Blockchain is often sold as a perfect, unchangeable ledger - once data is written, it can never be erased. But that’s not the full story. In reality, immutability in blockchain systems creates more problems than it solves in many real-world applications. It sounds like a feature, but for businesses, regulators, and everyday users, it’s often a bottleneck - and sometimes a disaster waiting to happen.

Immutability Isn’t Absolute - It’s Probabilistic

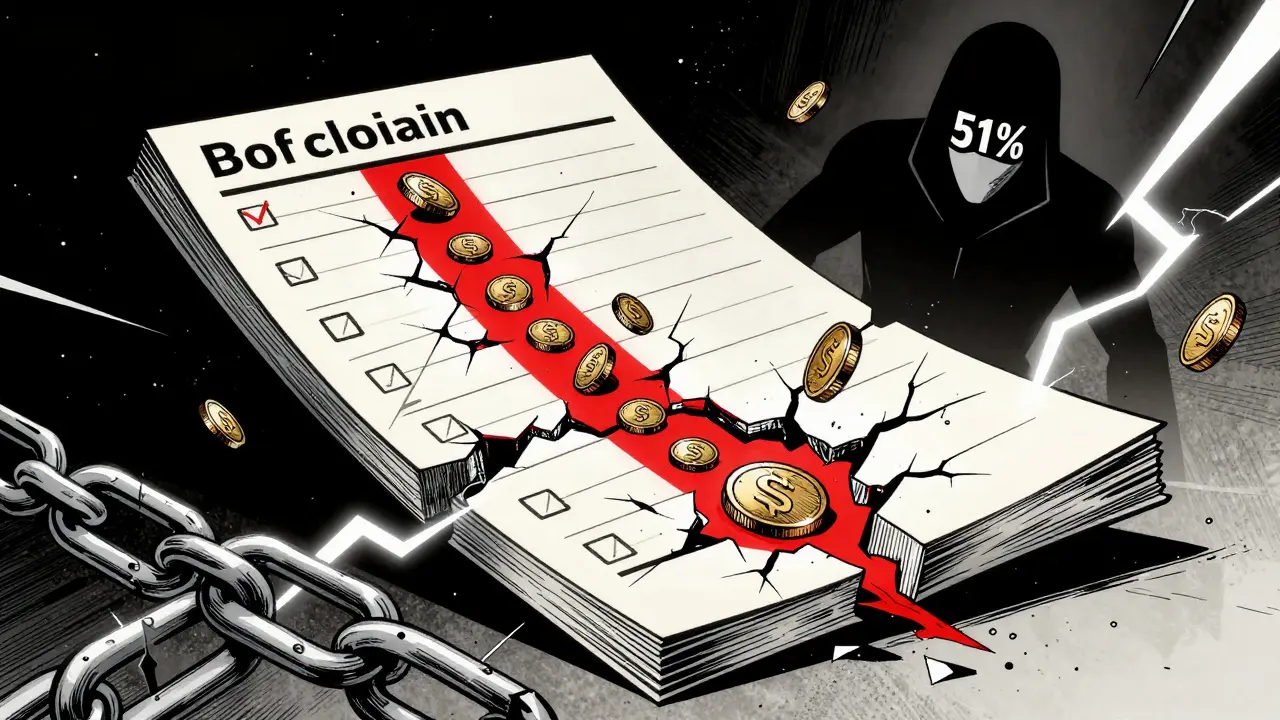

People think Bitcoin’s blockchain is untouchable. But that’s only true if no one has enough power to break it. In January 2019, the Ethereum Classic network got hit by a 51% attack. Attackers controlled more than half the mining power for over 12 hours. They reversed transactions, double-spent 219,500 ETC, and walked away with $1.1 million. This wasn’t a glitch. It was a direct proof that immutability depends on economic security - not magic. The same thing could happen to Bitcoin. If someone poured enough money into mining hardware, they could rewrite recent blocks. It’s expensive, sure - but not impossible. Immutability isn’t a law of physics. It’s a bet that no one will ever spend more than the value of the chain itself to break it. When that bet fails, the ledger breaks.GDPR and the Right to Be Forgotten

The European Union’s GDPR law says you have the right to delete your personal data. That’s simple. But what if that data is stored on a blockchain? You can’t delete it. You can’t edit it. You can’t even hide it. Once your name, email, or ID number is on-chain, it’s there forever. In 2023, a European healthcare provider got fined €500,000 for storing patient records on an immutable blockchain. They thought hashing the data was enough - but GDPR doesn’t care about hashes. If the original data can be linked back to a person, it’s still personal data. And under GDPR, that data must be erased on request. No exceptions. Companies like IBM and R3 Corda solved this by storing data off-chain. Only a cryptographic hash goes on the blockchain. The real data lives in secure, editable databases. That way, when someone asks for deletion, they delete the off-chain copy. The hash stays - but it’s useless without the data it points to.Smart Contract Bugs Can’t Be Fixed

Imagine writing a code that sends money to someone. You type the wrong address. One letter off. You send $4,200 - and it’s gone forever. No customer service. No undo button. No refund. That’s not hypothetical. On Reddit, a developer named u/CryptoEngineer lost 2.3 ETH because of a typo. On GitHub, over 200 users reported similar errors in Ethereum clients. DeFi projects lose millions every year because of bugs that can’t be patched. The code runs. The transaction executes. And that’s it. Some teams try to work around this with upgradeable smart contracts - proxy patterns that let developers swap out the logic. But here’s the catch: if you can change the contract, is it really immutable? And if you can change it, who controls that power? Centralization kills the trust blockchain is supposed to provide.

Scalability Makes Immutability Weaker

Bitcoin processes 7 transactions per second. Visa handles 24,000. That’s not a gap - it’s a canyon. When networks get crowded, transaction fees spike. Miners prioritize high-fee transactions. And when miners are incentivized to reorder or delay transactions, the chain becomes vulnerable. The more congested the network, the longer it takes for a transaction to get confirmed. Bitcoin requires 6 confirmations - about an hour - to feel safe. Ethereum’s PoS needs 64 epochs - roughly 13 minutes. But even that’s not foolproof. If a powerful actor controls enough hashing power or staked ETH, they can still reverse recent blocks. And then there’s storage. The Bitcoin blockchain is over 473 GB. That’s not just a number. It means your laptop can’t run a full node unless you have serious storage and bandwidth. Fewer full nodes = less decentralization = weaker immutability. It’s a feedback loop: as the chain grows, fewer people can verify it - and that makes it easier to attack.Energy Use and Environmental Cost

Bitcoin uses more electricity every year than Norway. That’s 121.49 TWh, according to the Cambridge Bitcoin Electricity Consumption Index. Why? Because Proof-of-Work needs massive computing power to solve cryptographic puzzles. That’s the price of immutability. Ethereum switched to Proof-of-Stake in 2022 and cut its energy use by 99.95%. But even then, the trade-off remains: strong immutability demands resources. And those resources aren’t free. They’re paid in electricity, hardware, and environmental cost. For many industries - healthcare, finance, logistics - that’s a non-starter.Enterprise Blockchains Are Already Changing

Public blockchains like Bitcoin and Ethereum cling to strict immutability. But enterprises? They don’t have that luxury. Hyperledger Fabric, used by 30% of Fortune 500 companies, lets admins delete or edit data. R3 Corda uses notaries to approve or reject transaction changes. Energy Web Chain lets members vote to correct records. These aren’t hacks - they’re design choices. Gartner reported in 2023 that 58.7% of enterprise blockchain implementations now include some form of mutability. Why? Because businesses need to comply with laws, fix mistakes, and adapt. Immutability sounds great on a whitepaper. In real life, it’s a liability.

What’s the Future?

The blockchain world is starting to admit the truth: absolute immutability doesn’t work. The World Economic Forum said it best in 2023: "The future of blockchain lies not in absolute immutability but in context-appropriate verifiability." That means:- Public chains like Bitcoin will keep strict immutability - but only for transactions, not for all data.

- Enterprise chains will build in correction mechanisms - through voting, governance, or off-chain storage.

- Zero-knowledge proofs and off-chain data storage will become standard for privacy-sensitive uses.

- Regulators will force changes. The EU’s 2023 Digital Finance Package already says blockchain solutions must allow data deletion.

Real Solutions Being Used Today

Here’s what actually works:- Off-chain storage: Store data in a secure database. Put only a hash on-chain. If data needs to be deleted, delete the off-chain copy. The hash stays - but it’s meaningless.

- Proxy contracts: Use upgradeable smart contracts with a central admin. Accept the trade-off: you gain flexibility, lose decentralization.

- Permissioned chains: Use consortium blockchains where a group of trusted parties can vote to correct errors.

- Zero-knowledge proofs: Prove data is valid without revealing it. This lets you verify compliance without storing sensitive info on-chain.

What You Should Do

If you’re building on blockchain:- Don’t assume immutability is a feature. Treat it like a constraint.

- Ask: "What happens if we make a mistake? Can we fix it?" If the answer is no, rethink your design.

- Never store personal data on-chain. Use hashes and off-chain storage.

- For enterprise use, pick a platform that allows controlled mutability - don’t force public blockchain into a private-world problem.

- Expect regulators to demand deletion rights. Design for it now.

Immutability was a brilliant idea in 2008. But we’re not living in 2008 anymore. The world has laws, mistakes, and real people who need to be protected - not just secured.

Can blockchain data ever be deleted?

Technically, no - not on public blockchains like Bitcoin or Ethereum. Once a transaction is confirmed, it’s permanently recorded. But in practice, yes - if you store data off-chain and only keep a hash on the blockchain. Deleting the off-chain data renders the on-chain hash useless. Many enterprises use this method to comply with GDPR and other privacy laws.

Why do smart contract bugs cause so much damage?

Because blockchain code runs exactly as written - with no human override. If a bug lets someone drain funds, or a typo sends money to the wrong address, there’s no way to reverse it. Unlike traditional banking, where a customer service rep can intervene, blockchain has no central authority. This makes smart contract development incredibly high-stakes.

Is Ethereum’s immutability stronger than Bitcoin’s?

No - both are vulnerable to 51% attacks. Bitcoin uses Proof-of-Work, Ethereum uses Proof-of-Stake, but both rely on economic security. Ethereum’s switch to PoS made attacks harder because attackers need to buy and lock up ETH, not just spend on mining hardware. But if someone owned enough ETH, they could still manipulate the chain. Immutability is never guaranteed - only probabilistic.

How do enterprises handle GDPR compliance on blockchain?

They avoid storing personal data on-chain. Instead, they store hashes of data on the blockchain and keep the real data in private, editable databases. When a user requests deletion, the off-chain data is erased. The hash remains, but it’s just a random string - no longer linked to personal information. This approach is used by IBM, R3 Corda, and major banks.

Will blockchain ever become fully mutable?

Not in public, permissionless chains like Bitcoin. Those rely on immutability for trust. But enterprise and consortium blockchains are already moving toward controlled mutability. By 2025, 75% of enterprise implementations are expected to include mechanisms for data correction - through governance votes, off-chain storage, or admin overrides. Immutability isn’t disappearing - it’s being tailored to fit real-world needs.