Cryptocurrency Exchange Safety

When working with cryptocurrency exchange safety, the set of practices that keep your crypto funds secure on trading platforms. Also known as exchange security, it covers everything from technical safeguards to legal oversight. One critical threat is double‑spending attacks, attempts to reuse a digital token in multiple transactions before the network confirms it, which exchanges counter with multiple confirmations and consensus checks. Another pillar is cold storage, offline wallets that keep the bulk of user assets away from internet‑connected servers, dramatically reducing hack risk. Finally, regulatory compliance, adherence to KYC/AML laws and licensing requirements, ensures that exchanges operate under supervision and can recover user funds if things go wrong. Together, these elements create a safety net that lets traders focus on strategy instead of worry.

Key Safety Elements

Effective cryptocurrency exchange safety starts with layered security. Exchanges deploy firewalls, intrusion detection systems, and regular penetration testing to spot vulnerabilities before attackers do. Multi‑factor authentication (MFA) adds a human factor, requiring users to confirm logins with something they own, like a phone. Cold storage is the gold standard for protecting large balances; the best platforms keep 95%+ of deposits offline, only moving funds to hot wallets for withdrawals. Real‑time monitoring watches for abnormal transaction patterns that could indicate a double‑spending attempt or a breach, instantly freezing suspicious activity. On the compliance side, robust KYC processes verify user identities, while AML tools flag illicit behavior, helping exchanges stay on the right side of regulators. Insurance policies further cushion users, offering reimbursements if a breach occurs despite all technical safeguards.

All this groundwork pays off when you explore the article collection below. You'll find deep dives into how specific exchanges like HTX Thailand or Klickl handle security, explanations of double‑spending defenses, and guides on setting up crypto businesses that meet regulatory standards. Whether you’re a beginner learning the basics or an advanced trader tweaking your risk model, the posts give practical steps to evaluate and improve safety on any platform you choose.

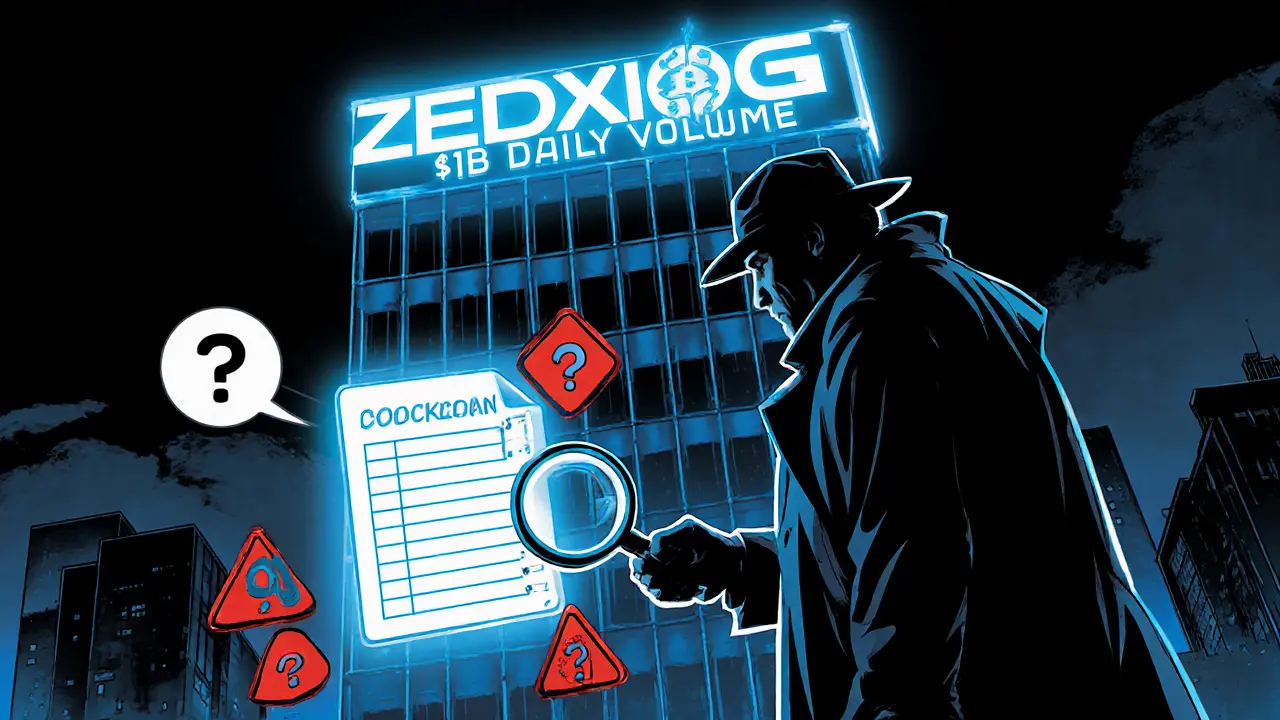

An in‑depth review of Zedxion Exchange, exposing its unverified volume claims, lack of licenses, security flaws, and user complaints. Learn why it ranks as a high‑risk platform.