Blockchain Differences: What Sets Chains Apart and Why It Matters

When people talk about blockchain, a distributed digital ledger that records transactions across multiple computers. Also known as distributed ledger technology, it’s the backbone of crypto, but not all blockchains work the same way. Some are open for anyone to join. Others are locked down to a few trusted players. The difference isn’t just technical—it changes who controls the data, how fast transactions go through, and whether you can trust the system at all.

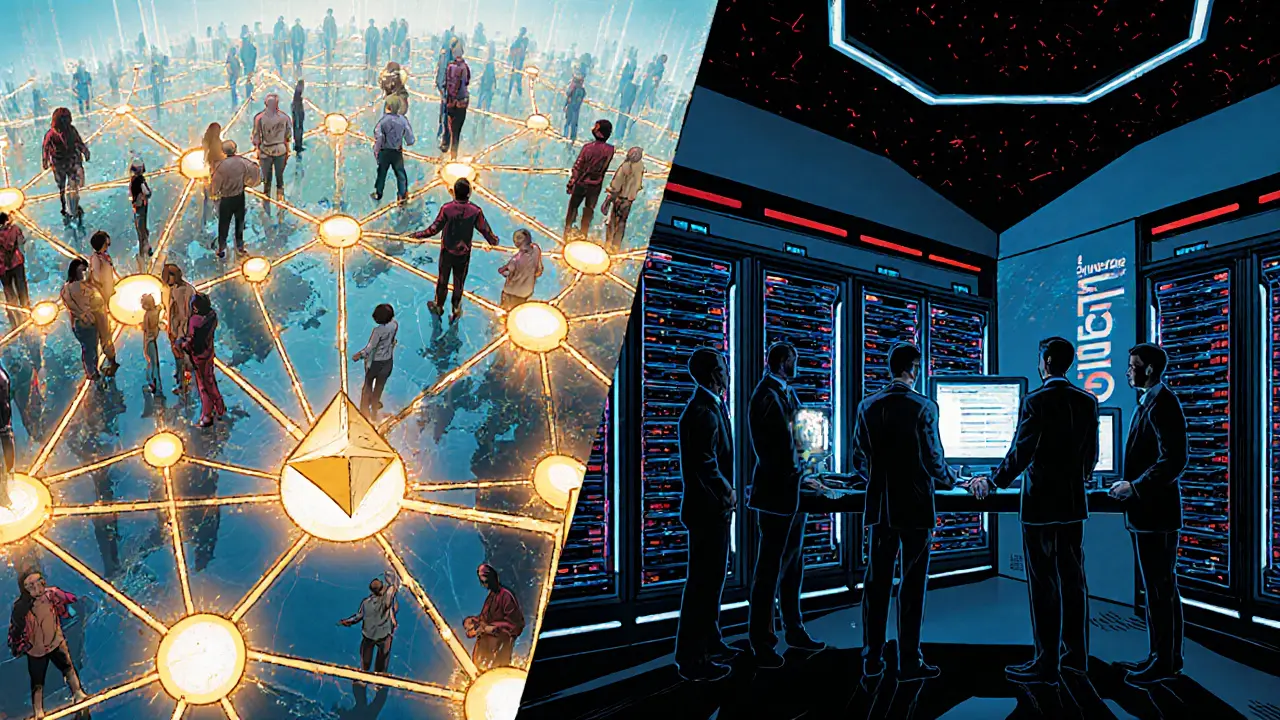

Take public blockchain, a permissionless network where anyone can read, write, and validate transactions. Also known as open blockchain, it’s what powers Bitcoin and Ethereum. These chains are transparent, secure through consensus, and hard to censor—but slow and expensive when traffic spikes. On the flip side, private blockchain, a closed network controlled by a single organization. Also known as permissioned blockchain, it’s used by banks and enterprises for internal record-keeping. These are faster, cheaper, and more private, but they sacrifice decentralization—and trust becomes dependent on the operator. Then there’s consortium blockchain, a semi-decentralized network run by a group of pre-selected organizations. Also known as federated blockchain, it’s the middle ground: faster than public chains, more trustworthy than private ones. Think supply chains tracking goods across multiple companies, or cross-border payments between banks.

The choice between these types isn’t academic. It affects everything from how you store assets to whether your data can be erased. Public chains let you own your keys and move freely, but you’re on your own if something goes wrong. Private chains give you control and speed, but you’re trusting a single company to not mess up—or worse, lie. Consortium chains balance both, but only if the members play fair. That’s why you see blockchain immutability highlighted in healthcare records and supply chains: those systems need tamper-proof logs, but they don’t need public access. And that’s why exchanges like BTCC or Zedxion can’t just plug into any chain—they need to match their security model to the blockchain’s design.

Understanding these differences helps you spot red flags. A project claiming to be "decentralized" but requiring KYC? Probably a private chain hiding behind buzzwords. A platform promising instant transactions with low fees? Might be a consortium chain with limited nodes. The posts below dig into real examples—from how UK firms track sanctions on public blockchains, to why crypto exchanges like HTX Thailand pick certain chains for compliance, to how airdrops like APENFT or MDX rely on specific blockchain rules to distribute tokens. You’ll see how these chains shape everything from scams to staking rewards, and why knowing the difference isn’t just smart—it’s necessary to protect your money.

Public and private blockchains differ in access, speed, privacy, and control. Public chains are open and transparent; private chains are restricted and efficient. Choose based on your need for decentralization or control.