USDF Staking: How It Works, Where to Do It, and What You Need to Know

When you stake USDF, a stablecoin designed to maintain a 1:1 peg with the US dollar. Also known as USDF token, it's built for users who want yield without volatility. Unlike Bitcoin or Ethereum, USDF doesn’t move in price—it’s meant to stay at $1. But that doesn’t mean it’s boring. Staking USDF lets you earn rewards just by holding it, turning idle coins into passive income. This isn’t speculation. It’s basic math: lock your stablecoin, get paid in the same currency.

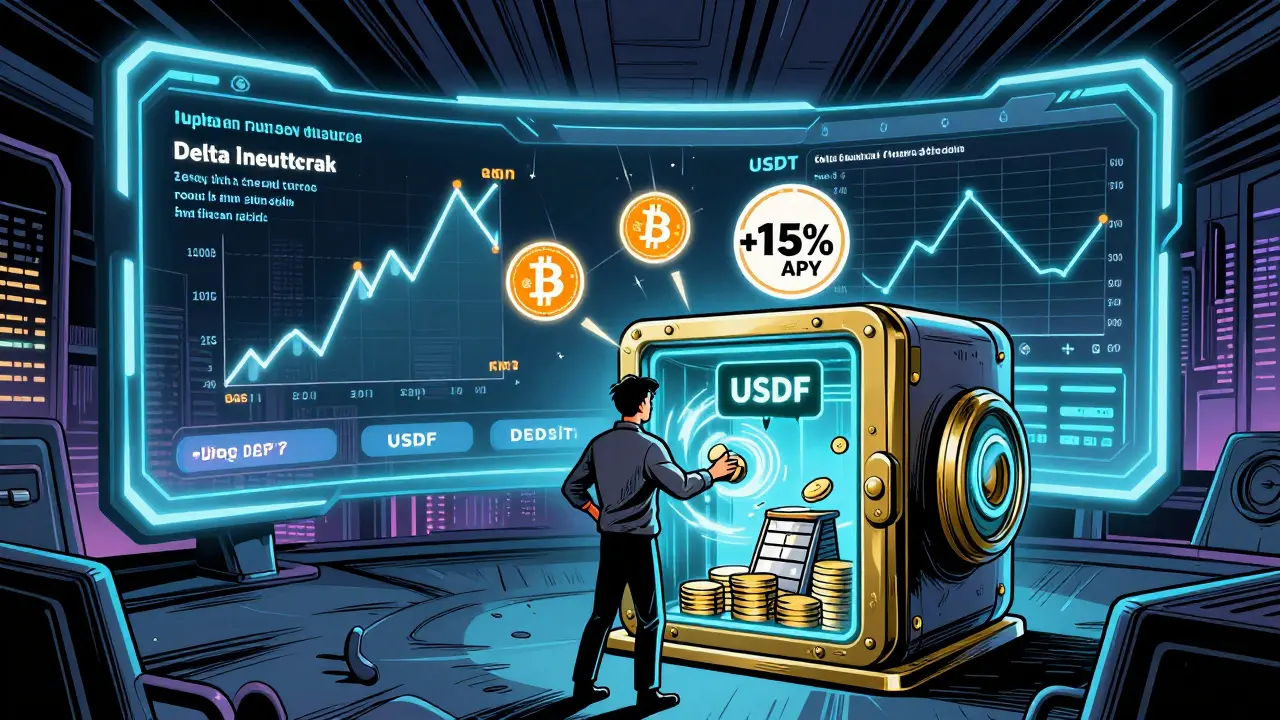

Staking USDF requires a wallet that supports the blockchain it runs on—likely Ethereum, BNB Chain, or another EVM-compatible network. You’ll need to connect your wallet to a platform that accepts USDF, lock your tokens for a set period, and then collect rewards, often paid daily or weekly. The returns? Usually between 3% and 10% APY, depending on demand and platform fees. This is similar to how you’d stake USDT or USDC, but USDF is newer, less mainstream, and often offers higher yields to attract users. That also means more risk. Not all platforms are trustworthy. Some might be poorly audited, or worse—exit scams. Always check if the platform is live on multiple blockchains, has public smart contract audits, and isn’t just a website with a fancy logo.

USDF staking fits into the bigger world of decentralized finance, where people earn interest without banks. It’s not for everyone. If you’re new to crypto, start small. Test with $50 before locking up $5,000. Watch out for platforms that promise 50% APY—that’s a red flag. Real staking rewards come from protocol fees, liquidity mining, or token inflation—not magic. And remember: even stablecoins can lose their peg under extreme market stress. USDF might be stable today, but its backing, reserves, and team matter just as much as the staking rate.

What you’ll find below are real reviews and warnings about platforms offering USDF staking. Some are legit. Some are dangerous. You’ll see how one exchange uses USDF to reward liquidity providers, another ties it to governance, and a third turned out to be a fake. No fluff. No hype. Just what people actually experienced when they tried to earn from USDF in 2025.

Aster USDF is a yield-bearing stablecoin pegged to USDT that earns passive income through delta-neutral futures strategies. Unlike traditional stablecoins, it turns idle capital into active DeFi leverage with up to 15% APY.