Crypto Compliance

When working with Crypto Compliance, the practice of meeting legal and regulatory standards in the cryptocurrency ecosystem. Also known as crypto regulatory compliance, it helps firms avoid fines and protect users.

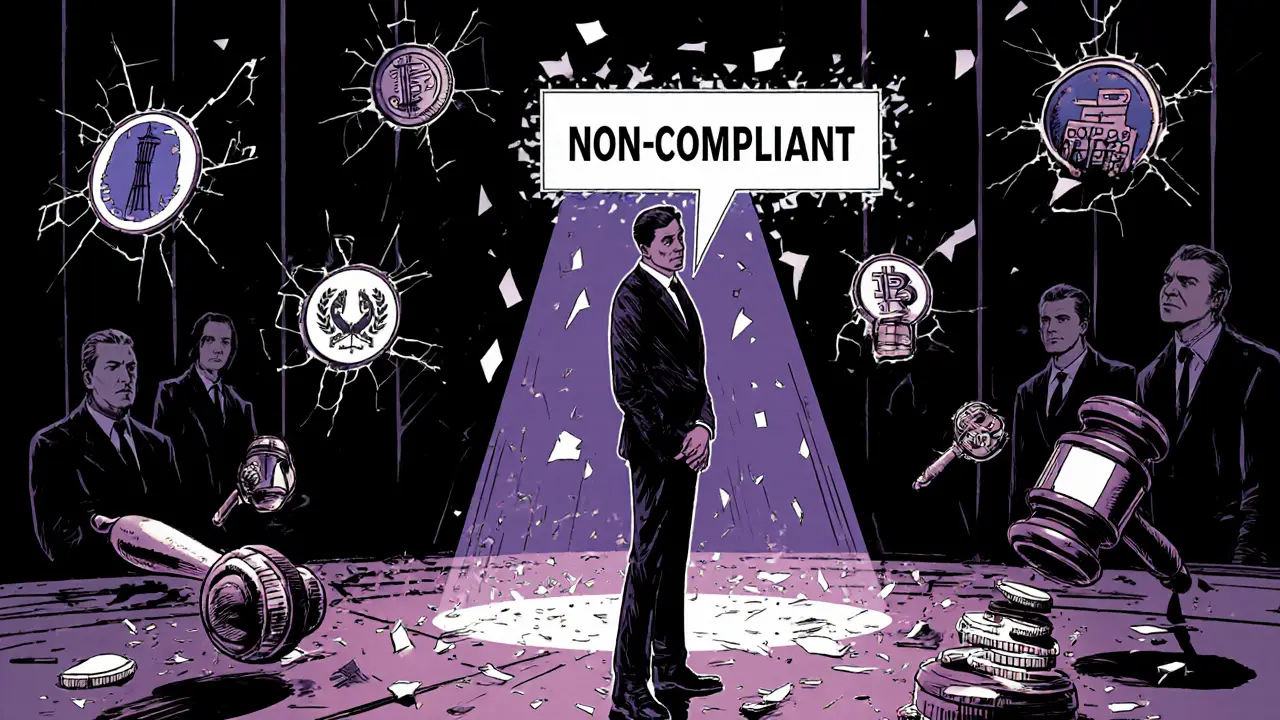

Closely tied to Crypto Regulations, rules set by governments and agencies that govern digital asset activities, AML Compliance, processes to prevent money‑laundering and illicit financing and Exchange Enforcement, government actions that penalize non‑compliant crypto platforms, crypto compliance forms the backbone of a trustworthy market. crypto compliance isn’t just paperwork; it’s a living system that reacts to new threats, like privacy‑coin delistings, and to tech changes, such as self‑sovereign identity solutions.

Why does this matter? Crypto compliance encompasses regulatory monitoring, risk assessment and continuous reporting. It requires AML compliance to scan transactions for suspicious patterns, while crypto regulations dictate the reporting thresholds and licensing needs. When regulators tighten rules, exchange enforcement actions spike, forcing platforms to upgrade KYC flows or face hefty fines. This chain reaction shows how one piece influences the next: stricter regulations → more enforcement → higher compliance standards. At the same time, emerging topics like immutable blockchain records and CBDC policies add layers to the compliance puzzle, pushing firms to adopt new verification tools and audit trails.

What You’ll Explore

Below you’ll find a curated set of articles that break down real‑world cases and practical guides. From the Thodex exit‑scam review that illustrates the fallout of weak compliance, to the 2025 privacy‑coin delisting wave that shows regulator pressure, each piece offers a clear lesson. You’ll also get step‑by‑step airdrop safety tips, deep dives into smart‑contract security, and overviews of tokenized securities that highlight how compliance bridges crypto and traditional finance. Dive in to see how compliance shapes exchange reviews, AML best practices, and the future of digital asset regulation.

The Payment Services Act crypto provisions now require strict licensing, cold storage, Travel Rule compliance, and asset classification. Learn the key rules in Singapore, Japan, Europe, and the U.S. as of 2025.

An in‑depth look at the $15.8B worth of crypto transactions tied to sanctioned entities in 2024, covering data sources, asset breakdown, evasion tactics, enforcement actions and future outlook.