Crypto Regulations Explained

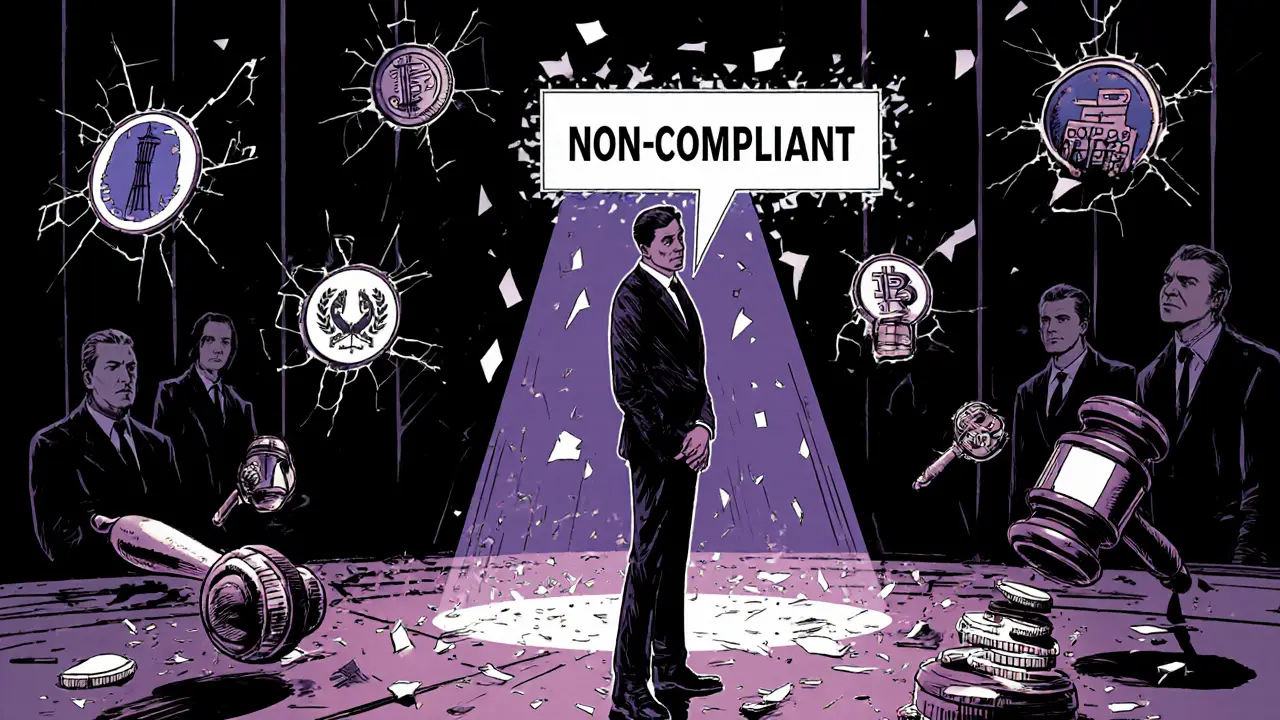

When working with crypto regulations, the set of laws and guidelines that govern digital assets, trading platforms, and blockchain activities worldwide. Also known as digital asset compliance, they shape how markets operate and protect investors.

These rules reach into crypto exchanges, platforms that let users buy, sell, and trade cryptocurrencies, demanding licensing, AML/KYC checks, and transparent reporting. privacy coins, cryptocurrencies that hide sender, receiver, and transaction amounts feel the pressure when regulators tighten anti‑money‑laundering rules, leading to delistings on major venues. Meanwhile, central bank digital currencies (CBDCs), government‑issued digital versions of fiat money emerge as a direct response to the same regulatory goals, offering faster settlements while keeping oversight. The SEC, U.S. Securities and Exchange Commission, the primary enforcer of securities law in the United States adds another layer by classifying many tokens as securities, which forces issuers to register offerings or face penalties.

In practice, crypto regulations encompass three core triples: (1) crypto regulations → require → exchange licensing, (2) crypto regulations → drive → privacy‑coin delistings, and (3) crypto regulations → inspire → CBDC development. The first triple means any exchange operating in a regulated jurisdiction must hold a license, implement know‑your‑customer (KYC) procedures, and submit regular audit reports. The second explains why you’ll see Monero, Zcash, and other privacy‑focused assets disappearing from big platforms after new AML rules land. The third shows governments launching CBDCs to reclaim control over money flows while staying compliant with anti‑terror‑funding statutes. Together, these connections illustrate how a single regulatory framework can reshape technology, market access, and even national monetary policy.

Looking ahead, traders should keep an eye on three practical signals. First, watch for licensing announcements from major exchanges—those signals often precede new market listings or sudden token withdrawals. Second, monitor regulatory bodies’ statements on privacy‑coin treatment; any hint of stricter AML guidance usually triggers rapid price moves. Third, follow central bank pilots for CBDCs; early adoption can create arbitrage opportunities between tokenized fiat and traditional crypto assets. By understanding how regulations interact with exchanges, privacy coins, CBDCs, and the SEC, you’ll be better equipped to navigate the shifting landscape and protect your portfolio.

What You’ll Find Below

The collection that follows dives deep into real‑world cases like the Thodex exit scam, the wave of privacy‑coin delistings coming in 2025, and the latest enforcement actions against exchanges. Each article breaks down the regulatory angle, explains the technical impact, and offers clear steps you can take—whether you’re claiming an airdrop safely or choosing a compliant platform for trading. Get ready to see how the rules shape the market and what that means for your next move.

The Payment Services Act crypto provisions now require strict licensing, cold storage, Travel Rule compliance, and asset classification. Learn the key rules in Singapore, Japan, Europe, and the U.S. as of 2025.

Explore how crypto exchanges build AML programs, from KYC to AI monitoring, and learn why compliance is crucial for staying legal and avoiding massive fines.