When your salary buys less than a loaf of bread by the time you get paid, money doesn’t just lose value-it disappears. That’s the reality for millions of Venezuelans. The bolívar has collapsed so badly that prices change by the hour. People don’t wait for paychecks to stretch-they switch to something that doesn’t vanish overnight: cryptocurrency.

Why Crypto Isn’t Optional Anymore

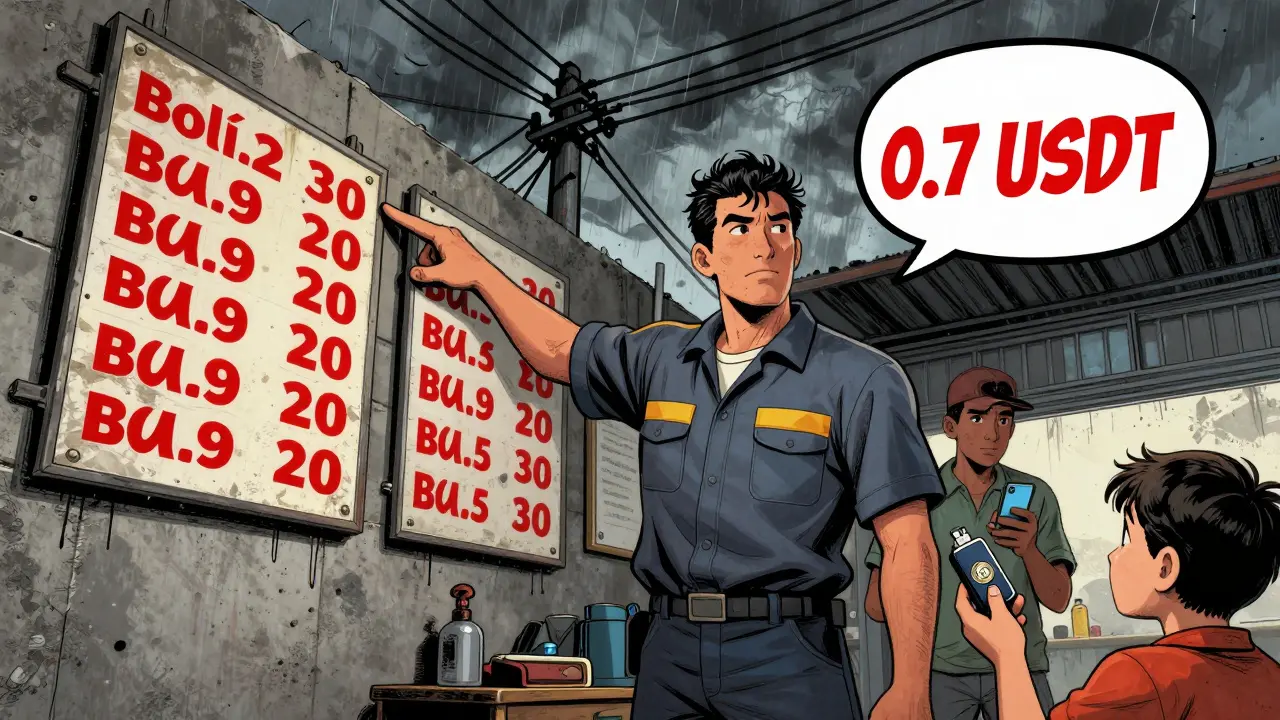

In 2025, Venezuela’s inflation hit 229% annually. That means if you earned 1 million bolívares in January, by June, that same amount could barely cover half your groceries. The currency isn’t just unstable-it’s broken. The Central Bank’s official exchange rate is meaningless. The black market rate is unreliable. What’s left? A third system: the USDT rate. USDT, or Tether, is a stablecoin pegged to the U.S. dollar. It doesn’t swing wildly like Bitcoin. It holds value. In Caracas, people don’t say "I paid in dollars" anymore. They say, "I paid in Binance dollars." That’s what locals call USDT because Binance is where most people buy and sell it. Street vendors, pharmacies, even universities now list prices in USDT. A coffee might cost 0.5 USDT. Rent? 200 USDT. No bolívares needed.How People Actually Use It Every Day

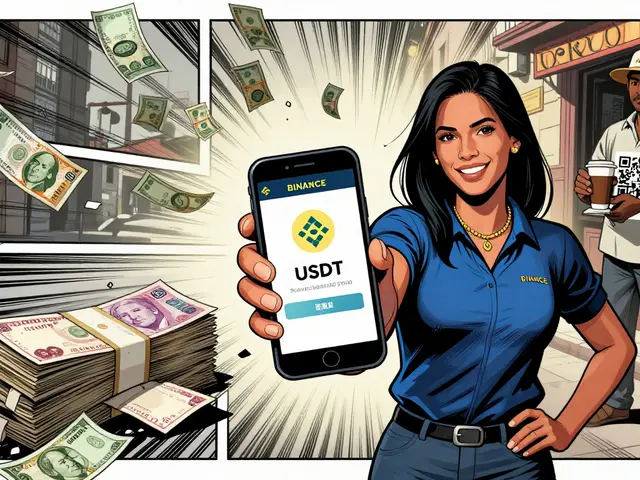

You won’t find Venezuelans mining Bitcoin for profit. They’re not speculating. They’re surviving. A teacher might get paid in bolívares on Friday. By Monday, those bolívares have lost 15% of their value. So they head to a peer-to-peer exchange-usually Binance or LocalBitcoins-on their phone, sell the bolívares for USDT, and keep it there. When they need to buy food, they send USDT to the vendor’s wallet. The vendor instantly converts it to cash through a local agent or keeps it for their own needs. Remittances from family abroad have become lifelines. In 2023, $5.4 billion flowed into Venezuela from overseas. About 9% of that came through crypto. Instead of waiting weeks for Western Union to clear (and paying high fees), someone in Miami sends $100 in USDT. The recipient gets it in minutes, converts it to cash locally, and buys what they need. No bank. No bureaucracy. No delays. Even small businesses have adapted. A mechanic might display two prices: one in bolívares (which no one pays), and one in USDT (what everyone actually pays). A phone repair might cost 50,000 bolívares-or 0.7 USDT. The USDT price stays steady. The bolívar price? It’s just a formality.The Tools They Use-And How They Learn

Most Venezuelans don’t have desktop computers. They use smartphones. That’s why mobile apps like Binance, Paxful, and LocalBitcoins dominate. You don’t need to understand blockchain. You just need to know how to scan a QR code, send a few taps, and confirm a transaction. Learning happens through word of mouth. A neighbor shows you how to buy USDT with cash. A WhatsApp group shares tips on avoiding scams. A Facebook page posts daily USDT exchange rates. There’s no formal training. No university course. Just real people teaching real people how to stay afloat. Internet access isn’t perfect. Power outages happen. But people adapt. They use mobile data, Wi-Fi hotspots, or even charge phones at gas stations during outages. Many keep backup wallets on cheap Android phones. Some use prepaid cards to convert crypto to cash without a bank account.

What About the Government?

The Venezuelan government tried to create its own crypto-the Petro-in 2018. It was supposed to be backed by oil. No one trusted it. By 2024, the Petro was dead. No one used it. Not even the state. Now, the government walks a tightrope. On one hand, it cracks down on mining operations, claiming they waste electricity. On the other, it quietly allows Binance and other platforms to operate because the economy can’t function without them. It doesn’t legalize crypto. It doesn’t ban it. It just looks away. Sanctions from the U.S. make things harder. Banks won’t touch Venezuelan accounts. International payment processors shut down. But crypto? It doesn’t care about borders or sanctions. It runs on a network no single government can control.It’s Not Perfect-But It Works

There are risks. Scammers target newcomers. Some people lose access to their wallets by forgetting passwords. Others get robbed during cash meetups. But compared to losing half your money between breakfast and lunch? The risks feel manageable. A Caracas resident named Carlos put it simply: "I don’t use crypto because I think it’s the future. I use it because the bolívar is the past. I need to feed my kids today. USDT lets me do that." That’s the truth. This isn’t about financial innovation. It’s about basic survival.

Bianca Martins

January 4 2026I live in the US and still can't believe this is real. People are just... using crypto like it's cash. No banks, no middlemen, no waiting. It's wild. 🤯

alvin mislang

January 5 2026This is why crypto is dangerous. People aren't learning responsibility, they're just escaping reality. The government should step in and fix this properly, not let people gamble with their survival. 🤦♂️

Monty Burn

January 6 2026The bolivar is dead long live the blockchain no one asked for a revolution but here we are the system failed so people built something better not because they wanted to but because they had to

Kenneth Mclaren

January 7 2026Wait wait wait. This is all a CIA psyop. USDT is controlled by the Fed. They let Venezuela use it so they can track everyone. The Petro was the real solution but they sabotaged it. Now they're using this to gather biometric data through QR codes. I'm not even kidding. I've seen the documents. 🕵️♂️

Vernon Hughes

January 7 2026What strikes me most is how organic this is. No central authority. No white papers. Just neighbors teaching neighbors how to send money with a phone. This isn't finance. This is human resilience in its purest form.

Alison Hall

January 9 2026This gives me chills. So many people just trying to feed their families. Crypto isn't a trend here-it's a lifeline. 💪

Brandon Woodard

January 9 2026One must observe with solemn gravity that the institutional collapse of sovereign currency has precipitated an emergent decentralized economic substrate. The agency demonstrated by these individuals is not merely adaptive-it is profoundly dignified.

prashant choudhari

January 10 2026This is the future of finance in developing economies. No banks needed. No corruption. Just peer to peer trust. Venezuela is ahead of the curve. We should be learning from them, not judging.

Gavin Hill

January 11 2026They didn't choose crypto because it was cool they chose it because everything else burned down and now they're walking through the ashes with a flashlight made of blockchain

SUMIT RAI

January 13 2026LMAO so now crypto is the new socialism? 😂 next they'll say Bitcoin is a human right. The US will ban this next. They hate when people escape their system. 🤡

surendra meena

January 13 2026This is NOT sustainable!!! Someone is going to get ROBBED!!! The government WILL crack down!!! And then what?!?!?! People will be left with NOTHING!!! This is a TERRIBLE idea!!!

rachael deal

January 13 2026I'm so inspired by how people are helping each other out. WhatsApp groups, QR codes, cash meetups-it's like a digital neighborhood watch for survival. We need more of this.

Elisabeth Rigo Andrews

January 15 2026The structural arbitrage between hyperinflationary fiat and algorithmic stability is a textbook case of emergent monetary substitution. USDT's peg to USD provides a non-sovereign unit of account that bypasses capital controls and sanctions architecture. It's not adoption-it's systemic reversion.

Andrew Prince

January 15 2026Let me be clear: this is not innovation. This is desperation dressed up as tech. People are not "building a parallel economy." They are being forced into a gray market because their government failed. And now you want to celebrate it? This is the same logic that led to the collapse of the Weimar Republic. And you think this is sustainable? Wake up.

Alex Strachan

January 16 2026Imagine being so broke you have to turn your phone into a bank. 🥲 But hey, at least they're not giving up. Props to the people turning QR codes into meals. 🙌

Daniel Verreault

January 17 2026The fact that this is happening without regulation, without infrastructure, without funding is proof that human ingenuity outpaces bureaucracy every time. This isn't crypto-it's civil society rebuilding itself in real time.

Shawn Roberts

January 18 2026I used to think crypto was for investors. Now I see it's for people who just need to eat. That's the real MVP.

Abhisekh Chakraborty

January 19 2026This is why I hate when people say crypto is useless. Look at this. Look at what people are doing. You think your 401k is safe? Try living in a country where your salary is worth less than your bus ticket. Then talk to me.