MDX Token: What It Is, How It Works, and Where to Find It

When you hear MDX token, the native cryptocurrency of the MDEX decentralized exchange. Also known as MDEX token, it’s not just another coin—it’s the engine behind one of the more active DeFi platforms on Binance Smart Chain. Unlike tokens that exist only to speculate, MDX has real functions: it pays for transaction fees, rewards liquidity providers, and lets holders vote on platform upgrades.

MDX works alongside MDEX, a decentralized exchange that lets users swap tokens without intermediaries, and connects directly to Binance Smart Chain, a blockchain optimized for fast, low-cost transactions. If you’re staking crypto or providing liquidity on MDEX, you’re likely earning MDX as a reward. That’s why so many DeFi users track its price and supply changes closely. It’s not a meme coin—it’s a utility token built for daily use in trading and yield farming.

You won’t find MDX on every exchange, but it’s listed on major ones like MDEX itself, Huobi, and Klickl. Some users hold it long-term because of its deflationary model—tokens are burned regularly to reduce supply. Others trade it actively because of its volatility and role in high-yield pools. Either way, if you’re into DeFi, you’ve probably come across MDX in a staking dashboard or a liquidity pool screen.

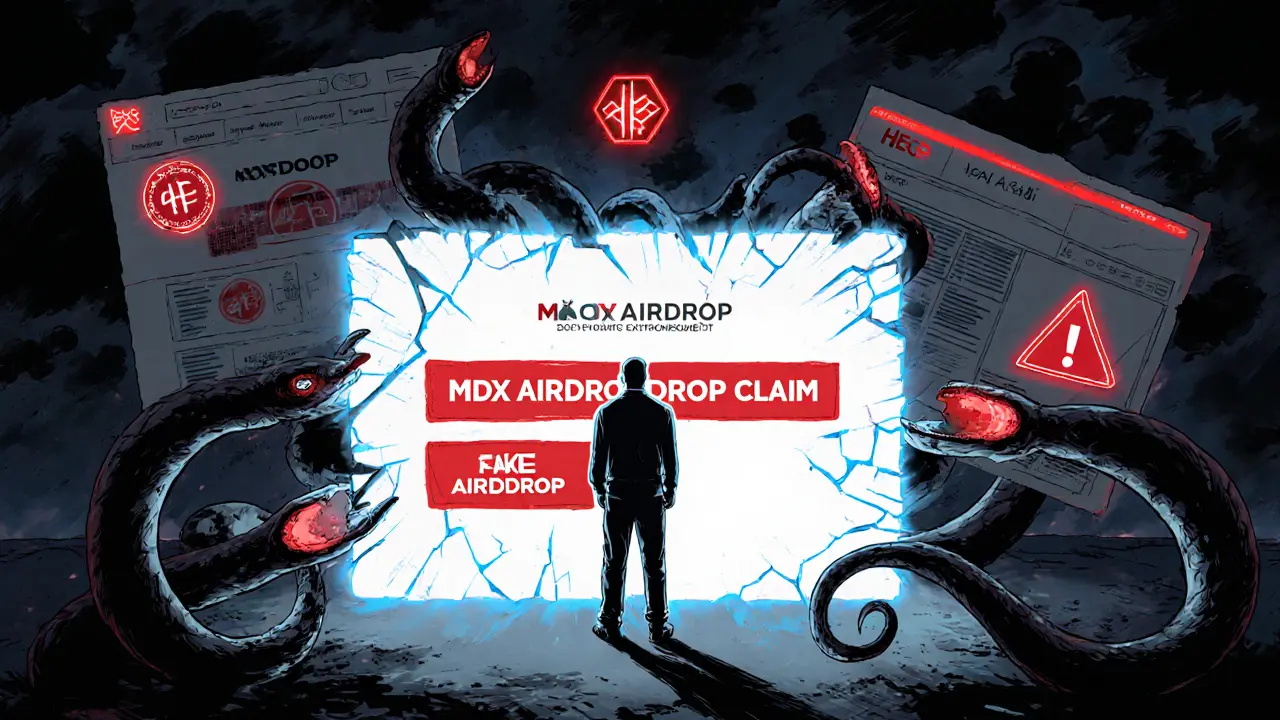

What’s missing from most guides? Real stories. Like the trader who earned more in MDX rewards over three months than their initial deposit. Or the user who lost funds because they didn’t check the contract address before connecting their wallet. These aren’t hypotheticals—they’re common experiences reflected in the posts below. You’ll find reviews of exchanges where MDX trades, breakdowns of staking APYs, and warnings about fake MDX tokens. No fluff. Just what matters if you’re using or considering MDX.

As of October 2025, there is no active MDX airdrop from Mdex. Learn the truth about past distributions, how to get MDX tokens legally, and how to avoid common scams targeting crypto users looking for free tokens.