Token Value Accrual Calculator

Calculate Token Value Accrual

See how token value grows as real-world usage increases. The more people use the token for its intended purpose, the more valuable it becomes through demand and network effects.

Most people think crypto tokens are just digital money. But if you look closer, the real power isn’t in how much they cost today-it’s in what they can do. A token with real utility isn’t a gamble. It’s a key. A key to services, features, and even voting rights inside a decentralized network. Without utility, a token is just a number on a screen. With it, it becomes part of how a system actually works.

What Exactly Is Token Utility?

Token utility is simple: it’s what the token lets you do inside its ecosystem. Think of it like a concert ticket. You don’t buy the paper for its value-you buy it to get in. Same with a utility token. You hold it not just to hope it goes up, but to use a service. For example, Filecoin’s token (FIL) lets you pay for decentralized storage. If you want to store files on a global network of computers instead of Amazon or Google, you pay in FIL. Basic Attention Token (BAT) rewards you for viewing ads on the Brave browser. You earn BAT, then spend it on premium features or tip creators. In DeFi, tokens like UNI or AAVE let you vote on protocol changes or get discounted fees on lending platforms. These aren’t investments in a company. They’re access passes. No ownership. No dividends. Just functionality. That’s what makes them different from security tokens, which are treated like stocks under the law. Utility tokens exist to make a platform work, not to make you rich.How Do Tokens Actually Get Value?

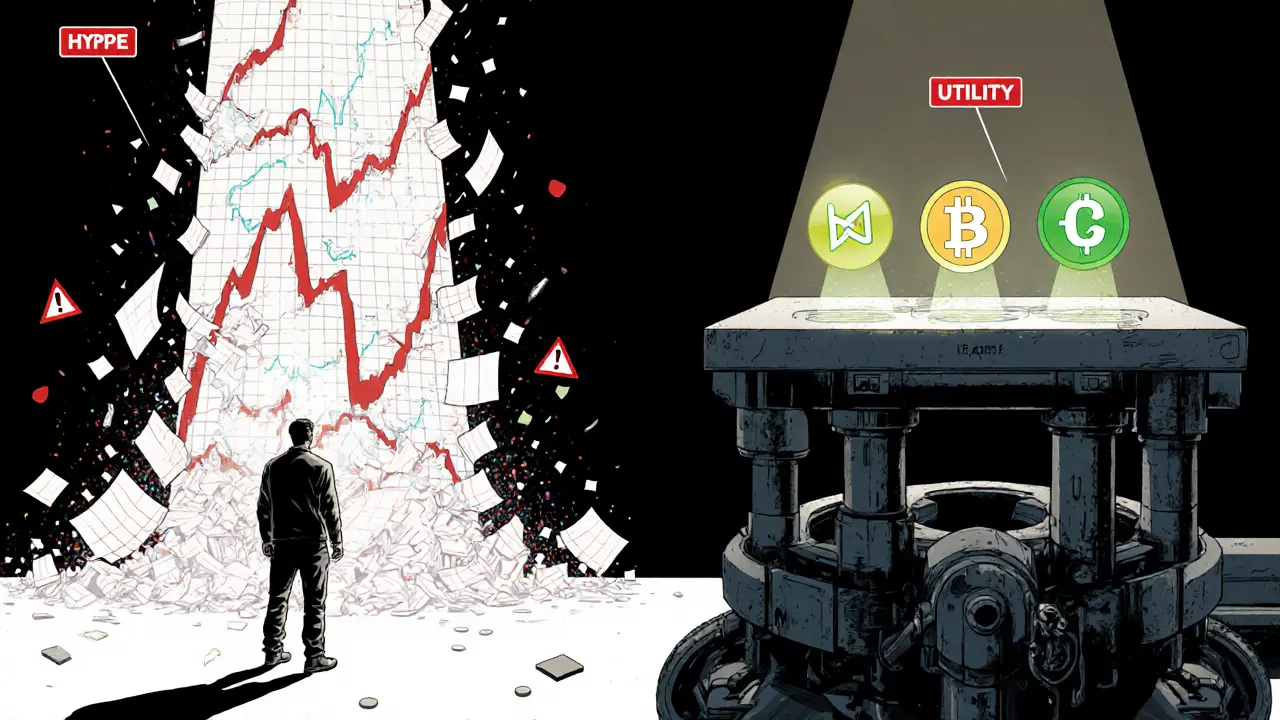

Value doesn’t come from hype. It comes from use. The more people use a token to do something real, the more valuable it becomes. That’s value accrual. It’s not magic. It’s math. Take a token that gives you a 20% discount on transaction fees. If 10 people use it, the discount matters little. But if 100,000 people use it every day? Now that discount saves them millions in fees. The platform earns more. The token becomes essential. And because it’s scarce-say, only 1 billion tokens ever created-demand pushes the price up. Not because someone said it’s the next Bitcoin. Because it’s actually needed. Some tokens build value through burning. Every time you pay a fee, a portion of the token gets destroyed. Less supply over time. More scarcity. More pressure on price. Others reward staking-locking up your tokens to help secure the network, and earning more in return. These aren’t tricks. They’re economic design choices that tie token value directly to network activity. The best tokens don’t just exist. They solve a problem. Filecoin solved cloud storage monopolies. BAT solved ad tracking and user exploitation. DeFi tokens solved centralized lending. If your token doesn’t make something better, faster, or cheaper, it won’t last.How Are Utility Tokens Created?

Creating a utility token isn’t as hard as it used to be. Back in 2017, you needed a team of developers. Now, tools like Token Tool by Bitbond let you launch one in minutes. You pick a blockchain-Ethereum, Solana, Polygon-set the name, symbol, total supply, and decide if it’s burnable, mintable, or governable. But here’s the catch: making a token is easy. Making one that matters? Hard. You need to answer three questions:- What service does this token unlock?

- Why can’t users pay with regular money or another crypto?

- What happens if no one uses it?

Why Most Utility Tokens Fail

Let’s be honest: 90% of tokens launched since 2017 are dead. Why? They were built to raise money, not to serve users. Founders sold tokens to investors who had no intention of using the platform. The platform never launched. Or it launched, but the token had no real use. No one paid with it. No one staked it. No one voted with it. It became a ghost asset. Another failure point? Overcomplicating things. Some projects add governance, staking, burning, rewards, and cross-chain swaps-all at once. That’s not innovation. That’s confusion. If users can’t understand how to use the token, they won’t. The best tokens are simple. You earn them. You spend them. You get something better in return. That’s it. Also, regulatory gray zones hurt. The SEC doesn’t care if you call your token a “utility token.” If it acts like a security-promising returns, backed by team effort, sold as an investment-it will be treated like one. Don’t assume you’re safe because you didn’t say “investment.” The regulators look at substance, not labels.Real Examples That Worked

Not all tokens are dead. Some actually changed how things work. Filecoin (FIL): Lets you rent unused hard drive space. You earn FIL by storing data. You pay FIL to retrieve it. It’s a decentralized AWS. Over 10 exabytes of data stored as of 2025. Real usage. Real value. Basic Attention Token (BAT): Used in Brave browser. Users get paid for watching privacy-respecting ads. Creators get paid from the same pool. Advertisers get real engagement. Over 40 million monthly active users. BAT isn’t traded just to flip-it’s spent daily. Uniswap (UNI): You don’t need UNI to swap tokens on Uniswap. But if you want to vote on fee structures, treasury spending, or new features, you need UNI. Over 1.5 million holders. Governance isn’t a gimmick-it’s the core. These projects didn’t rely on price pumps. They built systems where the token was necessary to participate. That’s the difference.

What’s Next for Utility Tokens?

The next wave isn’t about more tokens. It’s about smarter ones. We’re seeing tokens that adjust supply based on usage. If platform activity drops, fewer new tokens are minted. If usage spikes, more rewards go out. Dynamic models. Real-time feedback loops. Cross-chain utility is growing too. Tokens that work on Ethereum, Solana, and Polygon without needing bridges. That means users aren’t locked in. They can move freely. That’s better for adoption. Enterprise use is rising. Airlines are testing tokens for loyalty points. Retailers are using them for membership perks. Even local governments are exploring tokens for public service access. These aren’t crypto experiments. They’re practical replacements for old systems. The future belongs to tokens that solve real problems-not those that promise moonshots.How to Tell If a Token Has Real Utility

Before you buy or use a token, ask:- Can you use it right now? Or is it “coming soon”?

- Is there a real need for this token? Could the service work without it?

- Who uses it daily? Look for on-chain activity, not just social media hype.

- Is the token supply capped? Or can the team print more anytime?

- Are there mechanisms that tie token value to platform success? (Like burning or fee sharing?)

Final Thought: Utility Is the Only Long-Term Edge

Crypto markets swing. Trends fade. Hype dies. But utility? That lasts. A token that lets you store data cheaper than Amazon. One that pays you for browsing. One that lets you vote on how a financial system runs. Those don’t need a bull market. They need users. And users don’t care about charts. They care about results. If you’re building a token, build something people can’t live without. Not something they can flip. If you’re investing, don’t chase price. Chase purpose.What’s the difference between a utility token and a security token?

A utility token gives you access to a product or service-like paying for storage or voting on a protocol. It doesn’t represent ownership or promise profits. A security token, on the other hand, acts like a stock: it represents a share in a company, asset, or revenue stream, and is regulated like one. Regulators like the SEC look at intent and structure, not labels. If a token is sold with the expectation of profit from others’ efforts, it’s likely a security-even if called a utility token.

Can utility tokens be used as currency?

They can be used to pay for things within their ecosystem, but they’re not designed as general-purpose money. Unlike Bitcoin or stablecoins, utility tokens usually don’t aim to be a medium of exchange across different platforms. Their value comes from specific use cases, not widespread acceptance. You can trade them on exchanges, but that’s speculation-not utility.

Do I need a wallet to use a utility token?

Yes. You need a crypto wallet compatible with the token’s blockchain-like MetaMask for Ethereum or Phantom for Solana. The wallet holds your tokens and lets you interact with smart contracts. Some apps, like the Brave browser, hide this complexity and handle tokens automatically, but behind the scenes, you’re still using a wallet. Without one, you can’t send, receive, or use the token.

How do I know if a token’s value will grow?

Look at usage, not price charts. Check how many people are actively using the token on-chain. Are fees being paid? Are tokens being staked or burned? Is the user base growing? If the platform is solving a real problem and adoption is rising, value has a path to grow. If it’s just being traded with no real activity, it’s a gamble. Real utility creates demand. Demand creates value.

Are utility tokens regulated?

They’re not automatically regulated like securities, but they can be. The key is how they’re marketed and used. If a project promises returns or sells tokens as investments, regulators may step in. In 2025, the SEC and other agencies have become much better at identifying disguised security offerings. Projects that focus on functionality, not profit, are less likely to face enforcement-but legal risk still exists. Always research the jurisdiction and compliance posture of any project you engage with.

Can utility tokens be created without coding?

Yes. Tools like Token Tool by Bitbond, CoinTool, and TokenMint let you create ERC-20 or SPL tokens with a few clicks. You pick the name, symbol, supply, and features like burnability or governance. But creating a token is only the first step. Designing its economics, ensuring security, and driving adoption require deeper knowledge. No-code tools lower the barrier, but they don’t guarantee success.

Louise Watson

November 9 2025A token is a key. Not a lottery ticket.

Use it, or it's just noise.

Cydney Proctor

November 10 2025Oh, so now we're romanticizing digital keys like they're heirlooms from the 18th century? How quaint. The entire premise assumes users care about "utility" when 99% of them just want to flip it before breakfast.

Cierra Ivery

November 12 2025You say "no ownership" but then you list governance tokens like UNI-that's literally ownership disguised as participation. You're not explaining utility, you're gaslighting people into thinking voting rights aren't equity. Stop pretending.

Veeramani maran

November 12 2025bro i read this and my brain hurt like i ate too much spicy samosa

utility token = like pay for wifi with crypto? but why not usd? why not paypal? why not just qr code? i dont get it

Kevin Mann

November 13 2025I just want to say-this is THE MOST IMPORTANT THING I'VE READ ALL YEAR. Like, imagine if your Netflix subscription could vote on what shows get made? Or your Uber driver got paid in tokens that let them buy a new car? This isn't just tech-it's a REVOLUTION. I cried when I read the Filecoin part. I actually cried. 🥹🔥

Kathy Ruff

November 14 2025The real insight here is that value accrues through friction reduction. Tokens that lower the cost of participation-whether it's fees, trust, or access-create network effects that compound. BAT doesn't just pay you; it aligns incentives between users, creators, and advertisers. That's the magic. Not speculation. Alignment.

Robin Hilton

November 16 2025Let me get this straight. You're telling me that a token that lets you vote on a protocol is somehow not an investment? In America, if you give someone a vote that affects their money, that's called a security. This isn't innovation. It's legal evasion dressed up as philosophy.

Grace Huegel

November 16 2025I used to believe in this stuff. I really did. I staked my savings. I believed in the vision. And then the team vanished. The token became a ghost. And now I just sit here staring at my wallet, wondering if I was stupid... or just naive.

Nitesh Bandgar

November 17 2025You think you're clever with your "keys" and "access passes"-but let me tell you something, darling: most of these tokens are just digital confetti thrown at a party no one showed up to. I've seen 200 of these projects. 199 died screaming in the dark. The one that survived? It wasn't because of utility. It was because the founder had a Twitter thread with 500K likes.

Jessica Arnold

November 18 2025In many African and Southeast Asian economies, utility tokens function as informal financial infrastructure-bypassing banks, enabling micro-transactions, and empowering gig workers. This isn't Western tech fantasy. It's survival mechanism. The real utility isn't in the code-it's in the context.

Chloe Walsh

November 19 2025So let me get this straight-you’re saying if a token doesn’t make you rich it’s not a scam? That’s the most delusional thing I’ve ever heard. If you’re not flipping it for 10x, why even bother? This whole "utility" thing is just the crypto equivalent of telling your kid "it’s not about the trophy, it’s about the journey" while they cry because they lost the game

Stephanie Tolson

November 20 2025To anyone new here: don't get lost in the jargon. Ask yourself: "If this token disappeared tomorrow, would the service still work?" If yes, walk away. If no-you might be onto something. Utility isn't sexy. It's quiet. It's the unglamorous backbone. But it's the only thing that lasts.

Anthony Allen

November 22 2025I'm just curious-how do you measure "real usage"? On-chain transactions? Wallet addresses? Active stakers? What's the threshold? Is 100 daily users enough? 1,000? I feel like this whole "utility" thing is still super vague. We need metrics, not metaphors.

Megan Peeples

November 23 2025You say "no dividends"-but what about the fact that token holders get fee discounts, voting rights, and early access? That’s not utility. That’s preferential treatment. And preferential treatment is a form of equity. You’re just avoiding the word "stock" because it sounds too regulated.

Sarah Scheerlinck

November 24 2025I’ve been in crypto since 2015. I’ve seen the hype cycles. The ICOs. The rug pulls. But I’ve also seen communities form around tokens that actually solve problems. BAT changed how I browse. Filecoin gave my grandma a way to back up her photos without paying Big Tech. That’s not magic. That’s human impact.

karan thakur

November 25 2025This is all a distraction. The real goal is to replace the dollar with a private currency controlled by anonymous devs. The SEC knows this. The Fed knows this. They're just waiting for the right moment to crush it. Utility? A cover. A Trojan horse. Don't be fooled.

Evan Koehne

November 26 2025Ah yes, the classic "it’s not speculation, it’s utility" argument. The same thing people said about tulips in 1637. The only difference? Now we have blockchain. And memes. And influencers. And a whole industry built on pretending we’re not gambling.

Vipul dhingra

November 27 2025You think you know utility? I built a token for a local chai shop in Delhi. They accept it. People use it. No blockchain needed. Just QR code and trust. You overcomplicate everything with ERC20 and staking. Real utility is simple. You pay. You get chai. Done.

Jacque Hustead

November 29 2025This is the most balanced, thoughtful take I've seen on this topic. Thank you. It's easy to get lost in the noise, but the core truth is simple: if it doesn't make someone's life better, faster, or cheaper-it's just noise. And noise doesn't last.