Supply Chain Transparency in Crypto: How Blockchain Tracks Goods and Stops Fraud

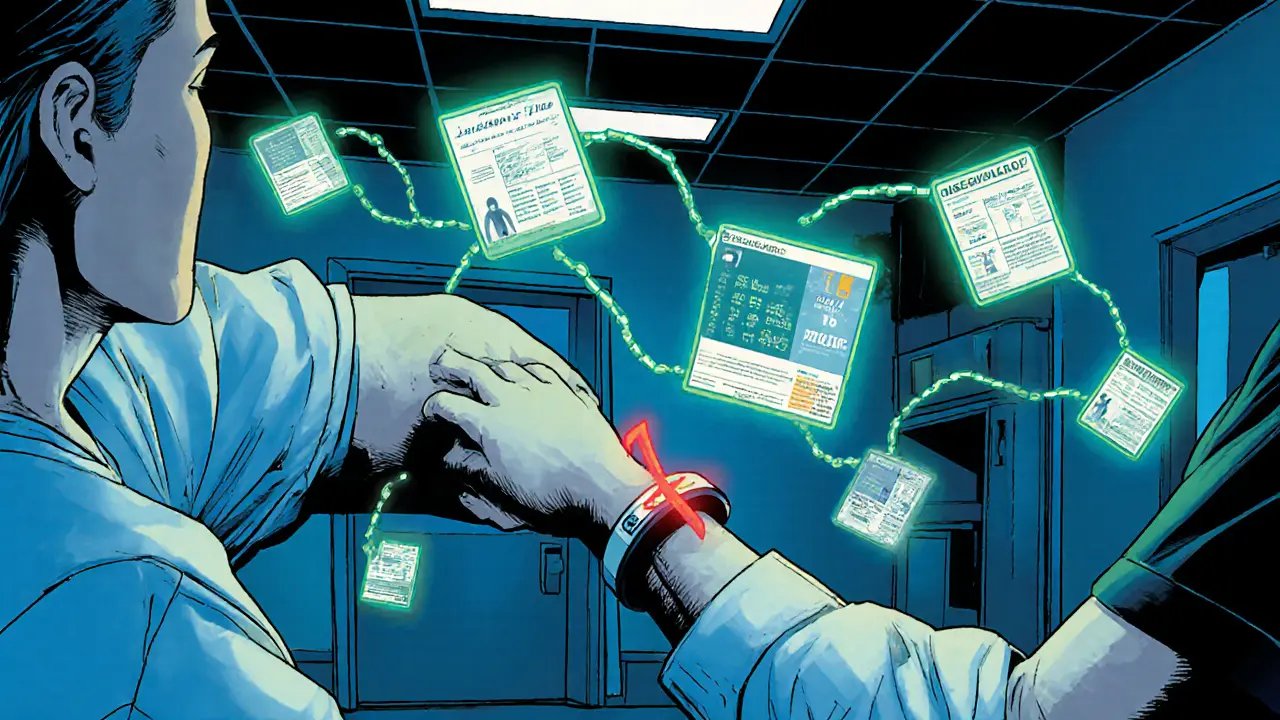

When you hear supply chain transparency, the ability to track every step of a product or asset from origin to end user with verifiable, tamper-proof records, you might think of food or clothing. But in crypto, it’s about tracking digital assets, exchange reserves, and even airdrop eligibility. blockchain traceability, the use of public ledgers to record and verify movements of value across networks is what makes this possible. Unlike traditional systems where a company says, ‘We checked it,’ blockchain lets anyone see the proof—every transfer, every wallet, every timestamp.

This isn’t theory. It’s why exchanges like BTCC and HTX Thailand are under pressure to prove they hold real reserves. It’s why scams like Flash Technologies (FLASH) and SPURDO fail—no one can verify where the tokens came from or if they ever existed. tokenized logistics, the process of representing physical or digital goods as blockchain tokens to enable real-time tracking and ownership verification is being tested in real projects like XYO, which uses GPS hardware to log location data on-chain. That’s supply chain transparency applied to movement, not just money. And when airdrops like KALA or APENFT drop, transparency tells you if the snapshot was fair or rigged. No more ‘trust us’—just check the ledger.

Right now, the biggest threat to crypto isn’t hacking—it’s hidden manipulation. A company claims it’s compliant with UK sanctions, but without transparent on-chain monitoring, you can’t tell if it’s true. That’s where supply chain fraud, the intentional obfuscation of asset origins or ownership to deceive users or regulators thrives. The posts below show you exactly how this plays out: from fake airdrops pretending to be linked to CoinMarketCap, to exchanges hiding volume data or claiming licenses they don’t have. You’ll see how real transparency works—like how Zedxion’s unverified claims exposed its lack of it—and how to spot the difference before you lose money.

What follows isn’t just a list of articles. It’s a field guide to seeing through the noise. You’ll learn how to trace token flows, verify exchange claims, and protect yourself from scams hiding behind fake transparency. No jargon. No fluff. Just what you need to know to tell truth from trickery in crypto’s messy supply chains.

Blockchain immutability ensures data can't be altered once recorded. Discover real-world uses in healthcare, supply chains, digital identity, and more where tamper-proof records save lives and money.