Crypto Energy Crisis: Why Blockchain Power Use Matters and How It's Changing

When you hear crypto energy crisis, the growing concern over how much electricity cryptocurrency networks consume, especially those using proof-of-work mining. Also known as blockchain power demand, it’s not just a buzzword—it’s a real-world issue affecting regulators, investors, and the future of digital currencies. Bitcoin alone uses more power than many countries. That’s not hype. It’s data from the Cambridge Centre for Alternative Finance. And while some say it’s the price of security, others argue it’s unsustainable. The question isn’t whether crypto needs energy—it’s whether it needs that much.

The proof of stake, a consensus mechanism that replaces energy-heavy mining with token-based validation. Also known as PoS, it’s the reason Ethereum cut its energy use by 99.95% after switching in 2022 changed everything. Suddenly, networks that once guzzled electricity could run on the power of a laptop. That shift didn’t just help the planet—it forced the whole industry to rethink its values. Projects that still rely on proof-of-work now face tougher scrutiny from governments, especially in Europe and the U.S., where clean energy laws are tightening. Even mining farms in Texas are being asked to prove they’re not straining the grid during peak hours.

It’s not just about Bitcoin. The blockchain energy use, the total electricity consumed by all public blockchains for transaction validation and network security. Also known as crypto power consumption, it includes everything from Solana’s low-energy nodes to smaller chains still mining with GPU rigs adds up fast. Some chains claim to be green but hide their real energy footprint. Others, like those running on renewable-powered data centers, are transparent about it. That’s why the posts below don’t just talk about coins—they talk about how they’re built, who controls them, and whether they’re worth the cost. You’ll find deep dives into exchanges that avoid energy-heavy chains, tokens tied to sustainable projects, and even how regulations in places like South Korea and Dubai are shaping what’s allowed to operate.

What you’re about to read isn’t a rant against crypto. It’s a clear-eyed look at how energy use shapes what works—and what doesn’t. You’ll see why some tokens vanish (hint: they’re not just scams—they’re power hogs), why exchanges like BitSwap and BloctoSwap avoid high-energy networks, and how projects like REI Network and Moca Network are built to be efficient from day one. If you’re holding crypto, you need to know where its power comes from. Because the next big shift won’t be in price—it’ll be in power.

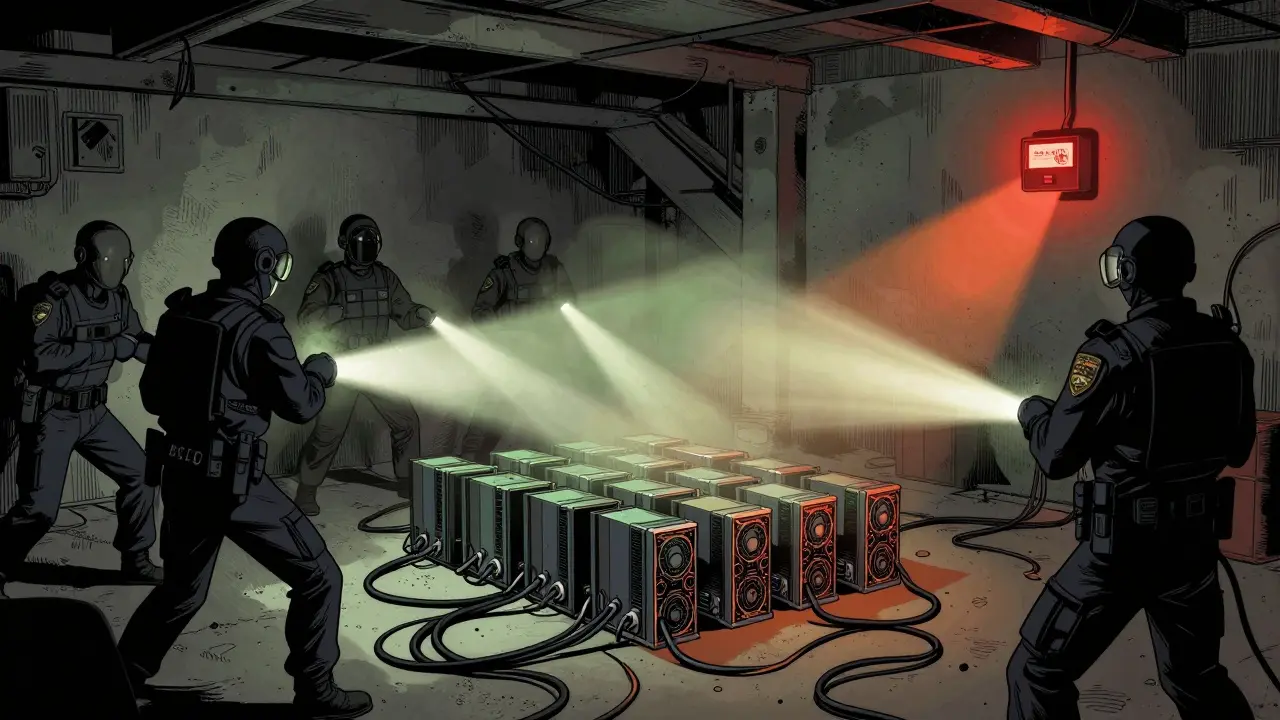

Kosovo banned crypto mining in 2022 to stop energy blackouts. By 2025, mining is allowed only with private power sources. Here's how the ban changed the country and what it means for miners today.