USDF vs USDT: What’s the Real Difference Between These Stablecoins?

When you hear USDT, a stablecoin issued by Tether Limited that’s pegged to the U.S. dollar and used across nearly every crypto exchange. Also known as Tether, it’s the most traded stablecoin in the world, with over $110 billion in circulation as of 2025. Most people assume all dollar-backed tokens are the same. But USDF, a newer USD-pegged stablecoin launched by the FTX-aligned framework, designed to compete with USDT through clearer audits and on-chain transparency is trying to change that. They both promise $1 value, but that’s where the similarity ends. USDT has been around since 2014. It’s on Ethereum, Tron, Solana, and even BNB Chain. You’ll find it on Binance, KuCoin, OKX—you name it. USDF? It’s barely on a handful of smaller DEXs. It doesn’t even have a dedicated wallet app. And while USDT’s reserves have been questioned for years, USDF claims to publish weekly attestations from a major accounting firm. But here’s the catch: no one’s verified those reports independently.

The real difference isn’t in the code—it’s in trust. Tether, the company behind USDT, has faced fines from the CFTC and lawsuits over reserve claims, yet still dominates the market because it’s the default. Traders use it because it’s liquid, fast, and accepted everywhere—even if they don’t fully trust it. USDF, on the other hand, is trying to win trust by being open. It doesn’t have the volume, but it does have public smart contracts, real-time reserve data, and no centralized freeze keys. That’s a big deal if you’ve ever had funds locked on a platform that suddenly turns off withdrawals. But if you’re trading on a major exchange, you won’t even see USDF as an option. Most platforms still list USDT because that’s what users demand. And that’s the problem: liquidity wins over transparency. You can’t swap $10,000 worth of USDF in seconds like you can with USDT. If you’re holding USDF, you’re betting on the future. If you’re holding USDT, you’re betting on the status quo—even if that status quo is shaky.

What you’ll find in the posts below isn’t just a list of articles—it’s a real-world look at how these stablecoins behave in practice. From exchange listings that quietly drop USDF to audits that expose reserve gaps, from users losing funds because they trusted a fake USDT clone to traders who switched to USDF after the FTX collapse. You’ll see how regulatory pressure is changing what’s allowed on exchanges, how blockchain analytics tools track these tokens, and why some people still avoid USDT entirely—even if it means slower trades. There’s no fluff. Just what’s happening now, with real examples and no hype.

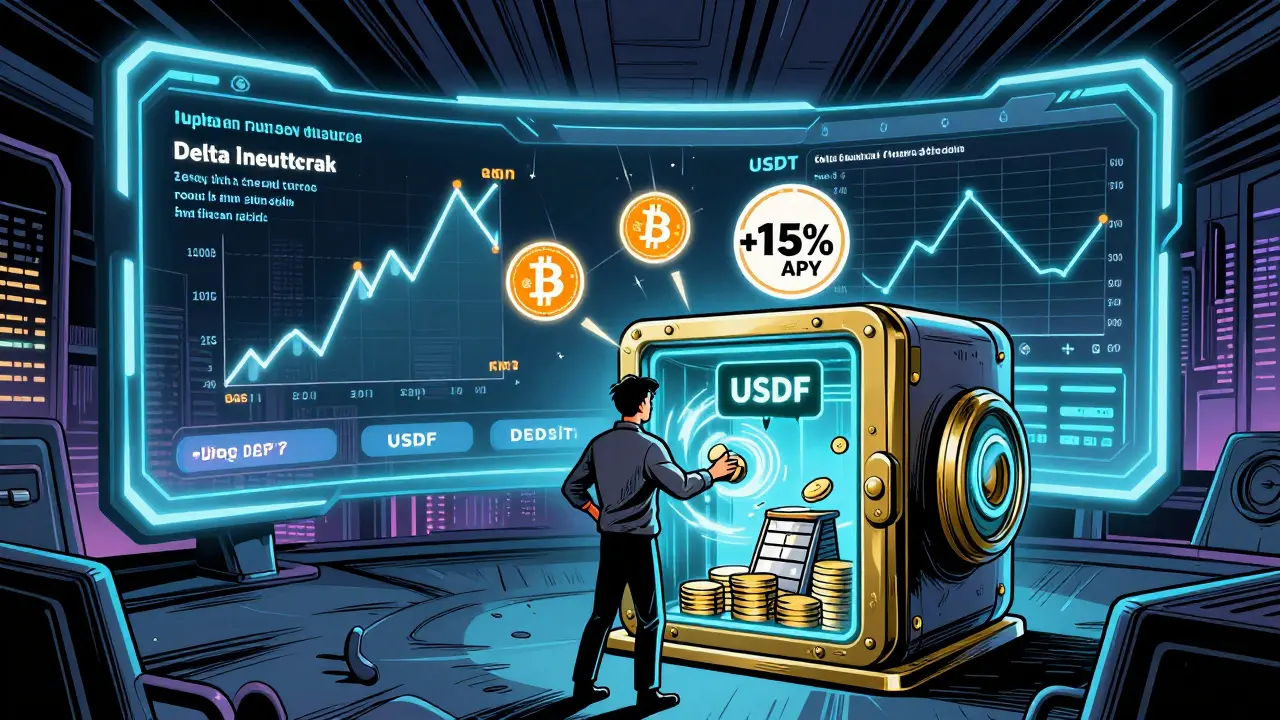

Aster USDF is a yield-bearing stablecoin pegged to USDT that earns passive income through delta-neutral futures strategies. Unlike traditional stablecoins, it turns idle capital into active DeFi leverage with up to 15% APY.