Crypto Regulation Comparison

When looking at crypto regulation comparison, the practice of contrasting how different jurisdictions, platforms, and token types are governed. Also known as crypto compliance analysis, it helps traders, developers, and businesses spot the rules that matter most for their activities.

One of the biggest players in this space are crypto exchanges, platforms where users buy, sell, and swap digital assets. They face strict licensing, AML/KYC checks, and periodic enforcement actions – think of the 2025 OKX fine or the SEC suits against unregistered offerings. Crypto regulation comparison shows how the same exchange might be free in one country but banned in another due to privacy‑coin policies. Speaking of privacy, privacy coins, digital currencies that mask transaction details, like Monero or Zcash, are now under a global delisting wave driven by FATF guidelines. Understanding their status lets you pivot to DEXs or P2P swaps if your main exchange pulls the plug.

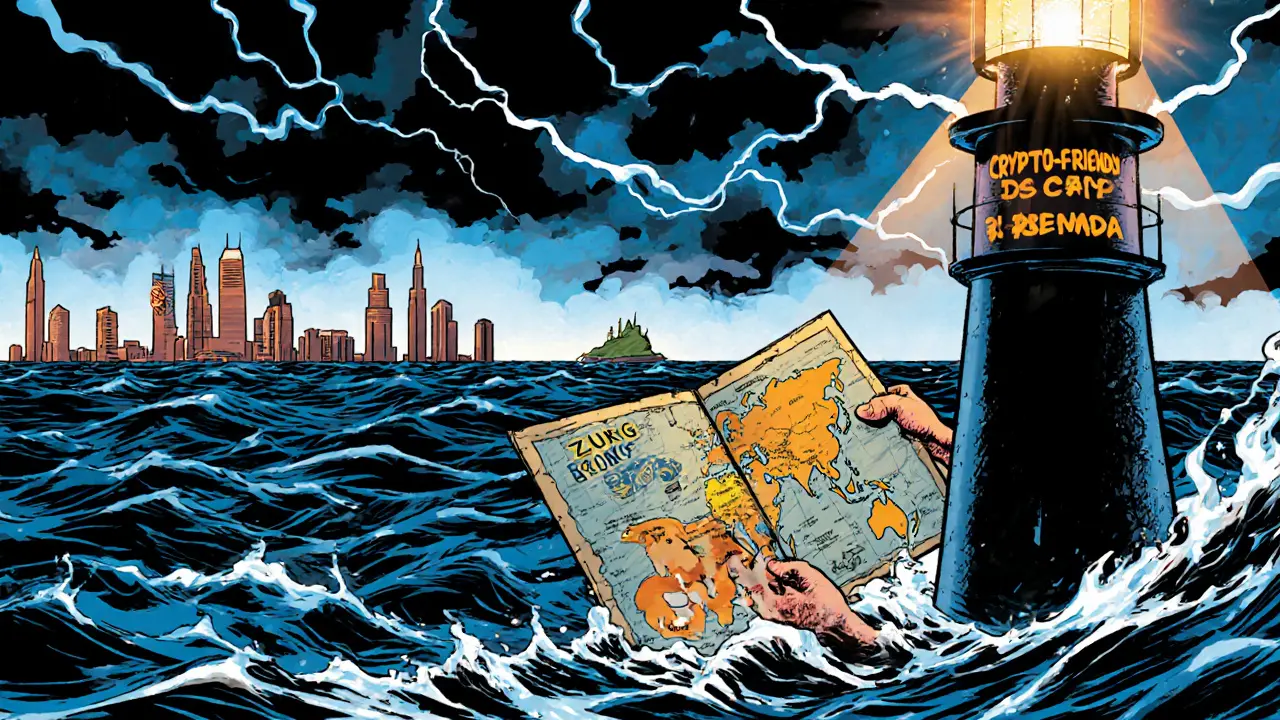

Another hot spot is the UAE free zones, designated areas that offer crypto companies tax breaks, crypto‑friendly licensing, and VARA oversight. Setting up a business there can shave months off compliance timelines, but you still need to track how local crypto regulation comparison stacks up against EU MiCA or US SEC rules. Finally, central bank digital currencies, government‑issued digital versions of fiat money, bring a new layer of policy that affects everything from payment speed to data privacy. Their rollout often forces exchanges to adapt AML processes and can reshape cross‑border token flows.

Why Knowing These Rules Pays Off

When you compare regulations side by side, you spot patterns: tighter AML leads to higher fees, privacy‑coin bans push users toward decentralized platforms, and UAE free‑zone incentives attract startups looking for rapid market entry. These insights let you choose the right exchange, avoid costly compliance missteps, and even plan for future CBDC integration. The posts below dive deeper into each of these angles – from airdrop eligibility under specific rules to enforcement actions that reshaped the market.

Ready to see real examples? Below you’ll find detailed guides, reviews, and how‑to articles that break down the latest crypto regulation comparison topics, so you can act with confidence.

Compare the world's most crypto‑friendly jurisdictions for traders in 2025. Learn about taxes, licensing, banking access, and which country fits your trading style.