Aster USDF: What It Is, How It Works, and Where to Find Real Airdrops Like It

When you hear Aster USDF, a stablecoin designed to maintain a 1:1 peg with the US dollar on a blockchain network. Also known as USDF, it’s not just another meme coin—it’s meant to hold value, move quickly, and work inside real crypto ecosystems. Unlike coins that vanish after a hype spike, Aster USDF was built to be used—whether for payments, trading, or as a bridge between volatile assets. But here’s the catch: most people don’t know if it’s real, where to get it, or if it’s even worth your time.

Stablecoins like Aster USDF are the backbone of crypto trading. They let you avoid the rollercoaster of Bitcoin or Ethereum without leaving the blockchain. That’s why platforms like BloctoSwap and BitSwap v3 often list them—they’re the default currency for traders who want to hold value while waiting for the next big move. But not all stablecoins are equal. Some are backed by cash reserves. Others rely on algorithmic magic that can break under pressure. Aster USDF claims to be fully collateralized, but you need to check where those dollars are held and who’s auditing them. And if you’re looking for an airdrop, be careful. Projects like DOGGY and WagyuSwap have tricked users into chasing ghosts. Real airdrops—like Bit Hotel’s BTH token or the upcoming ZOO Crypto World drop—don’t ask for your private key. They don’t charge fees. And they’re always announced on official channels, not random Telegram groups.

What you’ll find below isn’t a list of every coin that sounds like Aster USDF. It’s a curated collection of posts that cut through the noise. You’ll read about real crypto exchanges that actually list stablecoins, scams that mimic them, and how blockchain technology makes tokens like USDF possible in the first place. There’s also deep dives into how airdrops work, what makes a token valuable beyond hype, and which regulations in Dubai, South Korea, or Switzerland actually protect you. No fluff. No guesswork. Just what you need to know before you trade, claim, or invest.

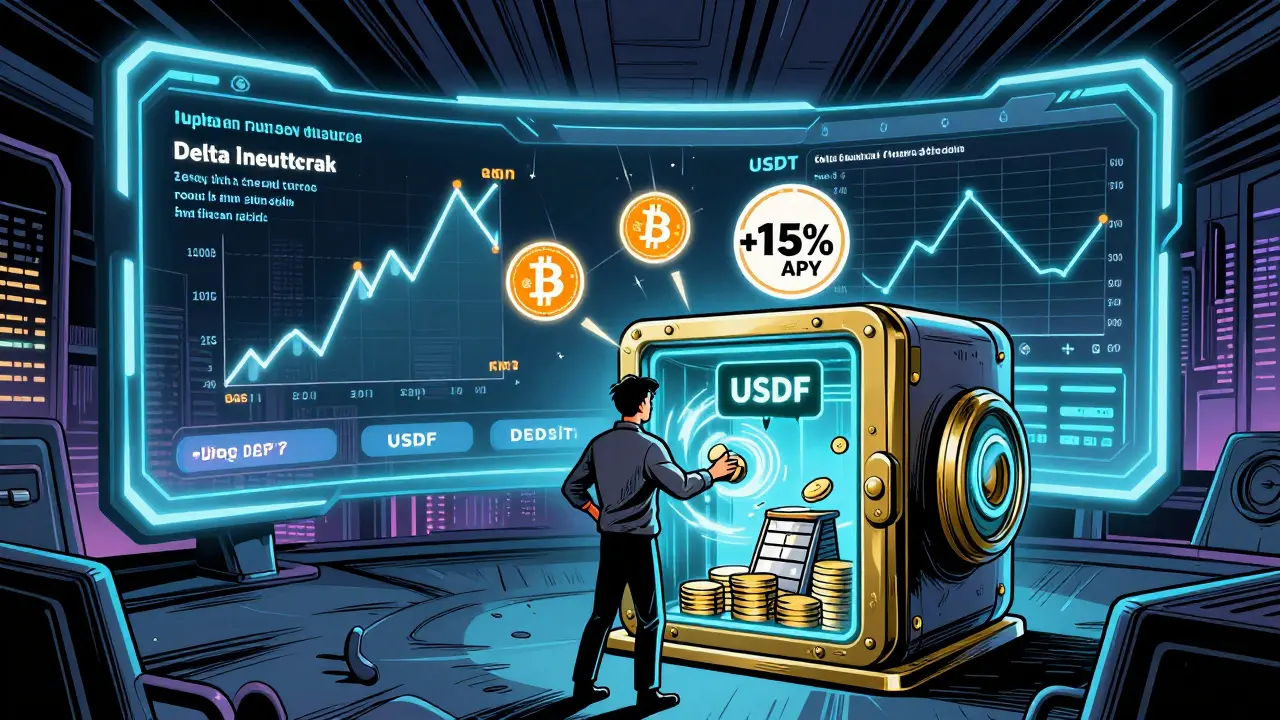

Aster USDF is a yield-bearing stablecoin pegged to USDT that earns passive income through delta-neutral futures strategies. Unlike traditional stablecoins, it turns idle capital into active DeFi leverage with up to 15% APY.