SyncSwap on Linea isn’t your typical crypto exchange. You won’t find big trading volumes, flashy promotions, or hundreds of tokens. In fact, as of early 2026, every single trading pair on SyncSwap (Linea) shows $0.00 in 24-hour volume. That’s not a typo. But that doesn’t mean it’s dead. It means you’re looking at something far more interesting: a decentralized exchange built for the future, not the present.

What Is SyncSwap (Linea)?

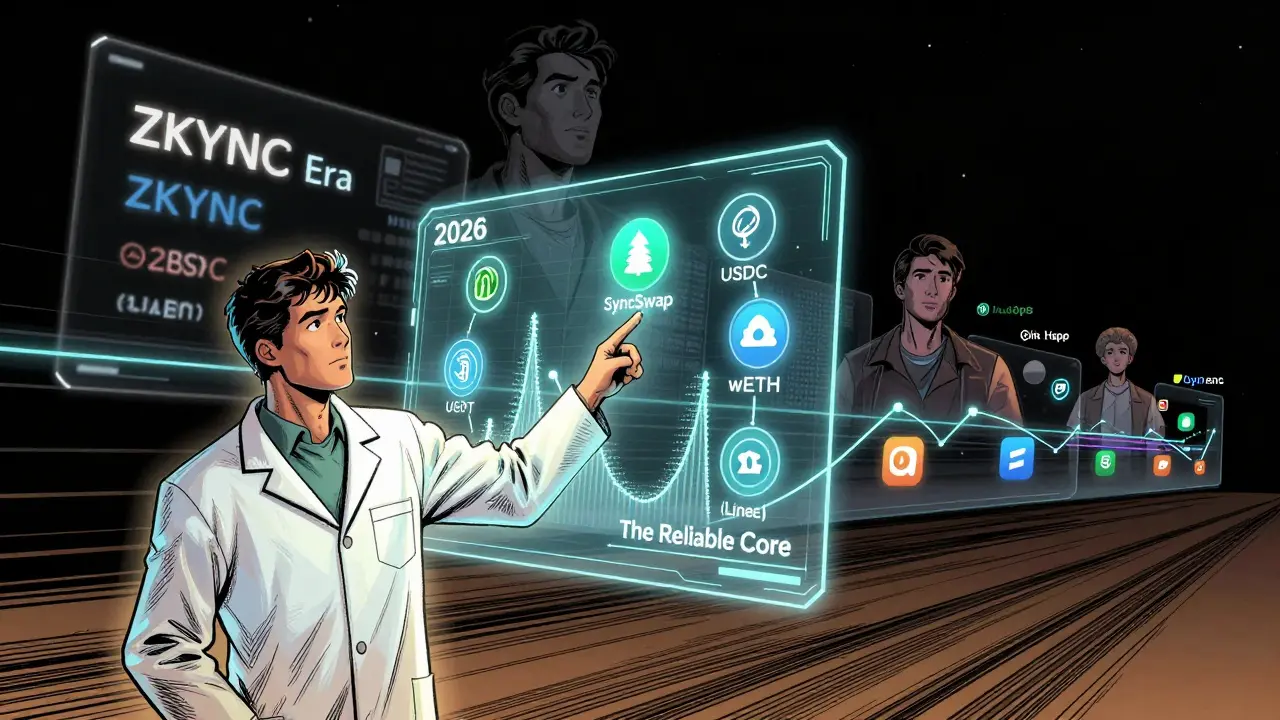

SyncSwap started on zkSync Era, one of the earliest and most successful zero-knowledge Ethereum Layer 2 networks. It quickly became the biggest DEX on that chain, handling over $8 billion in trades and locking up more than $80 million in assets. Now, it’s expanding to other zkEVM chains - and Linea is one of them. Linea, developed by Consensys (the same team behind MetaMask), is a zkEVM rollup. That means it’s built to be fully compatible with Ethereum, but faster and cheaper. Unlike older Layer 2s like Optimism or Arbitrum, which use optimistic rollups (and force you to wait up to a week for withdrawals), Linea uses zero-knowledge proofs. These are cryptographic proofs that verify transactions instantly without needing a waiting period. SyncSwap leverages this tech to make swaps near-instant and extremely cheap. On Linea, SyncSwap isn’t trying to compete with centralized exchanges like Binance or Coinbase. It’s not even aiming to be the biggest DEX on the chain right now. Its goal? To be the most reliable place to swap stablecoins - especially USDC and USDT - with minimal slippage and near-zero fees. That’s it.How SyncSwap (Linea) Works

Using SyncSwap on Linea is simple if you’ve used any other DeFi app before. You need a wallet that supports Linea - like MetaMask, Rabby, or Trust Wallet - and you need to have some Linea-native ETH (called LINEA ETH) to pay for gas. You can get this by bridging from Ethereum or buying it on a centralized exchange that supports Linea. Once you’re connected:- Go to app.synswap.finance and switch the network to Linea.

- Connect your wallet.

- Select the tokens you want to swap - right now, the only live pairs are USDC/USDC, USDT/USDC, and wETH/STONE3.

- Enter the amount and confirm the transaction.

Why the Trading Volume Is Zero (And Why That’s Not a Red Flag)

You might be wondering: if the volume is $0, why should I care? Because SyncSwap (Linea) is still in the early building phase. The Linea ecosystem itself is young. Most users are still bridging assets over, staking LINEA tokens, or waiting for new projects to launch. Liquidity providers haven’t flooded in yet. That’s normal. Look at zkSync Era in 2022 - it had almost no volume at first, too. SyncSwap’s success on zkSync Era proves the model works. It’s not a gamble on a new tech - it’s a proven architecture being ported to a new chain. The real question isn’t “Is this dead?” It’s “Will Linea grow fast enough to make this useful?” Right now, the answer is: maybe. Linea has backing from Consensys, major institutional investors, and a growing list of dApps. If more DeFi protocols launch on Linea in 2026 - and they’re likely to - SyncSwap will be the first place they integrate for stablecoin swaps.What You Can Trade Right Now

SyncSwap (Linea) lists only five tokens, but that’s not a flaw - it’s a strategy:- USDC - Circle’s stablecoin, fully backed and widely trusted.

- USDT - Tether’s stablecoin, still the most traded globally.

- wETH - Wrapped Ethereum, the standard ETH token on Layer 2s.

- STONE3 - A lesser-known token tied to a Linea-based project (likely a test or early liquidity incentive).

- LINEA - The native token of the Linea network (not directly tradable on SyncSwap yet, but needed for gas).

- USDC/USDC - Priced at 1.01 USDC, tiny 0.02% change. This is likely a glitch or a liquidity pool test.

- USDT/USDC - Priced at 1.000 USDC, no change. This is the real deal - a 1:1 stablecoin swap.

- wETH/STONE3 - Priced at 0.9734 STONE3, up 0.42%. This pair is probably used for farming or testing.

How It Compares to Other DEXs on Linea

Right now, there are only a handful of DEXs on Linea:| DEX | Technology | 24H Volume | Stablecoin Pairs | Best For |

|---|---|---|---|---|

| SyncSwap (Linea) | zkEVM (zero-knowledge) | $0.00 | USDC, USDT | Low-slippage stable swaps, future-proof tech |

| LineaSwap | AMM (standard) | $120K | USDC, USDT, LINEA | General trading, higher liquidity |

| QuickSwap Linea | AMM | $85K | USDC, USDT, LINEA | Beginners, simple UI |

| Uniswap v3 (Linea) | AMM | $50K | USDC, USDT, wETH | Advanced liquidity provision |

- Transactions settle in seconds, not minutes.

- Gas fees are 10x cheaper than on Ethereum mainnet.

- No risk of fraud or delayed withdrawals.

Who Should Use SyncSwap (Linea)?

This isn’t for everyone. Here’s who it’s actually for:- Stablecoin traders - If you’re moving USDC to USDT or vice versa across chains, this is one of the cleanest ways to do it.

- Linea early adopters - You believe in Linea’s tech and want to support its growth.

- DeFi builders - If you’re developing a dApp and need reliable stablecoin liquidity, SyncSwap’s architecture is a strong candidate for integration.

- Privacy-focused users - zkEVMs offer better privacy than optimistic rollups because transaction details are hidden by design.

Tokenomics and SYNC Token

SyncSwap has a native token: SYNC. There are 100 million tokens in total. But here’s the catch - the SYNC token isn’t used on the Linea version of SyncSwap yet. It’s only active on zkSync Era, where it’s used for governance and fee discounts. On Linea, there’s no SYNC token farming, no staking, no airdrops. That’s a deliberate choice. SyncSwap is prioritizing user experience and liquidity over token incentives. Many other DEXs blow up with airdrops, then collapse when the tokens dump. SyncSwap is avoiding that trap. If you’re hoping to earn SYNC by using SyncSwap on Linea - you won’t. But you also won’t be trapped in a token pump-and-dump cycle.

Is SyncSwap (Linea) Safe?

Yes. And here’s why:- It’s built on Linea, which is audited and backed by Consensys - one of the most respected names in Ethereum infrastructure.

- Zero-knowledge proofs are mathematically proven to be secure. Unlike optimistic rollups, there’s no window for fraud.

- The code is open-source and has been audited multiple times on zkSync Era.

- No rug pulls, no hidden contracts. The interface is simple and transparent.

What’s Next for SyncSwap (Linea)?

The Linea ecosystem is heating up. In late 2025, Linea launched its own token and began distributing airdrops to early users. More projects are moving in. If SyncSwap can attract even a fraction of that activity, its volume could explode. Expect to see:- More stablecoin pairs (like DAI, FRAX, or USDe).

- Integration with Linea-based lending protocols.

- Possible SYNC token utility on Linea by mid-2026.

- Partnerships with wallet providers to make syncing Linea easier.

Final Verdict

SyncSwap (Linea) isn’t a trading platform you’ll use every day - not yet. But if you’re building in DeFi, holding stablecoins, or betting on the future of Ethereum scaling, it’s one of the most important tools to watch. It’s not about volume today. It’s about technology tomorrow. If you’re curious, connect your wallet, swap $10 of USDC to USDT, and see how fast and cheap it is. That’s the real test. If it works smoothly - and it will - you’ve just used the future of crypto trading.Is SyncSwap (Linea) a scam because it has $0 trading volume?

No. Zero volume doesn’t mean it’s broken - it means it’s early. SyncSwap is a proven protocol that’s already handled billions in trades on zkSync Era. The Linea version is still gaining traction. Many successful DeFi projects started with no volume and grew as their ecosystem matured. SyncSwap’s tech is solid; the market just hasn’t caught up yet.

Can I earn SYNC tokens by using SyncSwap on Linea?

Not right now. The SYNC token is only active on zkSync Era, where it’s used for governance and fee discounts. SyncSwap has chosen not to launch token incentives on Linea to avoid the volatility and speculation that often hurt new DEXs. If SYNC becomes usable on Linea in the future, it will be announced officially.

Do I need LINEA tokens to use SyncSwap?

Yes. You need Linea-native ETH (often called LINEA ETH) to pay for gas fees. You can’t use Ethereum mainnet ETH. You can get it by bridging from Ethereum via the official Linea bridge, or by buying it on a centralized exchange that supports Linea, like Binance or OKX.

How does SyncSwap compare to Uniswap on Linea?

Uniswap v3 is more liquid and supports more tokens, but it uses an older AMM model. SyncSwap uses zero-knowledge proofs, which means faster finality, lower fees, and better security. Uniswap is better for casual trading. SyncSwap is better if you care about long-term reliability and scalability.

Is SyncSwap (Linea) good for beginners?

It’s not the easiest DEX for absolute beginners. You need to understand wallets, Layer 2s, and bridging. But if you’ve used MetaMask and swapped tokens on any DeFi app before, SyncSwap’s interface is clean and straightforward. Start with a small swap - $5 to $10 - to test it out.

Will SyncSwap add more tokens soon?

Almost certainly. The current token list is minimal because the platform is still in early adoption. As more projects launch on Linea and liquidity grows, SyncSwap will add new pairs - especially other stablecoins like DAI and FRAX. Keep an eye on their official Twitter and Discord for announcements.

Alisha Arora

February 2 2026This is literally the dumbest thing I've seen all week. $0 volume? That's not future-proof, that's dead. Why are people still talking about this like it's some kind of secret genius move? It's a ghost town.

Stop pretending it's innovative when it's just abandoned.

Someone please tell me why I should care.

It's not tech, it's trash.

And don't even get me started on the 'zero-knowledge' buzzwords. I've seen this movie before.

It ends with everyone running for the exits.

Wake up.

It's over.

Move on.

There are better chains out there.

Linea isn't even on the map yet.

SyncSwap is just a graveyard with a fancy name.

Stop glorifying failure.

It's not a vision, it's a corpse.

And you're all just standing around it, taking selfies.

Grow up.

Mrs. Miller

February 2 2026Interesting how we’ve turned ‘zero volume’ into a philosophical paradox.

Is it dead because no one’s trading? Or is it alive because it’s waiting for the world to catch up?

Maybe the real question isn’t ‘Is this dead?’

But ‘Are we too impatient to see the future?’

Back in 2017, no one traded on Uniswap either.

Everyone called it a toy.

Now it’s the backbone of DeFi.

So maybe SyncSwap isn’t failing.

Maybe we’re just not ready for it yet.

And that’s okay.

Some things don’t need noise to matter.

They just need time.

And a few brave souls who aren’t chasing the next meme coin.

Maybe that’s us.

Maybe that’s enough.

Michael Sullivan

February 3 2026LMAO $0 VOLUME?? 🤡

Bro this is the most overhyped dumpster fire since Terra.

SyncSwap on Linea? More like SyncSLEEP.

zkEVM? Cool. But no liquidity = no function.

You can't 'build for the future' when the present is a ghost town.

They’re not ‘avoiding token pumps’ - they’re avoiding users.

And the fact you’re defending this? 😭

Next you’ll say Bitcoin was ‘early’ in 2010 when nobody mined it.

It’s not tech - it’s a funeral with a whitepaper.

STOP. JUST. STOP.

Reda Adaou

February 3 2026I think there’s value in what SyncSwap is doing - even if it’s quiet.

Not everything has to explode to be meaningful.

Some projects are like seeds - they don’t show growth until the soil is ready.

Linea has serious backing, and SyncSwap’s focus on stablecoin swaps is actually smart.

Most people want to trade meme coins - but the real infrastructure needs to move real value.

USDC to USDT with near-zero fees and instant settlement?

That’s the quiet backbone of DeFi.

It’s not sexy.

But it’s necessary.

And honestly? I’d rather have this than another token farm that vanishes in 3 months.