Crypto Trading Taxes: What Every Trader Needs to Know

When dealing with crypto trading taxes, the set of rules that decide how your digital‑asset profits are taxed by authorities. Also known as digital asset tax obligations, it covers everything from short‑term gains to long‑term holdings. Capital gains form the core of this framework: every time you sell, swap, or use crypto to buy goods, a taxable event may trigger. Different countries treat the holding period, asset class, and even the type of transaction uniquely, so you can’t rely on a one‑size‑fits‑all approach. Keeping a detailed ledger of entry price, exit price, and timestamps becomes essential because tax agencies increasingly request proof of cost basis. Ignoring these details can turn a modest profit into a costly audit, and the penalties for under‑reporting have risen sharply in the past two years.

Accurate tax reporting starts with the data you receive from crypto exchanges. Many platforms now generate yearly CSV statements that break down trades, fees, and fiat conversions, making it easier to feed the numbers into your tax software. Choosing the right tax software can automate the calculation of short‑ versus long‑term gains, apply the correct tax rates, and even flag potentially missed events like airdrops or staking rewards. While DIY tools are handy, they often assume default tax rules that may not match your jurisdiction, so a quick review by a tax professional can prevent costly mistakes. Remember, the IRS, HMRC, and other agencies have started issuing guidance specifically for DeFi yields, NFT sales, and cross‑chain swaps, so staying informed about the latest rulings is part of a solid compliance strategy.

Below you’ll find a curated collection of articles that break down each part of the process – from understanding how capital gains are calculated on different blockchains, to step‑by‑step guides for using popular tax software, and tips for managing exchange statements. Whether you’re a casual trader, a heavy‑frequency DeFi player, or someone just getting started with NFTs, the resources here will help you keep your crypto trading taxes under control and avoid surprises at tax time.

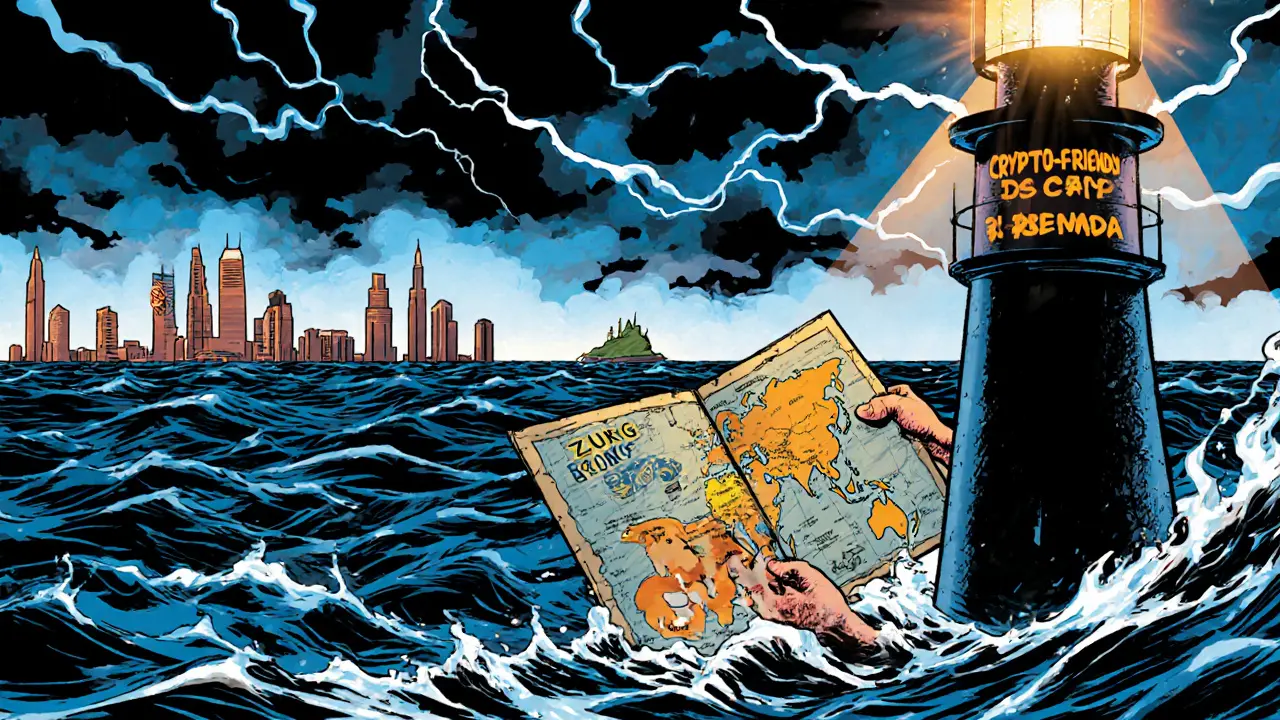

Compare the world's most crypto‑friendly jurisdictions for traders in 2025. Learn about taxes, licensing, banking access, and which country fits your trading style.