Cryptocurrency Regulation: What You Need to Know in 2025

When it comes to cryptocurrency regulation, the legal frameworks governments use to control digital assets like Bitcoin, Ethereum, and tokens. Also known as crypto compliance, it’s no longer just about stopping scams—it’s about defining what crypto actually is under the law. In 2025, this isn’t a single global rulebook. It’s a patchwork of strict policies, loopholes, and surprises that directly affect your wallet, your trades, and your access to exchanges.

Take South Korea’s FSC crypto rules, the country’s financial watchdog that demands real-name accounts, tracks every transaction under the FATF Travel Rule, and is now approving Bitcoin ETFs. If you’re trading on Korean exchanges, you’re under a microscope. Meanwhile, Dubai’s VARA licensing, a clear, business-friendly system that requires capital, bans risky tokens, and gives legal status to crypto firms is pulling in global exchanges like Binance and OKX. Then there’s Singapore’s Payment Services Act, which forces exchanges to hold cold storage, classify assets as securities or payments, and report everything. These aren’t suggestions—they’re legal requirements with fines or jail time if ignored.

But not all regulation is heavy-handed. Switzerland’s Crypto Valley, centered in Zug, treats crypto like cash—no capital gains tax, Bitcoin accepted in stores, and clear DLT laws that let startups build without fear. That’s why so many blockchain teams choose to register there. Meanwhile, places like the U.S. are stuck in legal gray zones, where the SEC sues exchanges while Congress debates for years. The result? You can’t just pick any exchange. Your location, your assets, and your goals all depend on which country’s rules you’re playing by.

Behind every exchange review, airdrop guide, or token breakdown you’ll find in this collection is one hidden thread: regulation. Whether it’s why BitSwap v3 has no KYC, why Coinhub.io is a scam (it can’t get licensed), or why Superp offers 10,000x leverage (it’s based in a jurisdiction that doesn’t ban high-risk trading), the rules are the real invisible hand. You’ll see how blockchain patent systems use smart contracts to prove ownership, how HSMs keep exchanges compliant, and why some airdrops vanish before they launch—because the team couldn’t navigate the legal maze. This isn’t theory. It’s what’s happening right now, in real markets, affecting real people. What you learn here won’t just help you avoid scams—it’ll help you make smarter moves in a world where the rules change faster than the price chart.

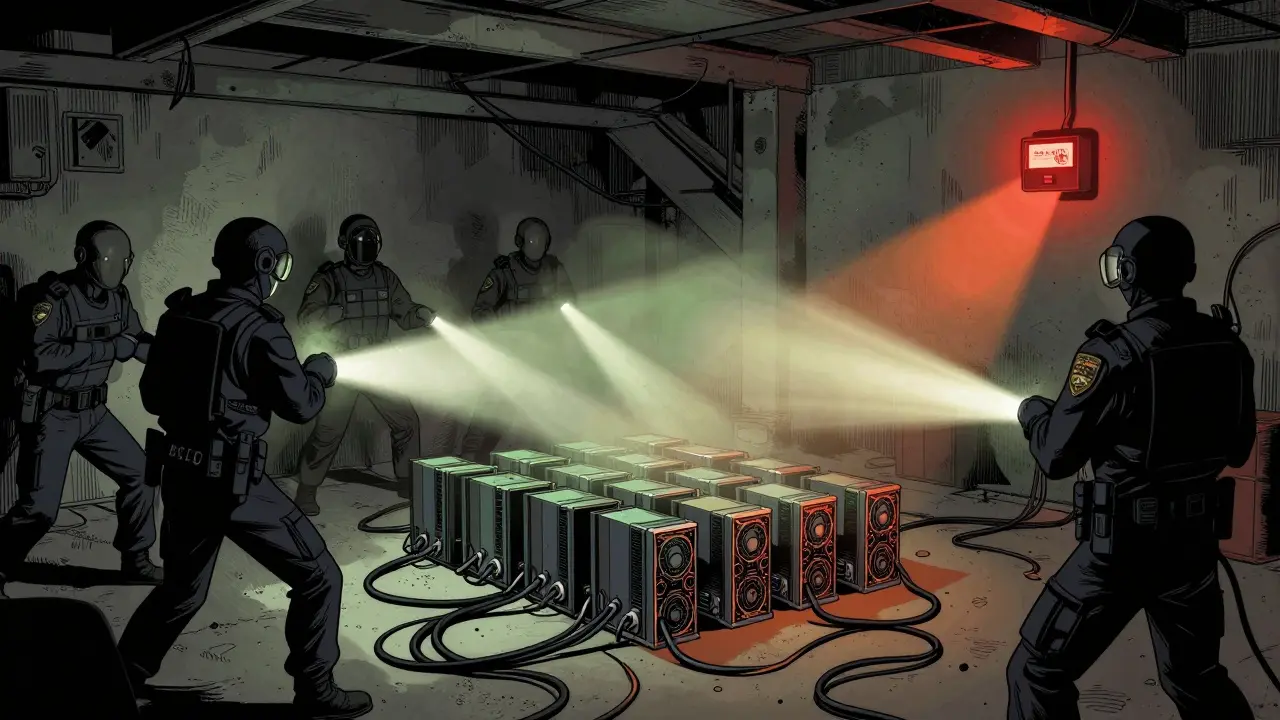

Kosovo banned crypto mining in 2022 to stop energy blackouts. By 2025, mining is allowed only with private power sources. Here's how the ban changed the country and what it means for miners today.