Crypto Platform Comparison: Your Guide to Exchanges, Fees, and Features

When evaluating Crypto Platform Comparison, the systematic review of different crypto exchange services, fee models, security measures, and regulatory environments. Also known as exchange comparison, it helps traders decide where to trade, store, or develop on‑chain strategies. A solid comparison starts with understanding the core crypto exchange, a digital marketplace that lets users buy, sell, or swap crypto assets and extends to related concepts like central bank digital currency (CBDC), state‑issued digital money that aims to complement or replace cash, the rise and fall of privacy coins, cryptocurrencies focused on anonymity that face increasing regulatory pressure, and the impact of crypto‑friendly jurisdictions, countries with favorable tax, licensing, and banking frameworks for crypto businesses. All these pieces interact: crypto platform comparison encompasses fee analysis, security audits, and regulatory outlooks, while requiring knowledge of exchange mechanics, CBDC adoption trends, privacy‑coin delisting rules, and jurisdictional benefits.

Why Comparing Platforms Matters

First, fees, the cost per trade, withdrawal, or deposit that directly affects net profit differ wildly between platforms. Some exchanges charge a flat 0.1% maker fee, others use tiered structures based on volume or token holdings. Understanding these models prevents hidden erosion of returns, especially for high‑frequency traders. Second, security, the set of measures like two‑factor authentication, cold storage, and insurance coverage that protect user funds varies: a platform with a history of hacks, such as the Thodex exit scam, signals higher risk than one that survived multiple audits. Third, the regulatory climate shapes access. CBDC projects, like the Digital Euro or Digital Yuan, influence how traditional banks and crypto firms integrate fiat on‑ramps, potentially altering liquidity and compliance costs for exchanges. Fourth, the wave of privacy‑coin delistings, driven by FATF guidelines that target anonymity‑focused assets forces platforms to adapt their listings, which can affect users who rely on those coins for privacy. Finally, choosing a jurisdiction, such as the UAE free zones or crypto‑friendly nations like Portugal, determines tax rates, licensing hurdles, and banking relationships. A trader based in a high‑tax region may benefit more from an exchange that offers tax‑optimized reporting, while a developer seeking institutional banking will look at platforms operating under supportive regulatory regimes.

Below you’ll find a curated set of articles that break down these elements one by one. We’ve included deep‑dive reviews of Thai exchanges like HTX Thailand, security‑focused pieces on double‑spending prevention, analyses of CBDC market impact, a look at privacy‑coin delistings in 2025, and a comparison of crypto‑friendly jurisdictions for 2025. Each post adds a layer to the overall picture, helping you match your trading style, risk tolerance, and regulatory environment with the right platform. Dive into the list and start building a more informed, profitable crypto strategy today.

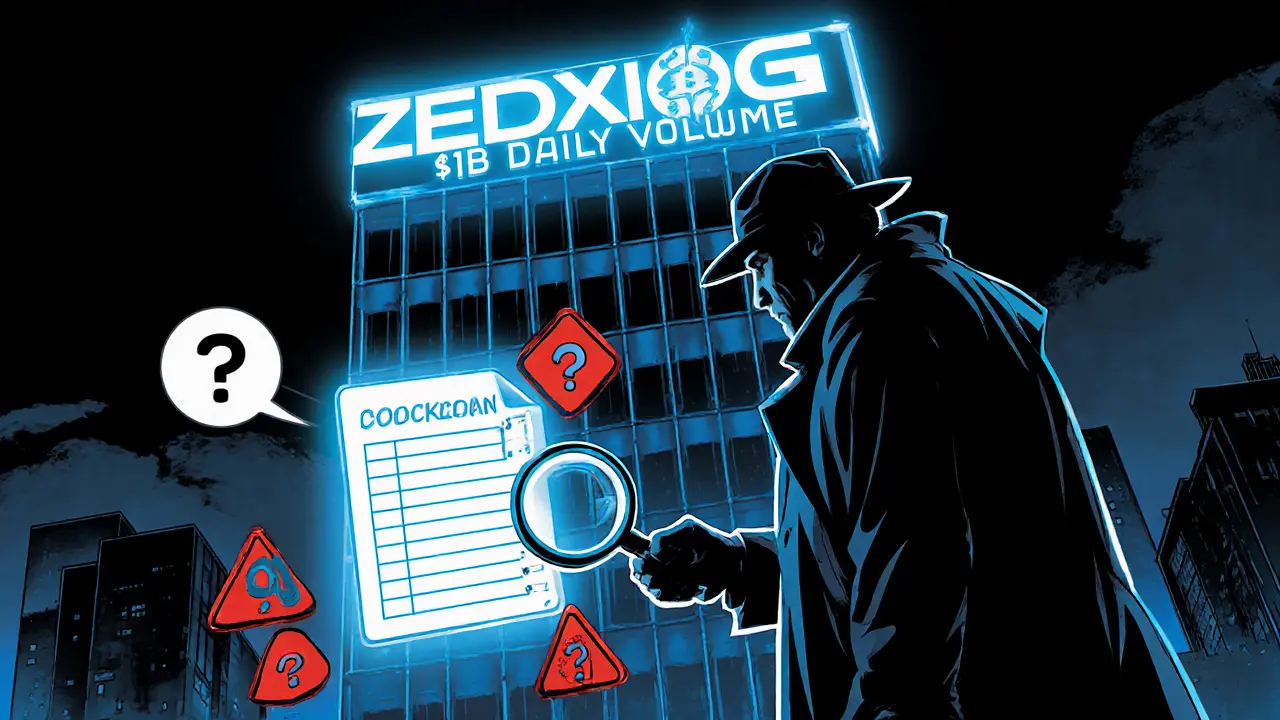

An in‑depth review of Zedxion Exchange, exposing its unverified volume claims, lack of licenses, security flaws, and user complaints. Learn why it ranks as a high‑risk platform.