Bitex.la is a Bitcoin-focused exchange built for Latin America

Bitex.la started in 2014 as a simple way for people in Argentina, Brazil, Mexico, Chile, Peru, and Uruguay to buy Bitcoin using local bank transfers. It wasn’t designed to compete with Binance or Coinbase. It was made for folks who can’t use credit cards, don’t have access to international payment systems, or need to send money across borders without paying 10% in fees. If you live in one of these countries and want to buy Bitcoin with your local currency, Bitex.la might seem like a good option. But there are serious red flags you need to see before you deposit any money.

It only supports Bitcoin - not even Ethereum

Here’s the first thing that trips people up: Bitex.la claims to support Bitcoin, Ethereum, Litecoin, and Ripple on G2, but Cryptowisser - a well-known crypto review site - says it only trades Bitcoin. Which one is right? Most user reports and transaction logs point to Bitcoin-only trading. If you’re looking to swap ETH for USDT or trade altcoins, this platform won’t help you. That’s not just limiting - it’s outdated. In 2026, even small exchanges offer at least 10 major coins. Bitex.la still operates like it’s 2015.

Deposit methods are strict - and cash-only in some places

You can’t use credit cards. You can’t use PayPal. You can’t even use Apple Pay. Your only options are bank transfers in local currencies (like ARS, BRL, MXN), wire transfers, or cash deposits via AstroPay in supported countries. That’s fine if you’re in Buenos Aires and have a local bank account. But if you’re in Mexico City and your bank doesn’t allow crypto-linked transfers? You’re stuck. And if you’re outside South America? Forget it. The platform doesn’t accept deposits from the U.S., EU, or Asia. This isn’t a global exchange. It’s a regional cash-in system with a website.

Verification is mandatory - and slow

Like every legitimate crypto platform, Bitex.la requires ID verification. But here’s the catch: users report waiting 3 to 7 business days just to get their account approved. One G2 reviewer said they submitted documents on a Monday and didn’t hear back until Friday - and even then, they were asked to resubmit. There’s no live chat. No phone support you can reach easily. And when you do get through, responses are vague. “We’re processing your request” is the most common reply. If you need to move money fast - say, to hedge against inflation or take advantage of a price dip - this isn’t the place for you.

Transaction speeds are painfully slow

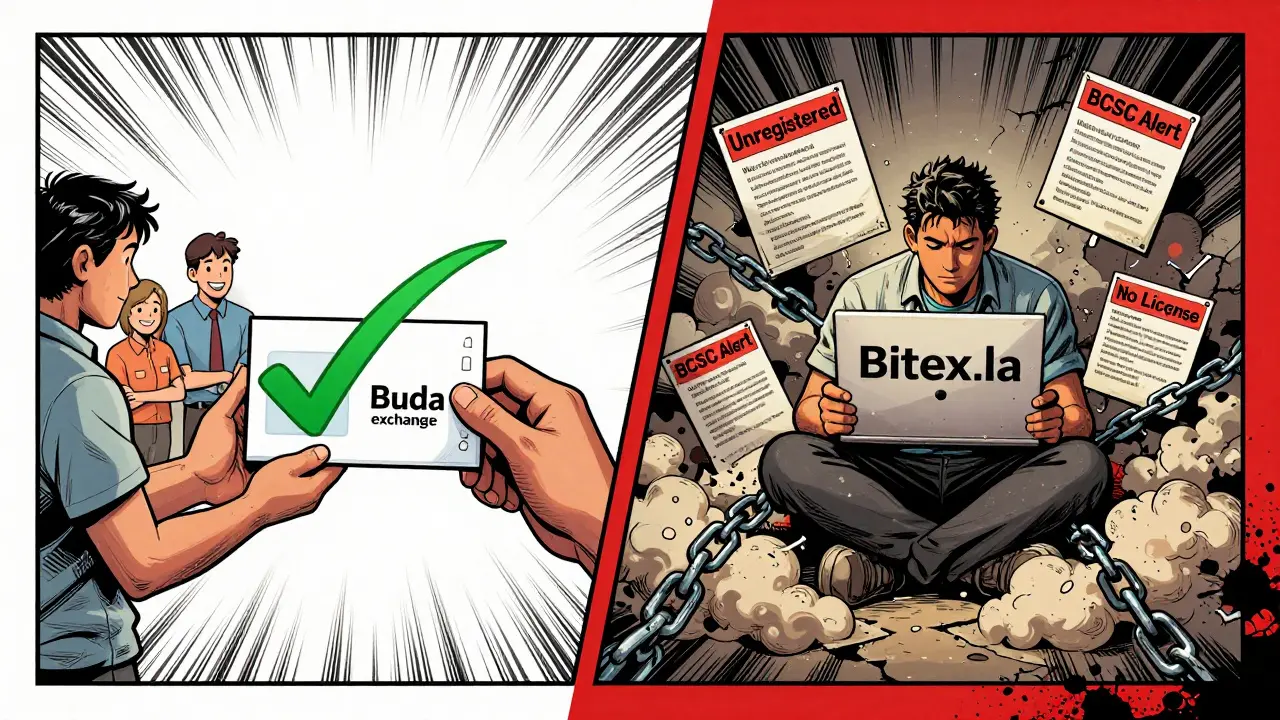

Even after your deposit clears, withdrawing Bitcoin takes days. Multiple users on G2 wrote: “It takes a long time to receive your money.” One person said they sent a withdrawal request on Tuesday and didn’t get their BTC until the following Monday. That’s not normal. Even smaller exchanges like Buda in Chile process withdrawals in under 24 hours. Bitex.la’s delays suggest either technical bottlenecks or internal mismanagement. Either way, it’s a dealbreaker for anyone treating crypto as a liquid asset.

Regulators are warning people away

The British Columbia Securities Commission (BCSC) issued a public warning in 2025 stating that Bitex.la is “neither recognized as an exchange nor registered as a broker.” That’s not a minor note. That’s a legal red flag. The BCSC doesn’t issue these warnings lightly. They’re backed by Canadian law. If you’re in Canada, the U.S., Australia, or the EU, using Bitex.la could put you at risk of losing funds with no legal recourse. Even worse, the platform’s registration address is in Argentina - a country with weak crypto oversight. There’s no official license number you can verify. No public audit. No transparency.

User reviews don’t add up

Trustpilot shows a 3.2/5 rating - but based on just one review. Cryptogeek lists a perfect 5/5 - from two reviews. G2 has three reviews: one praises the “beautiful” interface, another loves the low fees for cross-border payments, and the third calls customer service “terrible” and says they don’t know if the platform is regulated. Here’s the kicker: G2 admits reviewers were offered gift cards for completing their reviews. That’s not fake, but it’s not unbiased either. Meanwhile, Forex Peace Army - a site that tracks scam brokers - has zero reviews for Bitex.la. Traders Union, which has been monitoring fraudulent crypto platforms for over a decade, gave Bitex.la a 1.6/5. That’s the lowest possible score before calling it a scam. If you’re trying to decide based on reviews, the data is too thin - and too suspicious - to trust.

Who is this exchange actually for?

Bitex.la isn’t for investors. It’s not for traders. It’s not even for people who want to learn crypto. It’s for one specific group: people in Argentina, Brazil, or Mexico who need to send money internationally without using Western Union or Wise. One G2 user said they use Bitex.la to receive payments in Bitcoin from clients in the U.S., then cash out locally. That’s the real use case. It’s a bridge - not a marketplace. If you’re trying to build a crypto portfolio, buy altcoins, or trade for profit, you’re using the wrong tool. And if you’re outside South America, you’re playing with fire.

Alternatives are better, safer, and faster

If you’re in Latin America, try Buda (Chile, Colombia, Argentina, Peru) or Ripio (Argentina). Both support multiple cryptocurrencies, have faster withdrawals, and are regulated under local financial authorities. If you’re outside the region, use Kraken, Coinbase, or Bitstamp. All three accept bank transfers, have 24/7 support, and are registered with major financial regulators. They’re not perfect - but they’re not operating in the legal gray zone like Bitex.la.

Final verdict: Avoid unless you’re in a tight spot

Bitex.la has been around since 2014. That’s longer than most crypto startups survive. But longevity doesn’t mean safety. It just means they’ve found a small, underserved niche - and they’re exploiting it. The lack of regulation, the slow transactions, the mixed reviews, the BCSC warning - these aren’t bugs. They’re features of a platform that doesn’t want to grow. It wants to survive. And if you’re not in South America and you need to send or receive Bitcoin quickly? There are dozens of better options. Don’t risk your money on a platform that regulators have flagged and users can’t agree on. Wait. Do your homework. Choose something with a license, not a website.

mary irons

January 30 2026So let me get this straight - a platform that doesn't even support ETH in 2026 is being called 'useful'? 🤡 I mean, if you're still using Bitcoin-only exchanges, you're basically trading in the stone age. And don't get me started on the BCSC warning. If you're not in a country with actual financial oversight, you're not investing - you're volunteering for a rug pull.

Brandon Vaidyanathan

January 30 2026I KNEW IT. I KNEW IT. I told my cousin last week - 'If it's only Bitcoin and no live chat, it's a trap.' This isn't an exchange, it's a digital snake oil salesman with a .la domain. People are still falling for this? Bro, I saw a guy wire $5k to this thing last month. He hasn't been heard from since.

Jerry Ogah

January 31 2026I'm not saying this is a scam, but let's be real - if your 'customer service' takes 7 days to respond and your 'regulatory status' is just 'we're in Argentina,' you're not building trust. You're building a Ponzi theater. And the fact that G2 reviews are paid? That's not a feature, that's a confession.

Andrea Demontis

January 31 2026It's interesting how we equate longevity with legitimacy. Just because something's been around since 2014 doesn't mean it's evolved - it just means it's survived by avoiding scrutiny. This platform exists in a regulatory vacuum, and that vacuum is filled with desperation. People aren't choosing Bitex.la because it's good - they're choosing it because they have no other way to move money across borders. That's not innovation. That's systemic failure.

Joseph Pietrasik

February 1 2026idk why people are mad its bitcoin only like who even needs eth anymore anyway and the cash deposits are kinda cool honestly like if you live in mexico and your bank blocks crypto you got nothing else

Raju Bhagat

February 3 2026Bro this is literally the only way my uncle in Peru gets paid from his US clients! He doesn't have a credit card, he doesn't trust Wise, and he doesn't want to pay 10% to Western Union. This isn't about trading - it's about survival. Stop acting like everyone has access to Kraken. Not everyone lives in a Silicon Valley bubble.