Trader Residency Explained

When working with Trader residency, the legal status that determines where a trader pays taxes and follows regulations. Also known as trader tax residency, it shapes everything from crypto taxation to banking relationships. Crypto taxation, the set of rules that dictate how digital asset gains are taxed in a given jurisdiction directly influences a trader's residency decision, because lower rates can mean higher net profit. UAE free zones, designated areas offering 0% corporate tax, full ownership, and streamlined licensing for crypto businesses have become a hot spot for traders seeking a friendly environment. In short, trader residency encompasses tax planning, jurisdictional benefits, and compliance requirements. Choosing the right location often requires balancing the ease of exchange licensing against the cost of living and local regulations.

How Licensing and Compliance Shape Residency Choices

Another key piece of the puzzle is exchange licensing, the permission granted by regulators that allows a platform to operate legally. Traders gravitate toward jurisdictions where exchanges hold solid licenses because it reduces the risk of sudden shutdowns. Regulatory compliance, adherence to AML, KYC, and other legal standards required by governments also plays a huge role; a jurisdiction with clear guidelines helps traders stay on the right side of the law. The interaction between exchange licensing and regulatory compliance influences residency: a trader might move to a country where the primary exchange they use is fully regulated, cutting down on legal headaches. Meanwhile, emerging concepts like modular blockchain design improve scalability and security, making it easier for exchanges in compliant jurisdictions to offer fast, cheap trades. Understanding how these elements interlock—exchange licensing enables compliant operations, which in turn supports favorable trader residency—gives traders a strategic advantage.

The collection below pulls together practical guides that cover everything a trader needs to know about residency and its ripple effects. You’ll find detailed airdrop walkthroughs, in‑depth exchange reviews, security deep dives on double‑spending attacks, and step‑by‑step instructions for setting up a crypto business in UAE free zones. Whether you’re curious about the tax impact of a new token, want to compare exchange fees, or need to navigate regulatory compliance, these resources break down complex topics into clear actions. Dive in to see how each piece fits into the broader picture of managing your trader residency strategy.

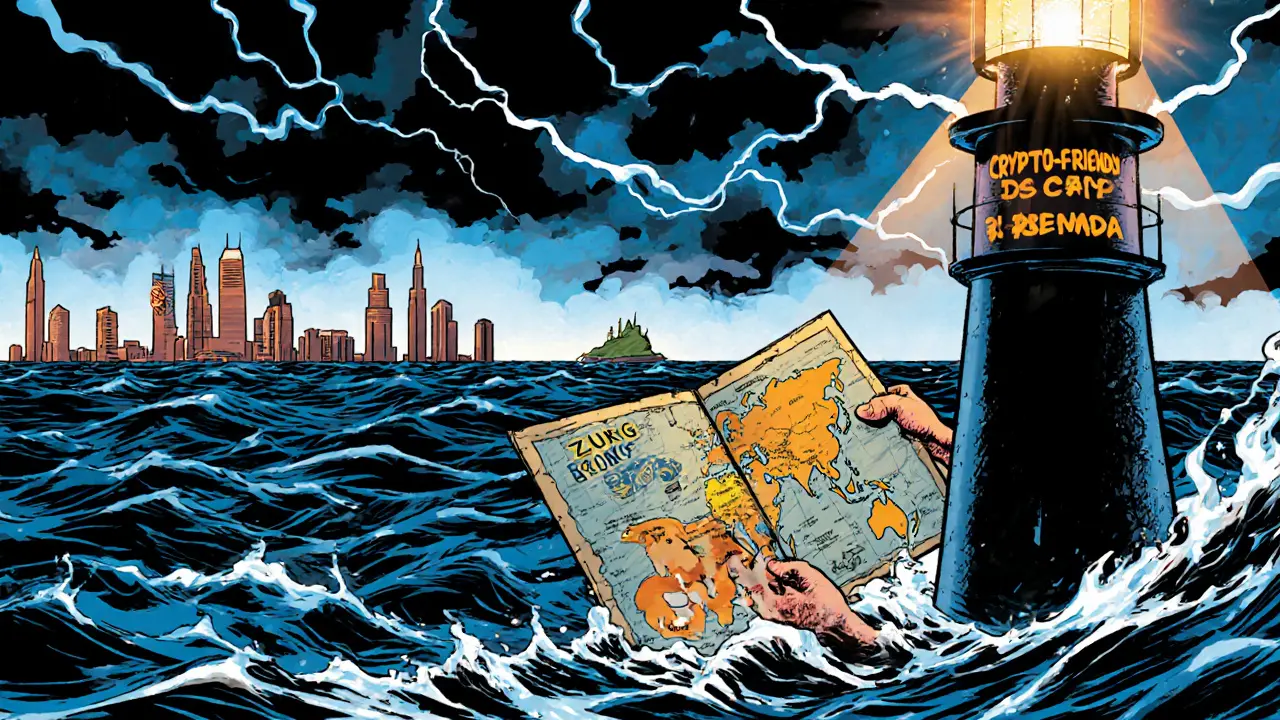

Compare the world's most crypto‑friendly jurisdictions for traders in 2025. Learn about taxes, licensing, banking access, and which country fits your trading style.