Block (bl0ck.gg), or BLOCK, isn’t another crypto project you can ignore - it’s one you should avoid. At first glance, it looks like a promising Layer 1 and Layer 2 blockchain with 5-second block times, 25% APY staking, and Ethereum compatibility. But behind the flashy website and inflated price charts lies a token with no real adoption, no verifiable team, and trading data so inconsistent it screams manipulation.

What Is BLOCK Actually?

Block (bl0ck.gg) claims to be a next-gen blockchain built for speed and low fees. It says it can process transactions in 5 seconds, charges just $0.0001 per trade, and rewards stakers with up to 25% annual returns. It even has its own decentralized exchange called BLOCKSWAP. Sounds great, right? But here’s the catch: none of this is backed by real usage.

The token has a fixed supply of 10 billion BLOCK coins. 70% of those are supposed to go to staking rewards and ecosystem growth. But if you check any major exchange - Binance, Coinbase, or Kraken - you’ll find something strange. On Coinbase, BLOCK is listed at $0.35. On Binance, it’s $0.14. On Coincarp, it’s $0.014. All at the same time. That’s not market volatility. That’s a red flag. Real tokens don’t trade at 25x differences across exchanges. This kind of inconsistency is textbook pump-and-dump behavior.

Why the Price Doesn’t Make Sense

Here’s the math: if BLOCK’s price is $0.35 on Coinbase and the supply is 10 billion, the fully diluted market cap would be $3.5 billion. But the actual circulating supply? Zero. Or close to it. Binance shows a 24-hour trading volume of $114. That’s less than what a single trade on Ethereum costs in gas fees. Polygon, a competitor, moves over $400 million in volume daily. BLOCK? It’s barely moving.

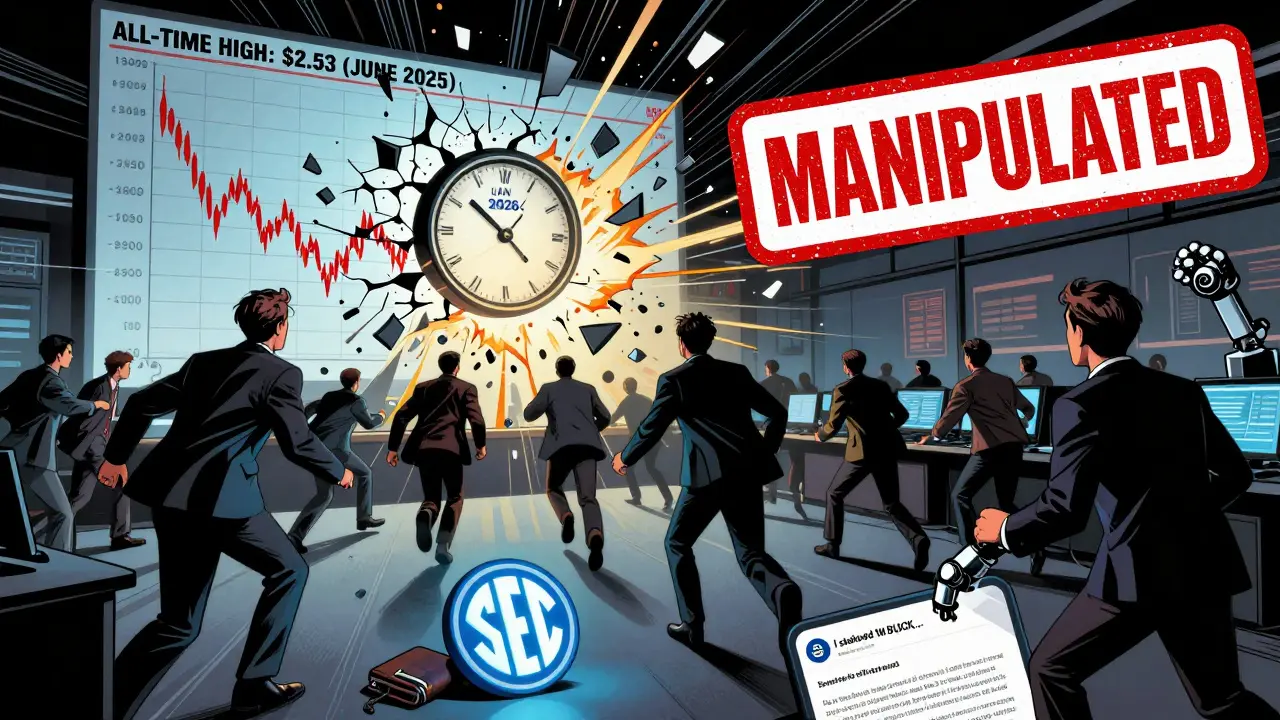

And yet, some price trackers list BLOCK’s all-time high as $2.53 - in June 2025. But today is January 2026. That’s over a year in the future. That’s not a typo. That’s a lie. Someone manually altered the historical data to make the token look like it had momentum. That’s not a mistake. That’s fraud.

No Developers. No Apps. No Future.

Any blockchain needs developers to build on it. Ethereum has millions. Polygon has over 19,000 dApps. BLOCK? GitHub shows three repositories. One is a logo. Another is a README file. The third is a copy-paste of an Ethereum template with no commits since 2023. No one is coding on this chain. No one is deploying smart contracts. No one is using it.

There are no major projects built on BLOCK. No DeFi protocols. No NFT marketplaces. No games. Not even a simple token swap contract that anyone can verify. Without developers, there’s no ecosystem. Without an ecosystem, there’s no value. Just empty promises.

Staking Rewards? Maybe. But at What Cost?

Some users on Reddit and Bitcointalk say they earned 25% APY by staking BLOCK tokens on BLOCKSWAP. That sounds amazing - until you realize they’re staking tokens they bought for pennies, hoping to cash out before the whole thing collapses. One user posted: “I staked 1 million BLOCK and got my reward. But I couldn’t sell it. No buyers. Price dropped 90% in 48 hours.”

Staking rewards are only valuable if you can exit. If no one is buying BLOCK, your “earnings” are just digital numbers on a screen. You can’t pay your rent with staking rewards if you can’t convert them to USD. And with zero fiat on-ramps and no liquidity, you’re stuck.

Community? Barely There

Look at the social proof. The official Twitter account @bl0ck_gg has 127 followers. The last reply to a user? December 2023. The Telegram group has under 500 members. Most posts are bots reposting price updates. There’s no active discussion. No developer updates. No roadmap. No answers to questions.

Compare that to Polygon. Their Twitter has over 1 million followers. They post daily updates. They host AMAs. They partner with brands like Starbucks and Adidas. BLOCK? They don’t even have a whitepaper. No team names. No LinkedIn profiles. No office address. Just a website with a fancy logo and a staking button.

Scams Are Already Happening

CryptoScamDB lists 12 verified reports of BLOCK-related scams. Users report being unable to withdraw tokens after depositing. Others say they were tricked into connecting wallets to fake BLOCKSWAP sites that drained their ETH. One Reddit user wrote: “I tried to trade BLOCK on exchange X. My $500 order moved the price 40%. That’s not a market - that’s a rigged game.”

Trustpilot has zero reviews. No legitimate reviews at all. That’s not because people are happy. It’s because no one who lost money is going to leave a good review. The average rating across forums is 1.8 out of 5.

Why Experts Are Warning Against It

CryptoSlate’s John Wu called it “a classic case of token concentration with extreme manipulation potential.” Binance Academy labeled the price discrepancies a “major red flag.” CoinDesk found no evidence of smart contract activity. Messari and CoinGecko both flagged it as “unverifiable” and “high-risk.”

Gartner’s January 2024 report said it plainly: “Tokens with simultaneous positive and negative 24-hour changes across exchanges are almost always manipulated.” BLOCK fits that description perfectly. The SEC is watching tokens like this. One day, exchanges will delist it. When that happens, your BLOCK tokens will be worth nothing.

Can You Still Trade BLOCK?

Technically, yes. A few small exchanges still list it. But trading it is like trying to sell a used car with no title. You might find someone willing to buy it - for a fraction of what you paid. But you won’t get your money back. You won’t get liquidity. You won’t get help.

If you already hold BLOCK, don’t panic. But don’t add more. If you’re thinking of buying, walk away. There’s no future here. No team. No product. No community. Just a website, a staking page, and a price chart that doesn’t reflect reality.

What Should You Do Instead?

If you want a fast, low-fee blockchain with real adoption, look at Polygon, Arbitrum, or Solana. They have developers, apps, liquidity, and public track records. They’re not perfect, but they’re real.

BLOCK is not a crypto project. It’s a gamble. And the odds are stacked against you.

Is BLOCK (bl0ck.gg) a scam?

BLOCK exhibits multiple red flags of a scam: extreme price discrepancies across exchanges, zero developer activity, no verifiable team, manipulated historical price data, and near-zero trading volume. While not officially labeled a scam by regulators, its structure matches known pump-and-dump schemes. Independent analysts and scam databases list it as high-risk with active fraud reports.

Can I make money staking BLOCK tokens?

You might earn staking rewards on BLOCKSWAP, but you won’t be able to cash out. The token has almost no liquidity - meaning if you try to sell, your order will crush the price. Even if you earn 25% APY, your tokens will likely become worthless if the project collapses or is delisted. The reward is meaningless without an exit.

Why is BLOCK’s price so different on each exchange?

This happens because BLOCK has almost no real trading activity. A few large holders can move the price with small orders, and exchanges don’t have enough buy/sell orders to stabilize the price. Some exchanges may even be listing fake data. This is a classic sign of market manipulation, not a healthy market.

Does BLOCK have a whitepaper or roadmap?

No. There is no official whitepaper, no technical documentation, and no published roadmap. The entire project exists on a single webpage (bl0ck.gg) with no links to GitHub, team bios, or development updates. This is extremely unusual for any blockchain project, even new ones.

Is BLOCK listed on major exchanges like Binance or Coinbase?

BLOCK appears on Coinbase and Binance, but not as a tradable asset. Coinbase lists it with a market cap of $0 and circulating supply of 0. Binance marks it as “Not listed.” This means these platforms don’t consider it a functional token - they’re just displaying price data from smaller, less regulated exchanges.

What should I do if I already own BLOCK tokens?

Don’t add more. Don’t stake more. If you can sell even a small amount at a loss, do it - you’re unlikely to get a better chance later. Store your tokens securely, but don’t expect them to recover. Monitor for exchange delistings, which could lock your tokens forever. Treat them as a total loss and move on.

Taylor Mills

January 25 2026BLOCK is a joke. 0.014 on Coincarp? Bro that's not volatility that's a scam. Don't even touch it.

Arielle Hernandez

January 26 2026The price discrepancies across exchanges are a textbook red flag. When Coinbase lists a token at $0.35 and Binance at $0.14 with no legitimate liquidity, it's not a market-it's a controlled environment designed to lure retail investors. The absence of verifiable developers, a whitepaper, or any real ecosystem confirms this is a speculative shell game, not a blockchain project. I've reviewed dozens of crypto projects, and this one checks every box for a pump-and-dump scheme.

Ryan Depew

January 26 2026I saw someone on Reddit staking 10M BLOCK and saying they made 25% APY. Bro, you're not earning money-you're just holding a balloon that's gonna pop. No one's buying. No one's trading. You're just a bigger sucker holding the bag when the lights go out.

Mike Stay

January 27 2026The lack of developer activity on GitHub is the most damning evidence. Three repositories-one a logo, one a README, and the third a copy-pasted Ethereum template with no commits since 2023? That’s not a blockchain. That’s a PowerPoint deck with a staking calculator attached. Real innovation doesn’t hide behind a glossy landing page and fake APY numbers. If you're investing in this, you're not betting on technology-you're betting on gullibility.

HARSHA NAVALKAR

January 28 2026I thought I was smart to get in early. Now I see I was just the first one to jump off the cliff. I staked 500k BLOCK. Got my rewards. Tried to sell. No buyers. Price crashed 90% in two days. Now I just sit here watching numbers that mean nothing.

Mathew Finch

January 28 2026You people are so naive. This isn’t a crypto project-it’s a psychological experiment. They know exactly how to trigger FOMO with fake charts, fake volume, and fake futures. The fact that price trackers show an all-time high in June 2025-when it’s currently January 2026-isn’t a glitch. It’s a deliberate lie. Someone is manually editing databases to create false momentum. That’s not incompetence. That’s criminal.

Jessica Boling

January 30 2026So BLOCK has a 25% APY... but no one can sell? Sounds like a pyramid scheme with better UI. I mean, congrats on the fancy website. Now go find a job that doesn't require you to lie to people to make money.

Tammy Goodwin

January 31 2026I used to think crypto was about decentralization. Then I saw this. It’s just another Wall Street trick with a blockchain label. No team. No code. No future. Just a website that looks like it was made in Canva by someone who watched one YouTube video about Ethereum.

Shamari Harrison

February 1 2026If you're holding BLOCK right now, don't panic-but don't double down either. Treat it like a bad credit card debt. Don't add to it. Don't ignore it. And if you can get even 10% of your money back, take it. This isn't an investment. It's a time bomb with a staking button.

Julene Soria Marqués

February 1 2026I checked the Telegram group. 500 members. Half are bots. The other half are just posting ‘HODL’ and ‘25% APY’ over and over. No one’s asking questions. No one’s challenging anything. It’s like a cult meeting where everyone’s afraid to say the emperor has no clothes.

Bonnie Sands

February 2 2026I’ve been tracking this since 2023. I know who’s behind it. It’s the same group that ran the ‘CryptoLotto’ scam last year. They just changed the name and the logo. They’re using the same wallet addresses. The same fake volume patterns. The same fake Reddit posts. This isn’t coincidence. It’s a repeat offense. The SEC is already compiling evidence.

MOHAN KUMAR

February 3 2026BLOCK? No team. No code. No future. Just fake numbers. People still buy this? I don't understand. In India we call this 'jugaad'-but this is just cheating.