Energy Crisis Crypto: How Blockchain and Crypto Are Responding to Global Power Shortages

When we talk about energy crisis crypto, the intersection of global power shortages and cryptocurrency operations, we’re not just talking about Bitcoin miners in Texas. We’re talking about how entire networks are being forced to adapt—some by cutting power use, others by turning waste energy into profit. The truth? Crypto isn’t the villain here—it’s becoming part of the solution. Many crypto projects now rely on stranded, flared, or otherwise unused energy sources, like methane from landfills or excess solar power that would otherwise go to waste. This isn’t theory; it’s happening right now in places like Texas, Kazakhstan, and even remote parts of Canada.

Behind every coin mined or transaction processed is real electricity. And as countries face rolling blackouts and soaring energy bills, the blockchain energy use, the amount of power consumed by decentralized networks for consensus and validation is under scrutiny. But here’s what most people miss: not all blockchains are equal. Bitcoin uses proof-of-work, which is power-heavy, but newer chains like Ethereum (post-merge) use proof-of-stake and cut energy use by over 99%. That shift alone changed the game. Even mining operations are evolving—some now run on solar during the day and shut down at night, syncing with grid demand. Others partner with power plants to use off-peak electricity, helping stabilize the grid instead of straining it.

Then there’s the rise of sustainable crypto, crypto projects designed to minimize environmental impact through energy-efficient tech and renewable sourcing. Tokens like those tied to carbon credits or renewable energy certificates are no longer niche. They’re gaining traction as investors demand accountability. Even exchanges are starting to report their energy footprints. This isn’t greenwashing—it’s necessity. When governments start taxing crypto based on energy use, only the leanest projects will survive. The crypto mining power, the electricity consumed by hardware dedicated to validating blockchain transactions debate isn’t going away. But the conversation is shifting from blame to innovation. Below, you’ll find real examples of how crypto is adapting: from stablecoins powered by zero-emission data centers to exchanges running on hydroelectric power. These aren’t future ideas. They’re live projects changing how crypto interacts with the world’s energy grid.

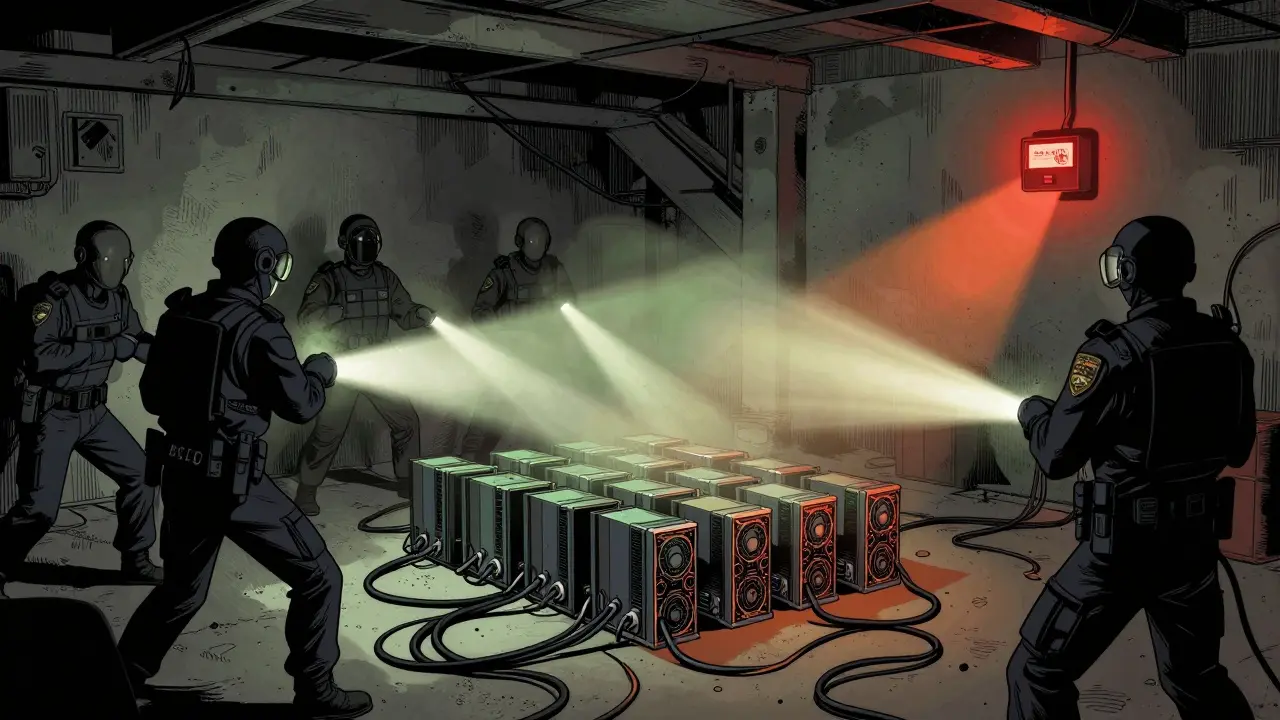

Kosovo banned crypto mining in 2022 to stop energy blackouts. By 2025, mining is allowed only with private power sources. Here's how the ban changed the country and what it means for miners today.