Permissioned Blockchain: What It Is and How It's Used in Crypto and Finance

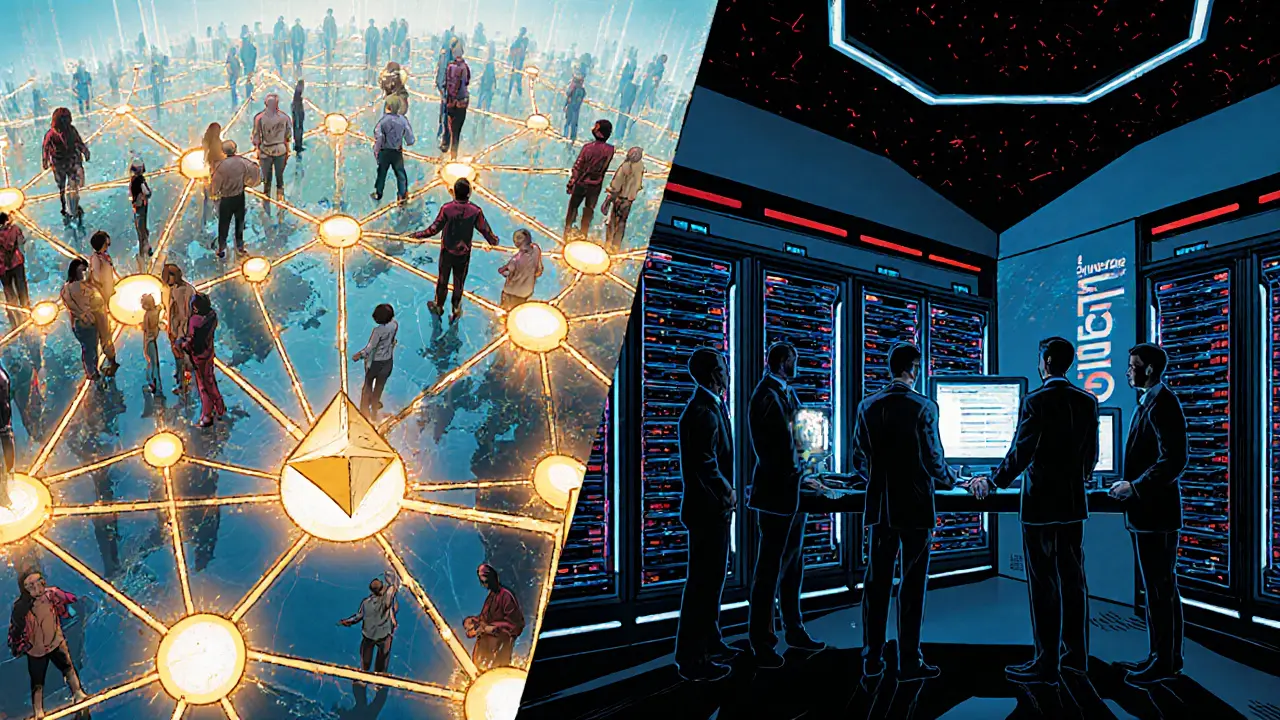

When you hear permissioned blockchain, a type of blockchain where only approved participants can join and validate transactions. Also known as private blockchain, it’s not open to everyone—unlike Bitcoin or Ethereum. Instead, it’s built for organizations that need control, speed, and compliance. Think of it like a members-only club where everyone has a verified ID. No random strangers allowed. That’s why banks, supply chain companies, and even government agencies use it.

What makes a permissioned blockchain, a type of blockchain where only approved participants can join and validate transactions. Also known as private blockchain, it’s built for organizations that need control, speed, and compliance. different is access control. In a public chain, anyone can mine or validate. In a permissioned one, only pre-approved nodes—like a bank’s server or a logistics company’s system—can write data. This cuts down on energy use, speeds up transactions, and makes audits easier. It also helps meet rules like GDPR or financial compliance laws, which public blockchains often can’t satisfy. That’s why consortium blockchain, a permissioned blockchain managed by a group of organizations rather than a single entity. Also known as multi-party blockchain, it’s common in finance and healthcare. is so popular. Groups like banks or insurers run these together, sharing control without giving up security.

It’s not just about locking people out—it’s about making systems work better. For example, a hospital might use a permissioned blockchain to track patient records across clinics, ensuring only authorized staff can view or update them. A shipping company could use it to prove a container wasn’t tampered with during transit. These aren’t theory experiments—they’re live systems saving time and money. And because they don’t rely on proof-of-work, they’re faster and cheaper than public chains. That’s why you’ll see them in enterprise blockchain, blockchain solutions designed for business use cases like supply chain, identity, or compliance. Also known as business blockchain, it’s the backbone of many corporate digital transformations. projects today.

Don’t confuse this with public crypto. You won’t find $100 million meme coins on a permissioned chain. There’s no mining, no wild price swings, and no anonymous wallets. Instead, you get reliability, traceability, and accountability. That’s why regulators are starting to prefer it. If you’re looking at crypto compliance, KYC, or cross-border payments, you’re probably dealing with a permissioned system—even if you don’t realize it.

Below, you’ll find real-world examples of how permissioned blockchains are being used—whether it’s for tracking sanctions compliance, securing financial transactions, or preventing fraud in exchanges. These aren’t theoretical ideas. They’re live systems shaping how businesses handle data today.

Public and private blockchains differ in access, speed, privacy, and control. Public chains are open and transparent; private chains are restricted and efficient. Choose based on your need for decentralization or control.