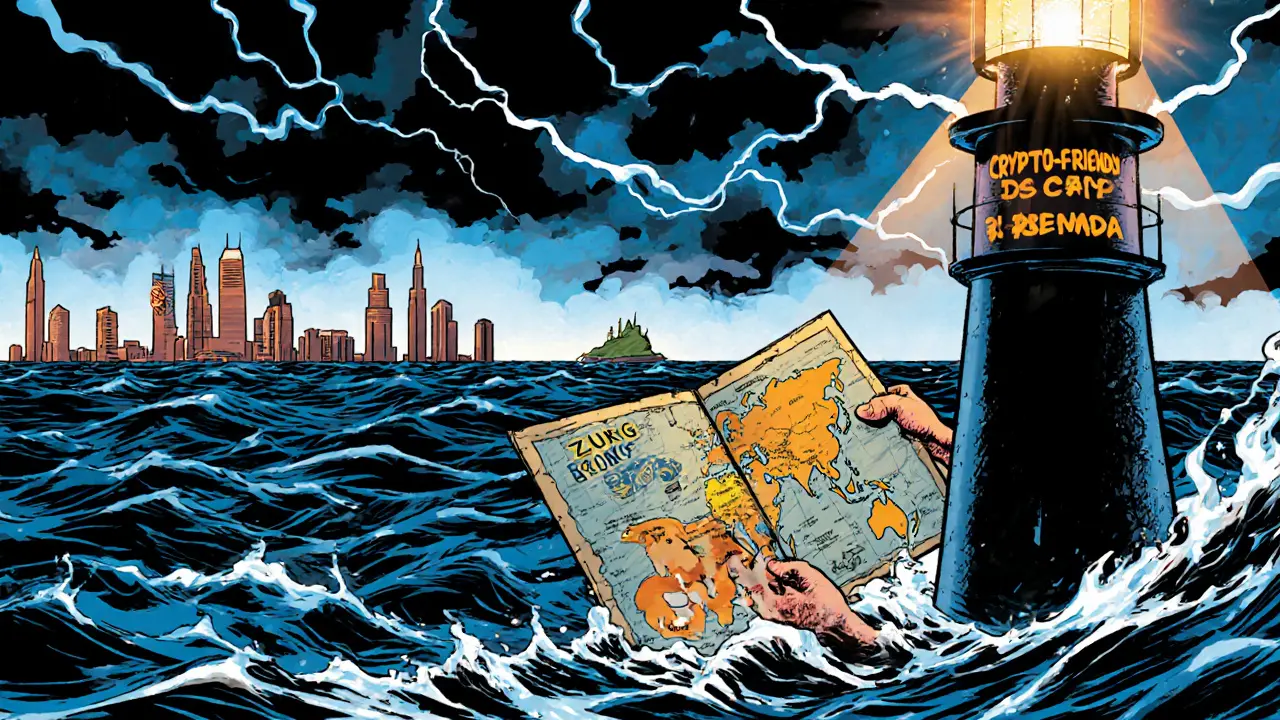

Best Crypto Jurisdictions

When working with best crypto jurisdictions, areas that provide clear, supportive rules for crypto businesses and traders, the first thing you notice is how much the legal backdrop can boost or break a project. A friendly regime reduces compliance costs, attracts talent, and gives exchanges the confidence to launch new services. In contrast, vague or hostile rules can lock up assets, scare investors, and force teams to relocate.

Key Factors to Consider

One of the most attractive spots right now is the UAE free zones, license‑friendly hubs like ADGM, DIFC and the Abu Dhabi Global Market that offer 0% corporate tax and robust digital asset frameworks. Those zones make it easy to set up a crypto company, get a VARA or ADGM licence, and tap into a growing regional market. Just across the sea, the Thailand crypto market, a blend of aggressive retail adoption and a regulatory sandbox that lets exchanges test new products offers a different flavor. Here, getting a crypto exchange licence involves working with the SEC and the Bank of Thailand, but the payoff is access to a fast‑growing user base and relatively low fees.

Both examples highlight why crypto licensing, the process of registering a business with a government authority to operate legally in the crypto space matters. Proper licensing signals legitimacy to investors, reduces the risk of sudden shutdowns, and often unlocks banking services that are otherwise off‑limits. Meanwhile, shifting privacy regulations, rules that govern the use of anonymity‑focused coins and how exchanges must handle them are reshaping where privacy‑first projects can survive. In 2025, many privacy coins have been delisted from major exchanges, pushing developers to look for jurisdictions with clearer guidance on DeFi and anonymous transactions.

All these pieces connect: the best crypto jurisdictions encompass regulatory‑friendly regions, require solid licensing, and adapt to evolving privacy rules. This web of factors determines where you’ll find the most supportive ecosystem for launching a token, operating an exchange, or simply trading with confidence. Below, you’ll discover detailed guides on setting up businesses in UAE free zones, reviews of Thai exchanges, insights on privacy‑coin delistings, and more. Dive into the curated articles to see how each jurisdiction stacks up against your specific needs and to get actionable steps for your next move in the crypto world.

Compare the world's most crypto‑friendly jurisdictions for traders in 2025. Learn about taxes, licensing, banking access, and which country fits your trading style.