USDF Crypto: What It Is, Where It’s Used, and What You Need to Know

When you hear USDF crypto, a stablecoin pegged to the US dollar to reduce volatility in crypto trading. Also known as USDF token, it’s built to give traders a safe harbor during market swings—without leaving the blockchain ecosystem. Unlike Bitcoin or Ethereum, which swing wildly in price, USDF stays steady. That’s the whole point. You buy it to hold value, not to gamble. And while it’s not as famous as USDT or USDC, it’s showing up more often on smaller exchanges, especially those focused on niche tokens like BBTC or WBB.

USDF crypto isn’t just a number on a screen—it’s a tool. Traders use it to move in and out of risky meme coins without cashing out to fiat. If you’re trading on a decentralized exchange like BitSwap v3 or BloctoSwap, you might see USDF as a trading pair. It lets you lock in profits or avoid losses when the market turns sour. It’s also used in airdrops and IDOs, like the WagyuSwap or Bit Hotel campaigns, where users need a stable asset to qualify or claim tokens. And because it’s often built on BNB Chain or similar networks, gas fees stay low, making it practical for small trades.

But here’s the catch: USDF isn’t regulated like USDC. There’s no public audit trail you can easily check. That’s why you’ll find it on platforms like Superp or Moonit—places that don’t require KYC and move fast. If you’re using it, you’re trusting the issuer. That’s fine if you’re swapping a few dollars for a meme coin. But if you’re holding large amounts? You need to know who backs it. Some stablecoins fail when their reserves vanish. Others get frozen by regulators. USDF hasn’t had a major incident yet—but it hasn’t been tested under pressure either.

It’s also tied to broader trends in crypto. As countries like South Korea and Dubai tighten rules on crypto exchanges, stablecoins like USDF become even more important. They’re the bridge between regulated fiat and wild crypto markets. And with blockchain patent management and distributed ledger tech evolving, the infrastructure behind stablecoins is getting stronger. But the real question isn’t about the tech—it’s about trust. Who’s issuing USDF? Where are the reserves? Are they real?

Below, you’ll find real reviews and warnings about platforms where USDF is traded. Some are legit. Some are scams. Some are just confusing—like Moonit, which isn’t an exchange at all. We’ve pulled together the facts so you don’t waste time on dead ends or fake platforms. Whether you’re trading on a cross-chain DEX or chasing a BNB Chain airdrop, knowing how USDF works could save you money—and maybe even your crypto.

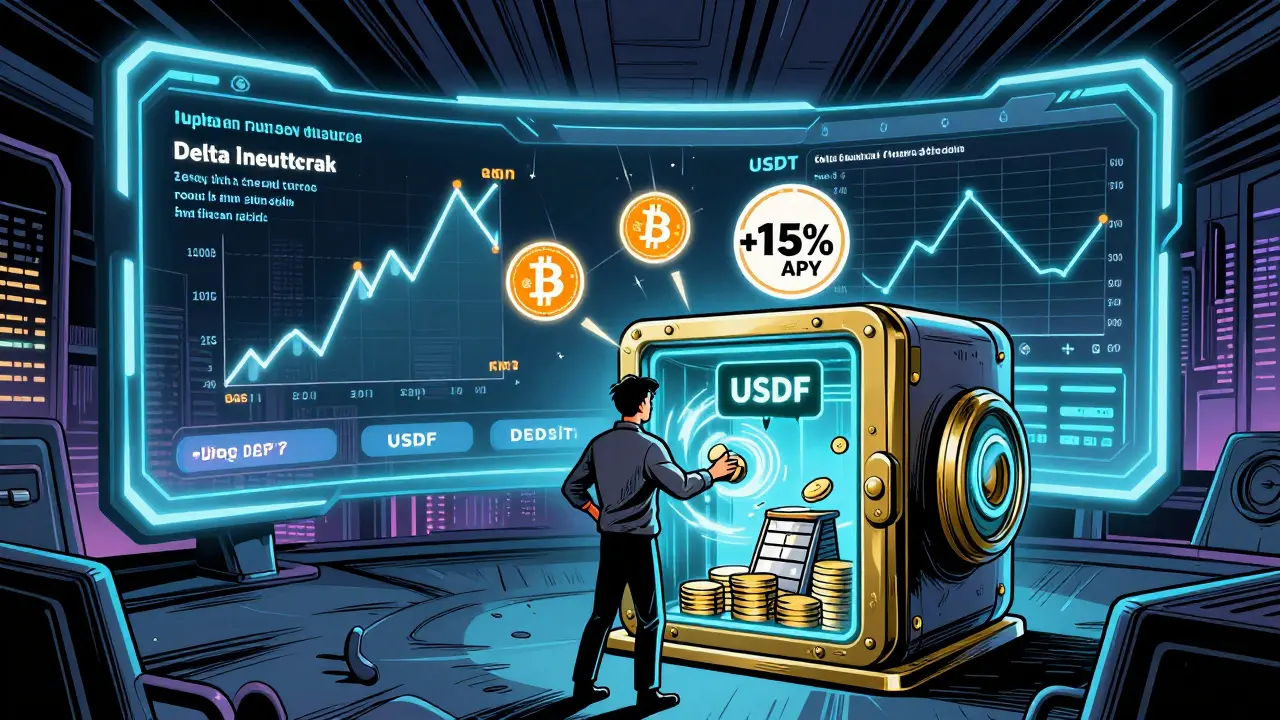

Aster USDF is a yield-bearing stablecoin pegged to USDT that earns passive income through delta-neutral futures strategies. Unlike traditional stablecoins, it turns idle capital into active DeFi leverage with up to 15% APY.