Blockchain Immutability: Why It Matters and How It Keeps Crypto Secure

When you hear blockchain immutability, the property that makes recorded data on a blockchain impossible to alter after confirmation. Also known as tamper-proof ledger, it’s the reason you can send Bitcoin without trusting a bank. It’s not magic—it’s math, time, and network agreement working together to lock data in place. Once a block is added to the chain, changing even one letter in a transaction would break the entire sequence, and every node on the network would spot it instantly.

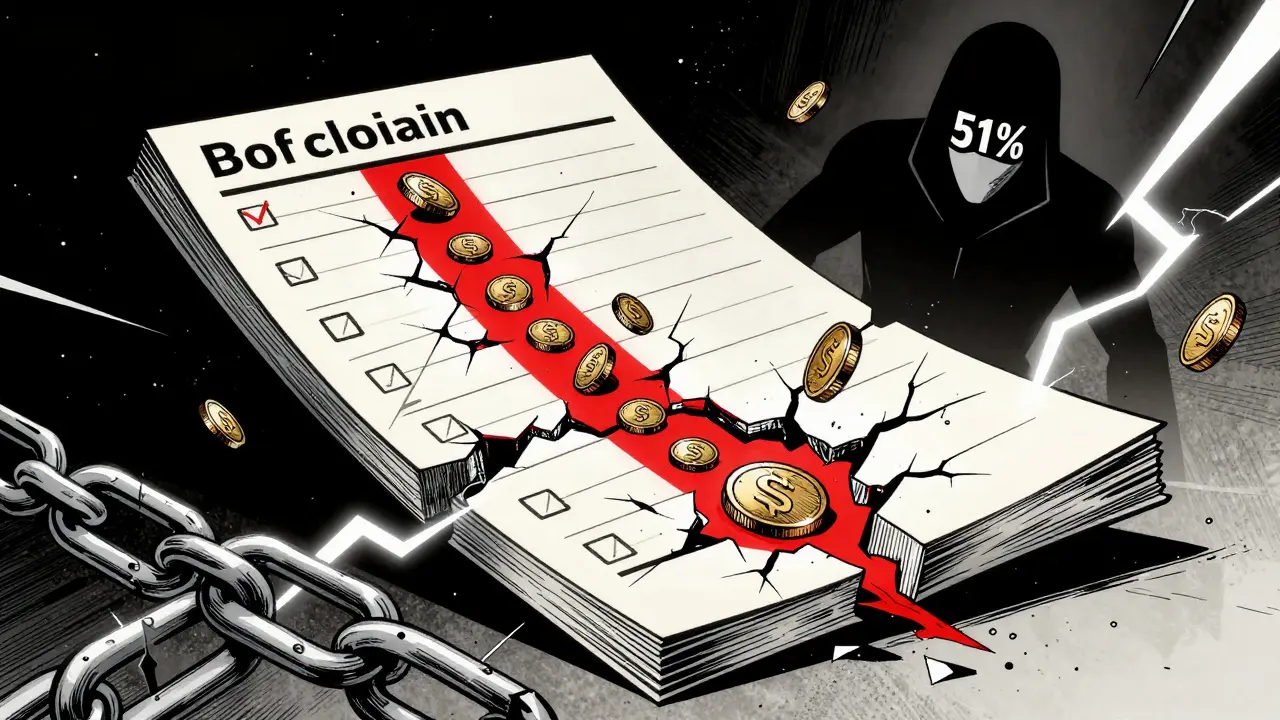

This isn’t just theory. It’s what stops someone from spending the same Bitcoin twice, or a exchange from quietly deleting your withdrawal history. The cryptographic hashing, a system that turns data into unique, fixed-length strings that can’t be reversed or tweaked without changing the entire chain is the backbone. Every block contains a hash of the one before it. Change one? The next block’s hash breaks. The next one breaks too. And suddenly, the whole chain looks fake. That’s why consensus mechanisms, the rules that make nodes agree on which blocks are valid like Proof of Work and Proof of Stake are so critical. They don’t just validate transactions—they enforce the immutability by making it computationally expensive to cheat.

But here’s the catch: blockchain immutability doesn’t mean the data is always correct. It just means once it’s in, you can’t change it. That’s why scams like fake airdrops or manipulated token prices still happen—they get recorded as-is. Immutability protects the record, not the truth. That’s why you still need to check sources, watch for red flags in tokenomics, and avoid projects with no real utility. The blockchain won’t save you from bad decisions—it just makes sure no one can lie about what happened after the fact.

What you’ll find below are real examples of how blockchain immutability works—or fails—in practice. From exchange hacks where transaction histories were frozen in place, to meme coins with impossible token supplies that got permanently recorded, these posts show you how the tech plays out in the wild. You’ll see how exchanges prevent double-spending, why privacy coins get delisted, and how modular blockchains are trying to improve security without breaking the core promise. This isn’t about theory. It’s about what you need to know to protect your assets in a world where the ledger never forgets.

Blockchain immutability sounds like a strength, but it causes real problems with data privacy, smart contract errors, and regulatory compliance. Learn how businesses are adapting - and why absolute immutability doesn't work in practice.

Blockchain immutability ensures data can't be altered once recorded. Discover real-world uses in healthcare, supply chains, digital identity, and more where tamper-proof records save lives and money.