Yield-Bearing Stablecoin: How These Crypto Assets Pay You While Staying Stable

When you think of stablecoins, you probably think of USDT, a digital dollar pegged to the U.S. dollar and used for trading or storing value without crypto’s wild swings. But there’s a smarter version now—yield-bearing stablecoin, a stablecoin that pays you interest just for holding it. Also known as earnable stablecoin, it’s not just a store of value—it’s a tool that works for you while you sleep.

These coins keep their $1 value like traditional stablecoins, but they’re built into DeFi protocols that lend them out, stake them, or use them in liquidity pools. Every day, you earn a little more—often 3% to 10% APY—without touching your balance. It’s like a savings account, but you control the keys. And unlike bank accounts, you don’t need to trust a middleman. The rules are written in code, on blockchains like Ethereum, Base, or Polygon. You don’t need to be a trader to use them. Just hold. Earn. Repeat.

What makes them different? Regular stablecoins like USDC or DAI are just digital cash. Yield-bearing ones like aUSDC, a version of USDC that earns interest through Aave’s lending protocol, or frxETH, a liquid staking token that turns ETH into a yield-generating stable asset, are engineered to generate returns. They’re not magic—they’re math. And they’re growing fast. In 2024, over $40 billion in stablecoin deposits were earning yield across DeFi. That’s not speculation. That’s real income.

Some of these coins are backed by real assets—like U.S. Treasuries or money market funds. Others rely on algorithmic mechanisms that adjust supply to keep value steady while feeding rewards. You’ll find them on platforms like Aave, Compound, or Curve. You can swap them, send them, or use them as collateral—all while your balance grows. And because they’re stable, you don’t have to panic when the market drops. You just keep earning.

But not all yield-bearing stablecoins are safe. Some rely on risky pools or untested smart contracts. Others are fake—marketing gimmicks that vanish when the hype fades. That’s why you need to know what’s behind the numbers. Is the yield coming from real lending? Or from token inflation? Is the issuer audited? Is the protocol open-source? These aren’t just technical questions—they’re your money on the line.

Below, you’ll find real reviews, deep dives, and warnings about platforms and tokens that offer yield. Some are legitimate tools that millions use daily. Others are traps dressed up as opportunities. You’ll see how people earned passive income with stablecoins, how exchanges integrate them, and how scams try to copy their names. No fluff. No hype. Just what works, what doesn’t, and what you need to watch out for in 2025.

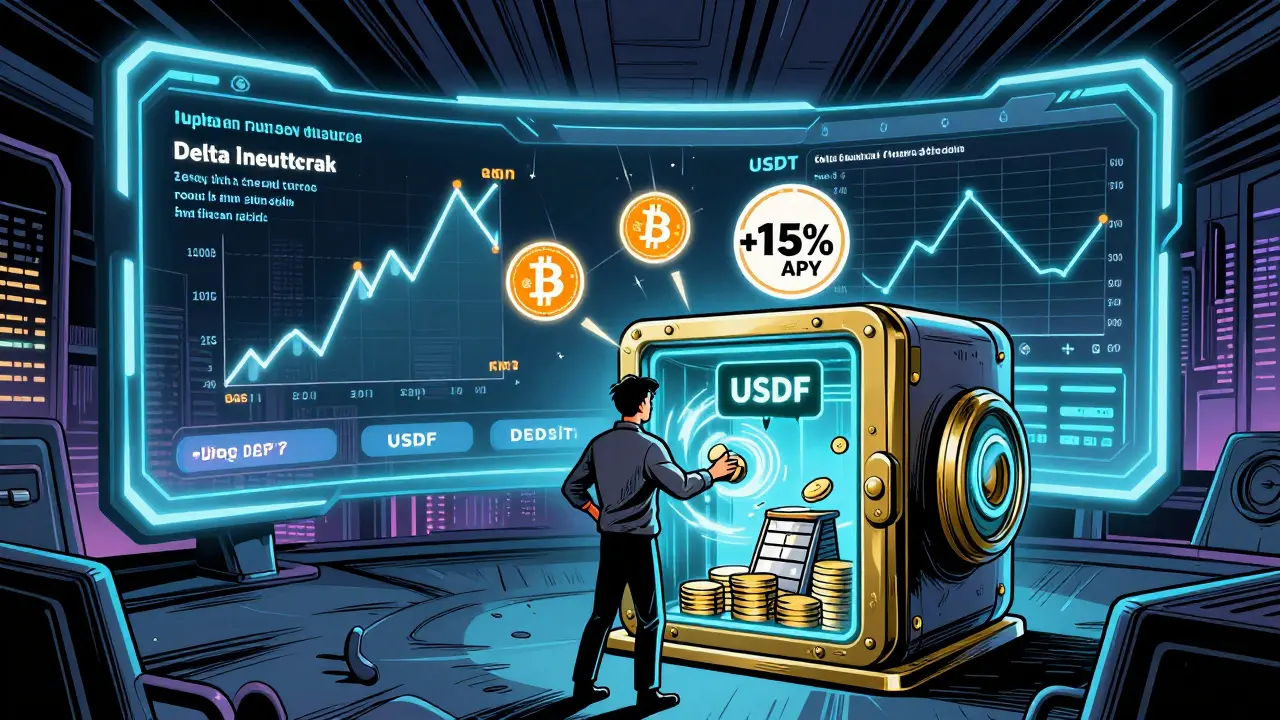

Aster USDF is a yield-bearing stablecoin pegged to USDT that earns passive income through delta-neutral futures strategies. Unlike traditional stablecoins, it turns idle capital into active DeFi leverage with up to 15% APY.