Mdex DEX: What It Is, How It Works, and Why It Matters in Decentralized Trading

When you trade crypto without a middleman, you’re using a Mdex DEX, a decentralized exchange built on Binance Smart Chain that lets users swap tokens directly from their wallets. Also known as MDX DEX, it’s one of the faster, cheaper alternatives to Ethereum-based DEXs like Uniswap. Unlike centralized exchanges, Mdex doesn’t hold your funds — you control your keys, and trades happen through smart contracts. That means no KYC, no account freezes, and no third-party risk.

What makes Mdex stand out isn’t just speed — it’s how it combines two big ideas: automated market making and cross-chain incentives. It uses a Binance Smart Chain, a blockchain optimized for low-cost, high-throughput transactions that supports smart contracts and DeFi apps to process swaps in seconds, with fees under a penny. It also rewards liquidity providers with MDX tokens, the platform’s native currency, giving users a direct incentive to lock up their assets. This isn’t just a trading tool — it’s a liquidity engine. Many users start here because they want to avoid Ethereum’s gas wars, but they stay because of the rewards and the growing list of tokens supported, from major DeFi coins to new BSC-based projects.

But Mdex isn’t perfect. It’s not regulated, and like most DEXs, it’s vulnerable to smart contract bugs and rug pulls. Some tokens listed on Mdex have little to no liquidity, making trades risky. That’s why users who stick with it tend to be experienced — they know how to check token audits, verify liquidity locks, and track trading volume before swapping. Still, for those who want to move fast, pay less, and earn while they trade, Mdex DEX remains one of the most practical tools in the DeFi toolbox.

Below, you’ll find real reviews, comparisons, and breakdowns of platforms like Mdex — including how it stacks up against others like GIBX Swap, Zedxion, and HTX Thailand. You’ll see what traders actually experience, where the risks hide, and how to spot the difference between a working DEX and a flashy scam. Whether you’re trying to understand liquidity pools, comparing fees across chains, or just looking for a safe way to swap tokens on BSC, the posts here give you the straight facts — no fluff, no hype.

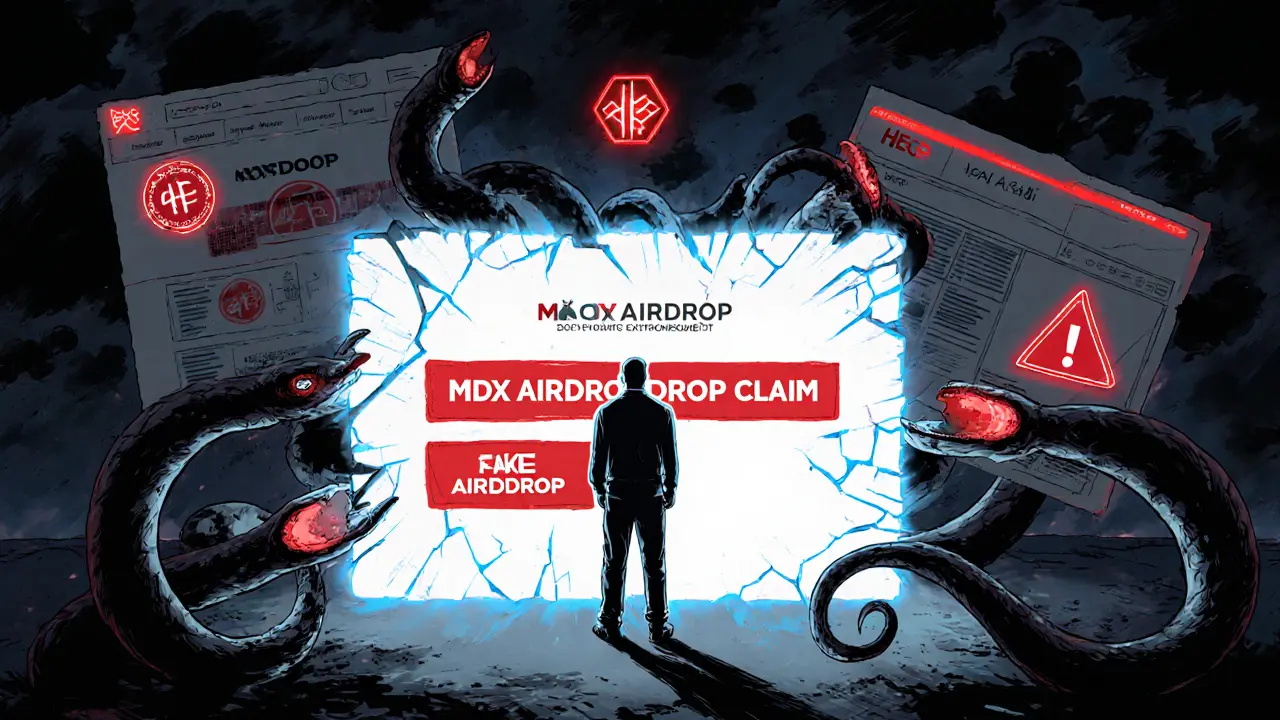

As of October 2025, there is no active MDX airdrop from Mdex. Learn the truth about past distributions, how to get MDX tokens legally, and how to avoid common scams targeting crypto users looking for free tokens.