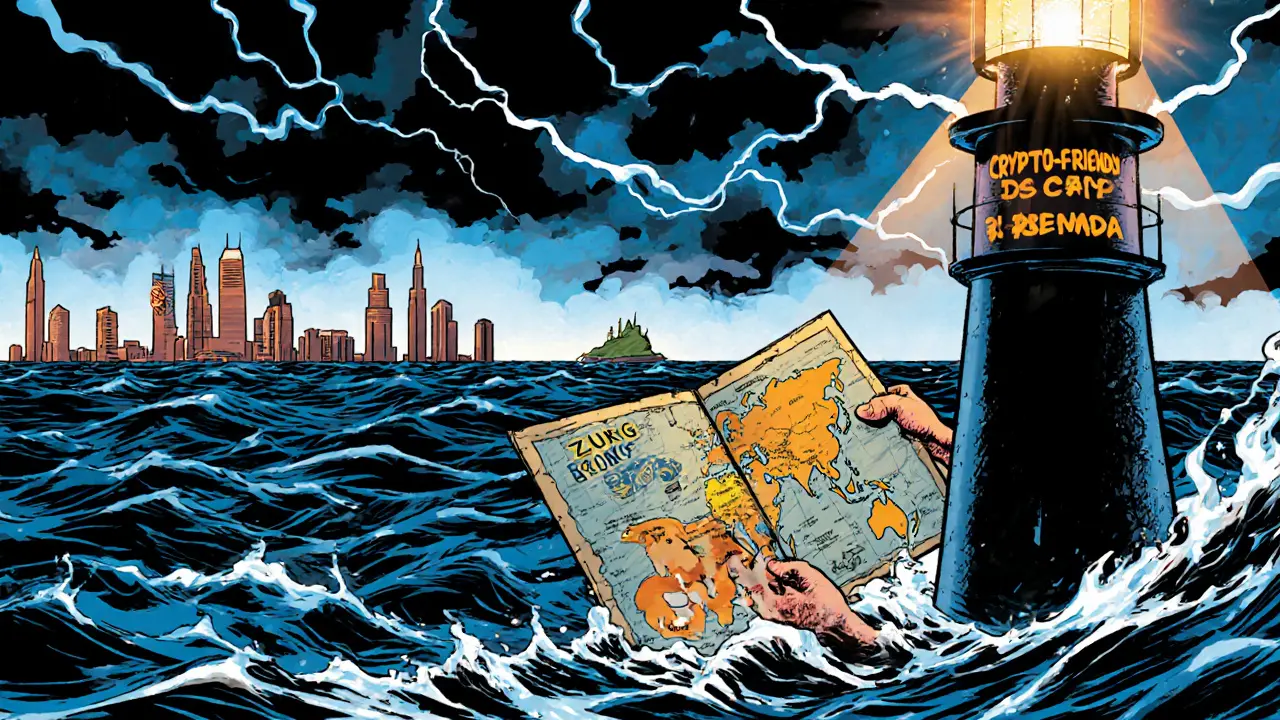

Crypto‑Friendly Jurisdictions: Where Crypto Businesses Thrive

When navigating the world of crypto startups, knowing which countries or regions welcome blockchain projects is crucial. crypto‑friendly jurisdictions, places that offer clear regulations, low taxes, and supportive infrastructure for crypto activities. Also known as crypto‑welcoming jurisdictions, they let founders focus on innovation instead of endless compliance hoops. In this guide we’ll break down what makes a jurisdiction attractive, the key regulatory pieces you’ll need, and how real‑world examples fit the picture.

Key Traits That Define a Crypto‑Friendly Jurisdiction

First, a jurisdiction must provide a clear licensing pathway. Without a defined process, businesses waste time guessing which permits they need. For example, the UAE free zones, special economic areas that allow 100% foreign ownership and issue crypto‑specific licenses have become magnets for exchanges and token issuers. Second, tax treatment matters—a low‑or‑zero corporate tax on crypto gains can dramatically improve cash flow. Third, regulatory sandboxes let projects test products under relaxed rules before scaling. Finally, robust AML/KYC frameworks give investors confidence, while still keeping the process simple enough to avoid bottlenecks.

These traits are interconnected. A sandbox (entity) influences the overall attractiveness (central entity) by easing entry barriers, while favorable tax policies (attribute) boost long‑term sustainability. Likewise, a clear licensing regime (attribute) reduces legal risk, a factor that investors often weigh heavily. When you line up these pieces, you see why places like the ADGM crypto, Abu Dhabi Global Market’s regulatory framework that blends fintech innovation with strict compliance rank high on the list.

Beyond the UAE, other regions have built reputation on similar foundations. The VARA licensing, Virtual Asset Regulatory Authority in the UAE that issues specific licenses for crypto service providers adds another layer of certainty for firms operating in the country. Meanwhile, European micro‑states like Estonia offer e‑Residency and straightforward e‑money licenses, making it easy for a remote team to set up a legal entity. Each jurisdiction tailors the three pillars—licensing, tax, and sandbox—to its own economic goals, creating a diverse map of opportunities.

When you compare these options, ask yourself three questions: Does the jurisdiction have a dedicated crypto regulator? Are tax rates on digital assets competitive? Can you test your product in a sandbox before full launch? Answering them quickly narrows the field to the most viable spots. Below, you’ll find a curated collection of articles that dive into specific airdrops, exchange reviews, and detailed business‑setup guides for places like the UAE, as well as insights on regulatory enforcement and privacy‑coin trends. Use them to match your project’s needs with the right jurisdiction, and you’ll be ready to move from idea to live product without hitting unexpected legal walls.

Compare the world's most crypto‑friendly jurisdictions for traders in 2025. Learn about taxes, licensing, banking access, and which country fits your trading style.