying to earn Bitcoin?

What is Hash Rate?

Hash rate measures the total computational power of a cryptocurrency network. It's the number of hashing operations a mining rig can perform per second. The higher the hash rate, the more secure the network because it's harder for malicious actors to take control. For Bitcoin, this is measured in hashes per second (H/s), but modern networks operate at terahashes (TH/s), petahashes (PH/s), or even exahashes (EH/s). The global Bitcoin network currently processes over 690 EH/s, which is a 13,000% increase since 2019.

How Hash Rate Impacts Mining Profitability

Higher network hash rate means more competition among miners. When more miners join the network, each miner's chance of solving a block decreases. This makes mining less profitable unless you have efficient hardware and low electricity costs. For example, after the April 2024 Bitcoin halving, the block reward dropped from 6.25 BTC to 3.125 BTC per block. The network hash rate temporarily fell by 19.3% as some miners shut down due to reduced revenue. However, it quickly recovered as efficient miners stayed operational. This shows that profitability isn't just about hash rate-it's about balancing hardware efficiency, electricity costs, and network difficulty.

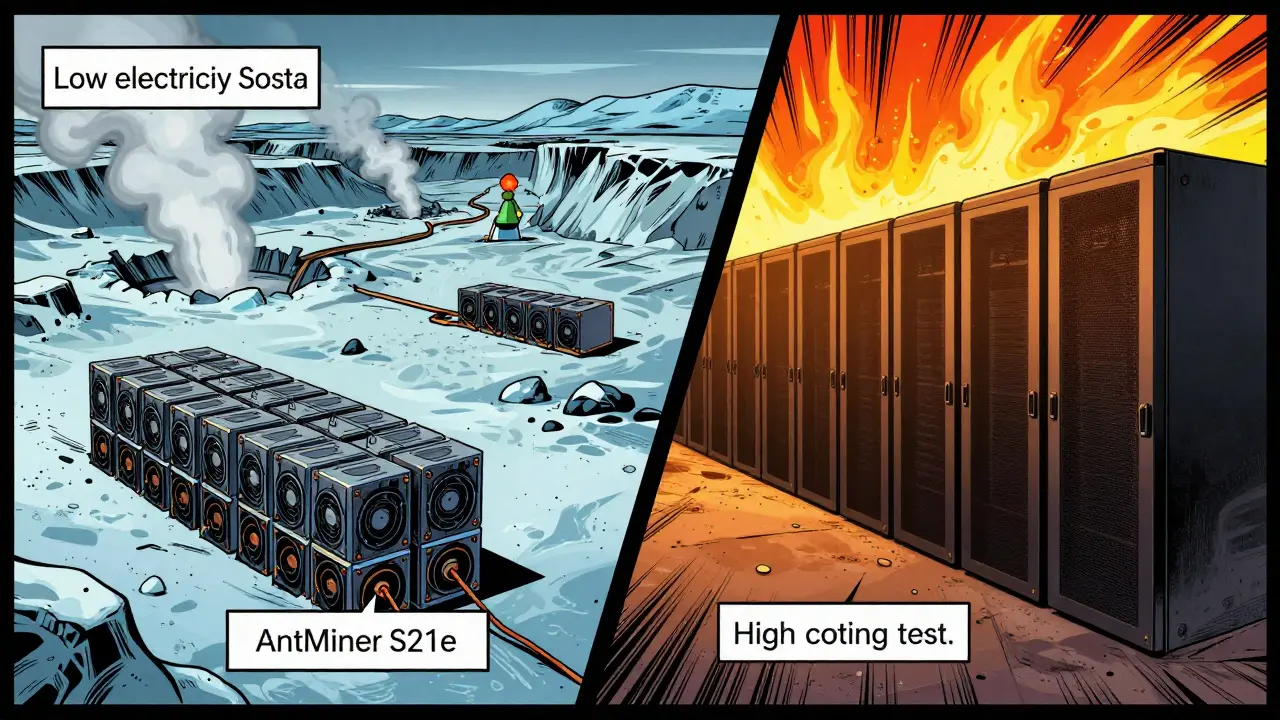

Electricity Costs: The Biggest Factor

Electricity costs make up 60-70% of mining expenses. A miner using an AntMiner S21e XP Hyd (860 TH/s, 11,180 watts) would spend about $1,138 per year on electricity at the U.S. average rate of $0.1178/kWh. However, in places like Iceland, where electricity costs $0.03/kWh, the same miner would only spend $290 annually. This difference can turn a profitable operation into a losing one. According to JPMorgan's September 2024 report, miners with electricity costs above $0.08/kWh faced 47% margin compression post-halving, forcing 32% of marginal producers to shut down.

Hardware Comparison: ASIC vs GPU Mining

| Hardware | Hash Rate (TH/s) | Power Consumption (W) | Daily Profit (BTC) | Daily Profit (USD) |

|---|---|---|---|---|

| AntMiner S21e XP Hyd | 860 | 11,180 | 0.00047200 | $39.11 |

| AntMiner S19 XP Hyd | 110 | 5,000 | 0.00006000 | $5.00 |

| NVIDIA RTX 4090 (for Bitcoin) | 0.0001 | 320 | 0.00000600 | $0.50 |

As you can see, ASIC miners dominate Bitcoin mining. The AntMiner S21e XP Hyd generates over 78 times more daily profit than the RTX 4090. GPU mining is generally not viable for Bitcoin due to low efficiency. However, GPUs remain competitive for other cryptocurrencies like Ethereum Classic, where they hold 87% of the network hash rate.

Understanding Network Difficulty

Network difficulty is a measure of how hard it is to mine a Bitcoin block. It adjusts every two weeks to maintain a consistent block time of approximately 10 minutes. As more miners join the network, difficulty increases, requiring more computational power to solve blocks. Since January 2020, Bitcoin's difficulty has risen 4,812% from 1.73 trillion to 83.15 trillion as of October 2024. This means miners need more efficient hardware to stay competitive. For example, a miner with a 500 TH/s ASIC in 2020 would now need a 1,000 TH/s rig to achieve similar returns due to rising difficulty.

Halving Events and Their Impact

Bitcoin's halving events reduce block rewards by 50% every 210,000 blocks, roughly every four years. The April 2024 halving cut rewards from 6.25 BTC to 3.125 BTC per block. This immediately decreased miner revenue by half. The network hash rate dropped 19.3% to 555 EH/s before recovering, according to CoinWarz data. Halvings force miners to optimize their operations or exit the market. For instance, miners with high electricity costs often shut down during these events, while those with access to cheap power stay operational.

Real-World Challenges for Miners

Bitcoin mining isn't just about hardware and electricity. Noise levels from mining rigs can exceed 85 decibels, requiring industrial facilities. Cooling infrastructure often costs 2.5 times the hardware price. Supply chain delays average 14.3 weeks for ASIC delivery, according to ASIC Miner Value's Q3 2024 report. Regulatory hurdles also pose risks. New York has a two-year moratorium on proof-of-work mining, while the EU's MiCA framework will impose a 20% energy tax on mining operations starting January 2025. On the flip side, Texas offers 0% corporate tax, attracting 23.7% of U.S. mining operations.

Future Outlook for Mining Profitability

Industry experts have mixed views on mining's future. JPMorgan's September 2024 report forecasts that 68% of current mining operations will become unprofitable by 2026 without efficiency improvements. However, CoinShares' August 2024 analysis projects mining will remain viable through 2140 due to increasing transaction fee revenue compensating for declining block rewards. Nic Carter of Castle Island Ventures predicts 45% of Bitcoin mining will use stranded energy sources like geothermal or flared gas by 2027. This shift toward renewable energy is already happening-geothermal and flared gas operations now control 18.7% of Bitcoin's hash rate, creating an 11.3% cost advantage over grid-powered miners.

Frequently Asked Questions

What is a good hash rate for Bitcoin mining?

It depends on your hardware and electricity costs. Top ASIC miners like the AntMiner S21e XP Hyd (860 TH/s) are standard for serious miners. However, profitability requires electricity costs below $0.08/kWh. Miners with higher costs often struggle after halving events.

How often does Bitcoin's network difficulty adjust?

Every 2,016 blocks, roughly every two weeks. Difficulty increases or decreases based on the network's total hash rate. After the April 2024 halving, difficulty rose 4,812% since January 2020, meaning miners need more efficient hardware to stay profitable.

Can I mine Bitcoin profitably with a GPU?

Generally no. High-end GPUs like the RTX 4090 only generate $0.50 daily in Bitcoin, while electricity costs often exceed that. GPU mining is viable for other coins like Ethereum Classic, but Bitcoin requires specialized ASIC hardware for profitability.

What's the biggest risk in Bitcoin mining?

Electricity costs. Miners with rates above $0.08/kWh face significant margin compression post-halving. For example, a miner with $0.12/kWh electricity could lose $1,200 monthly even with top-tier hardware. Location matters-regions with cheap power like Iceland or Texas offer better returns.

When will Bitcoin mining become unprofitable?

It varies. JPMorgan projects 68% of current operations will become unprofitable by 2026 without efficiency improvements. However, miners using renewable energy sources like geothermal or flared gas can maintain profitability longer due to lower costs. Transaction fees may eventually compensate for declining block rewards, extending mining viability beyond 2140.