Crypto HSM: How Hardware Security Modules Protect Your Digital Assets

When you hear about a crypto exchange getting hacked, the real story isn’t always about weak passwords or phishing—it’s often about what happened to the crypto HSM, a physical device designed to generate, store, and manage cryptographic keys in a tamper-resistant environment. Also known as a hardware security module, it’s the digital equivalent of a bank vault with a heartbeat—only it doesn’t sleep, doesn’t get tired, and doesn’t answer to social engineering. Without it, private keys would be sitting on servers like house keys under a doormat, waiting for the next thief to walk by.

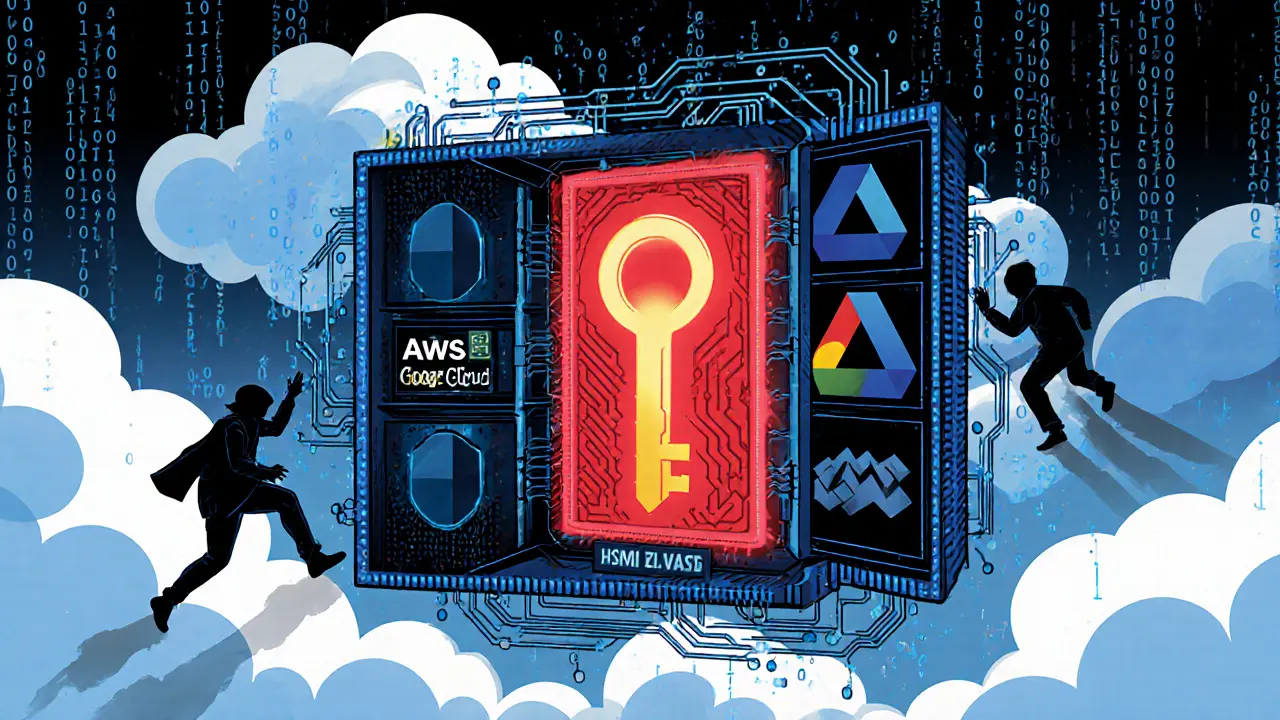

Every major exchange—Coinbase, Kraken, Binance—uses crypto HSM, a certified device that isolates cryptographic operations from the rest of the system to prevent remote access or malware infection because regulators demand it. The FIPS 140-2, a U.S. government standard that certifies the security level of cryptographic hardware and software isn’t just a checkbox—it’s the baseline for trust. If an exchange doesn’t meet it, banks won’t process withdrawals, insurers won’t cover losses, and users won’t trust it. These aren’t optional upgrades. They’re the reason Bitcoin hasn’t been stolen from its own network, while smaller chains like Ethereum Classic got wiped out in 51% attacks. The difference? One had HSM-backed cold storage; the other didn’t.

Think of a crypto HSM as the bodyguard for your private keys. It never leaves its secure cage. Even if a hacker breaks into the server, they can’t touch the keys inside. The HSM only responds to signed commands from authorized systems, and even then, it logs every request. That’s why breaches like the one at Mt. Gox happened—because they stored keys in software, not hardware. Modern exchanges don’t just use HSMs—they use multiple, geographically separated, and air-gapped ones. Some even split key fragments across different HSMs so no single device holds the full key. That’s not paranoia. That’s how you survive a targeted attack.

It’s not just about exchanges either. Institutional investors, custody providers, and even blockchain projects running their own nodes rely on HSMs to prevent insider threats. A developer with bad intentions can’t just copy a key from a server if it’s locked in a FIPS-certified device. The same tech that secures military communications now secures your ETH or BTC. And while you might never see one, you feel its effect every time you send crypto without losing it to a hack.

Below, you’ll find real breakdowns of how HSM key management works, what happens when it fails, and how exchanges stack their defenses. You’ll also see how these same principles connect to blockchain forensics, cold storage, and even regulatory compliance. This isn’t theory—it’s the quiet backbone of everything you trust in crypto.

Cloud HSMs are the industry standard for securing cryptocurrency private keys. Learn how they work, their costs, top providers, and why they're mandatory for exchanges handling over $1 million daily.